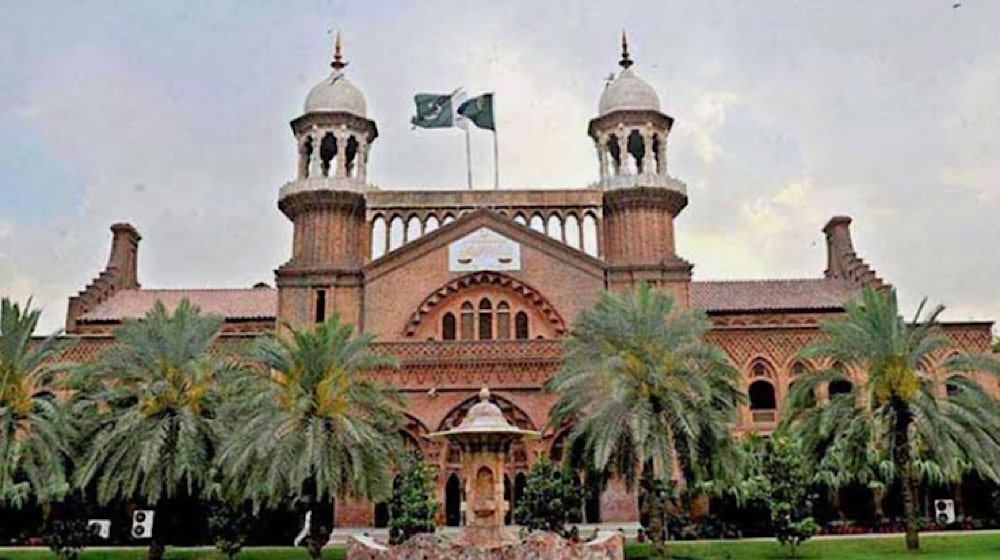

Lahore High Court (LHC) has directed the Federal Board of Revenue (FBR) to submit comments by March 19, 2024, on why the verified and determined income tax refunds along with additional payment for delayed refunds have not been paid to a public limited company.

The petitioner is a Public Limited Company, which is registered/incorporated under the Companies Ordinance, 1984 under the name of “Fauji Foods Limited”.

LHC order said that it is contended by counsel that the Large Taxpayer Office Lahore and Centralized Income Tax refund Office FBR are under obligation to release the verified and determined refunds to the credit of petitioner to the tune of Rs.285,383,802/- along with additional payment for delayed refunds as provided under Section 171 of the Income Tax Ordinance, 2001, but the needful is not being done without any justification.

The petitioner has further submitted that impugned inaction is illegal and without lawful authority.

Let notice be issued to FBR with direction to file the report and parawise comments, to reach the LHC by the next date of hearing on March 19, 2024, LHC order added.

The company contested that, “the state cannot be allowed to unnecessarily withhold the funds of the taxpayer, not only because of its fault but also through an intentional effort on the part of state functionaries by violating principles and doctrine of “unnecessary enrichment” which could not be allowed to happen in terms of Articles 4, 8, 10, 25 and 10A of the Constitution of Pakistan, 1973.

The cost of the petition may graciously be imposed on the respondents for their intentional delay in releasing/issuing the refund to the company.

The tax department may be directed to immediately release the verified and determined refunds to the credit of the petitioner to the tune of Rs. 285 million along with additional payment for delayed refunds as provided under section 171 of the Income Tax Ordinance, 2001, the company added.

The petitioner while claiming exemption from advance tax for Tax Year 2022 adjusted its refundable income tax for the first time to the tune of Rs. 63.5 million in April 2021 from its overall refund for tax year 2019.

The company requested the FBR to credit the already determined refund of Rs. 285 million to the account of the petitioner as already declared in the taxpayer profile of the petitioner. However, to date, there has been no response from the respondent department and the taxpayer has been deprived of its lawful property.

The non-issuance of a valid and determined refund of the petitioner by the department is not only illegal but is also infringing upon the petitioners’ fundamental rights protected under the Constitution of Pakistan and the precedents set by the higher courts.