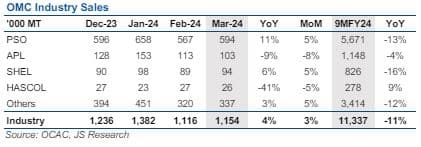

OMC sales clocked in at 1.15 million tons for March 2024, up 4 percent/3 percent on a YoY/MoM basis. The monthly increase was led by higher Motor Spirit (MS) and High-Speed Diesel (HSD) sales, according to a report by JS Global.

The report estimates that Rs. 729 billion of Petroleum Development Levy (PDL) has been collected during 9MFY24, approximating 84 percent of the FY24 collection target of Rs. 869 billion. At this run rate, the report expects FY24’s PDL target to be comfortably met despite a drop in YoY industry sales. For FY24, the report expects industry sales slightly lower than the number seen during the previous year.

The lackluster sales in recent months are in line with the historical trend of weaker sales in the winter season due to restricted mobility. Moreover, elevated sales during the December quarter were driven by the Rabi season demand.

Improvement in offtakes this month, yet below YTD average

OMC sales clocked in at 1.15 million tons for March 2024, up 4 percent/3 percent on a YoY/MOM basis. The monthly increase was led by higher Motor Spirit (MS) and High Speed Diesel (HSD) sales. Overall, total industry sales during 9MFY24 remained down by 13 percent YoY, whereas MS and HSD offtakes both depicted a 5 percent YoY decline for March 2024.

The lackluster sales in recent months are attributed to constrained mobility due to low temperatures, in line with the historical trends in winter. Moreover, elevated sales during October and November were driven by the Rabi sowing season.

After 21 months, the first YoY increase is observed in POL product sales. However, sales continue to remain dull despite the modest economic recovery witnessed in recent months after the lifting of import restrictions. For FY24, the report anticipates industry sales to land slightly lower than the numbers seen during the previous year.

PSO stands out during March 2024

PSO emerged as the top performer during March, boasting an MoM volumetric increase of 5 percent, surpassing the industry’s growth of 3 percent, and a YoY growth of 11 percent compared to the industry’s 4 percent. The notable difference was seen in MS (up 15 percent MoM), elevating the company’s market share in the segment to 49.7 percent for the month, compared to approximately 43.3 percent in the previous month.

SHEL secured the second position, demonstrating a 6 percent YoY and 5 percent MoM increase in POL volumes. APL and HASCOL depicted a decline in sales volumes during March.

PDL Collection Well Underway

As the country enters the last quarter of the fiscal year, one of the government’s non-tax revenue targets i.e. PDL appears to be progressing well.

The report estimates that Rs. 729 billion of Petroleum Development Levy (PDL) has been collected during 9MFY24, approximating 84 percent of the FY24 collection target of Rs. 869 billion. This is largely on the back of higher PDL allocation towards fuel prices, averaging at Rs. 59/Rs. 56 per liter for MS/HSD during 9MFY24, despite industry offtakes registering an 11 percent YoY decline during the period.

The report projected total collections for the full year to clock in over Rs. 900 billion, on the current level of PDL. Despite inflationary pressures, this target appears achievable, the report added.