Focused on addressing Pakistan’s persistent fiscal deficits and economic challenges, the World Bank has released the Pakistan Federal Public Expenditure Review 2023 in which it has revealed that K-Electric’s privatization has saved PKR 900 billion for consumers and the government.

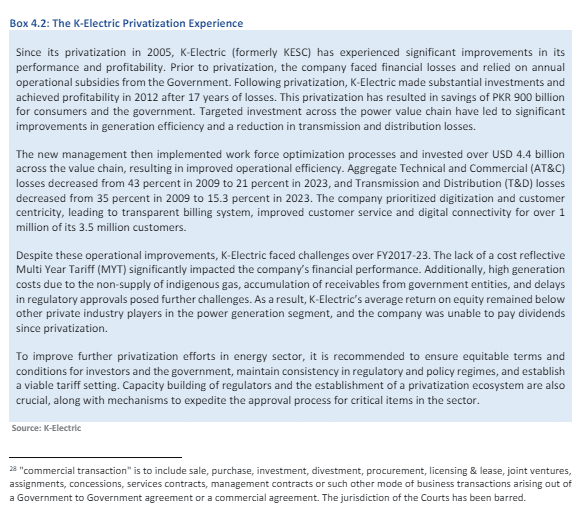

The report highlights the significant improvements in performance and profitability that K-Electric has achieved since its privatization in 2005, driven by substantial investments, workforce optimization, and operational efficiencies. Despite these advancements, the report also notes the ongoing challenges K-Electric faces, including high generation costs, regulatory delays, and accumulation of receivables from government entities.

The World Bank emphasized the need for continued reforms and strategic investments to sustain these gains and further enhance Pakistan’s energy sector.

The energy sector remains a critical area of focus in the report, emphasizing the importance of efficient management of state-owned enterprises (SOEs) to improve fiscal health.

The World Bank points out that the persistent inefficiencies and financial losses of SOEs have been a significant drain on public resources. It stresses the need for structural reforms to address these inefficiencies and ensure that SOEs can operate on a commercially viable basis.

Additionally, the report discusses the broader challenges in Pakistan’s energy sector, such as the high cost of electricity generation and distribution, which are exacerbated by the lack of a cost-reflective Multi-Year Tariff (MYT). The World Bank underscores the necessity for regulatory consistency and policy stability to attract investments and improve the sector’s overall efficiency.

The report indicates that without a cost-reflective MYT, electricity generation costs have remained high, contributing to a financial shortfall of PKR 150 billion annually.

Furthermore, the report recommends the implementation of a unified debt management strategy to better handle the financial risks associated with the energy sector, including the accumulation of circular debt, which stood at PKR 2.3 trillion as of FY22.

The World Bank also emphasizes the importance of public investment management to support sustainable economic growth. The report notes that despite the critical need for infrastructure development, Pakistan’s public investment levels have been relatively low, averaging only 2.5% of GDP in FY22, compared to the South Asian average of 6.7%. It calls for enhanced project selection, implementation, and monitoring processes to ensure that public funds are effectively utilized.

Strengthening public investment management would not only improve the quality of infrastructure but also boost investor confidence and economic stability.In addressing regressive subsidies, the report points out that poorly targeted energy subsidies have disproportionately benefited higher-income households while placing a substantial financial burden on the government.

In FY22 alone, electricity subsidies amounted to PKR 167 billion, with a significant portion benefiting middle and high-income households. The World Bank suggests reallocating these subsidies towards more targeted social programs, such as the Benazir Income Support Programme (BISP), to achieve better social outcomes and reduce fiscal pressures. This reallocation would help in making the subsidy system more equitable and efficient, ensuring that the benefits reach those most in need.

Improving debt management is another key recommendation of the report. Pakistan’s high public debt levels, which reached 78.0% of GDP in FY22, pose a significant risk to its fiscal stability.

The World Bank calls for the establishment of a unified Debt Management Office (DMO) to enhance coordination and efficiency in managing public debt, reduce borrowing costs, and mitigate financial risks. The development of a domestic debt market is also recommended to diversify funding sources and reduce reliance on external borrowing.

The report provides a comprehensive analysis of Pakistan’s fiscal challenges and offers a roadmap for achieving fiscal sustainability. By implementing the recommended reforms, Pakistan can create the fiscal space needed for critical investments, improve the efficiency of public spending, and enhance the resilience of its economy.

The World Bank’s endorsement of K-Electric’s privatization is a testament to the potential for strategic investments in key sectors to drive positive change and contribute to the country’s development goals.

The Pakistan Federal Public Expenditure Review 2023 highlights the urgent need for fiscal consolidation and structural reforms across various sectors, including energy, to ensure long-term economic stability and growth.

The report’s recommendations, if implemented effectively, could pave the way for a more sustainable and prosperous future for Pakistan.