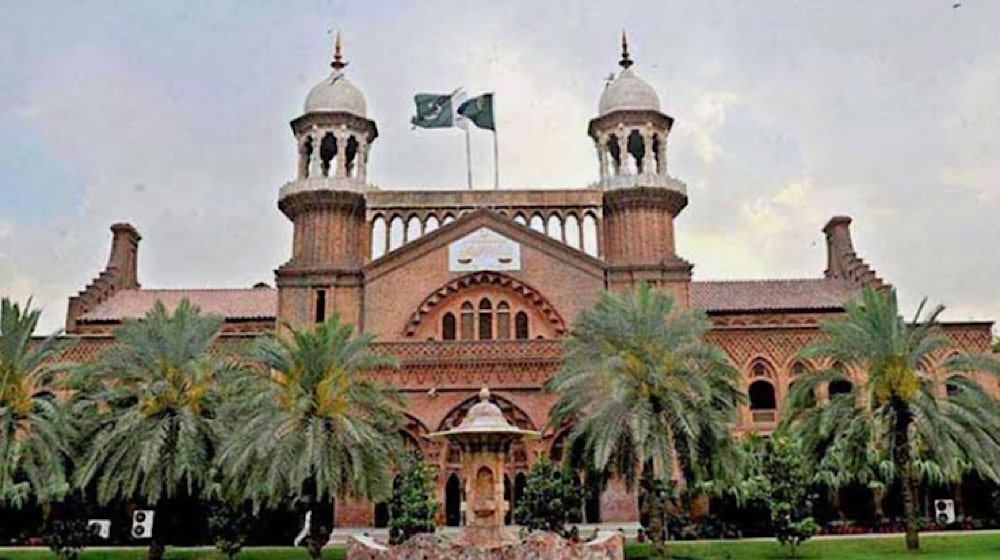

Lahore High Court (LHC) has issued a judgment on the calculation of taxes on insurance companies under section 99 read with the Fourth Schedule of the Income Tax Ordinance 2001.

Through the latest judgment, the Lahore High Court has declared that the income of an insurance company shall be computed as per provisions of section 99 read with the Fourth Schedule of the Income Tax Ordinance 2001.

LHC has issued a detailed judgment on the taxation of the insurance companies.

The judgment of the LHC has ended confusion among the insurance companies about the computation of taxes on these companies.

LHC judgment said that the controversy revolves around the construction of Section 99 of the Ordinance, 2001 which provides that: “ (99); Special provisions relating to the insurance business. —

The profits and gains of any insurance business shall be computed in accordance with the rules in the Fourth Schedule..”

The insurance companies contended that the Fourth Schedule provides for the computation of the profits and gains in terms of Rule 5 of the Fourth Schedule, yet it does not relate to the determination or computation of tax liability which is a different concept.

On the contrary, it is a case of the Department that the income of the taxpayers in these cases would have to be taken cumulatively and the tax liability determined on that basis.

LHC has referred to the judgment of the Supreme Court of Pakistan which distinguished the computation of profits and gains and the computation of tax payable and clearly stated that these were two different concepts.

LHC observed that Fourth Schedule refers to the computation of profits and gains but does not make any reference to the computation of tax payable in the opinion of the Supreme Court of Pakistan. If this were the case, the computation of tax liability would have to be made on the basis of the general provision of the First Schedule.

Clearly, First Schedule provides a different rate of tax in respect of dividend income and if the First Schedule is to be applicable, the Department cannot be heard to argue that with respect of insurance businesses, they will not be entitled to the benefit in the rate of tax provided by the First Schedule while that benefit would be applicable and extended to other similarly placed companies and taxpayers.

Therefore, although the current Section 99 does not contain the words “and the tax payable thereon”, this would not make any difference, in that, at the relevant time to which these tax references relate there were no provisions regarding the tax payable on the business of insurance in the Fourth Schedule, LHC judgment added.