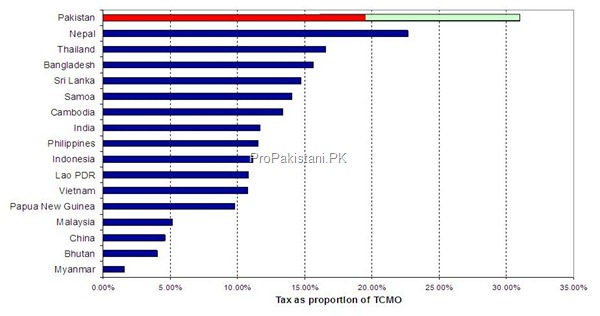

The tax rate on cellular industry is not only higher amongst all different sectors of Pakistan but it is also comparatively huge as compared with different countries of the region including Bangladesh, Sri Lanka, India, Malaysia, Indonesia etc.

It is also significantly higher when compared to other industries locally (19.5% for Cellular Industry vs. 16% for most other industries).

The tax rate on cellular sector has reached 31 percent in Pakistan whereas in other countries cellular taxes range between 10 to 15 percent. The FED on cellular services which is received in the mode of GST stands at 19.5 percent compared with 17 percent on different sectors.

The withholding tax rate on telephony services collected as advanced tax are set at 11.5 percent, which is maximum of 6 percent on rest of the sectors. Besides, the activation tax of Rs. 250 on each new connection is additional burden on all cellular companies.

The tax rate on cellular sector is a case of severe discrimination and should be brought down to a comparable industry level, Zafar Usmani, Chief Operating Officer Zong said.

The cellular industry in Pakistan is already an overly taxed sector, which pays double taxes as compared with other countries of the world, he said.

“If you look at the industry’s growth, it is not what it used to be and if we want to see another boom in the telecom sector we need to have lower taxes”, COO Zong suggested the government.

Minimizing the cost burden of operators who are willing to serve large areas could enable the rural populace to become a part of the mobile revolution at a faster pace and with greater ease.

The cellular companies are inclined to explore outside this framework as the market in urban and semi-urban areas is nearing saturation. This means going into low density geographical locations where revenue expectation and subscribers per cell site is much lesser making them a low revenue/low margin proposition. At the same time, it is very important to bring the critical mass residing in rural areas on board as these are the ones that stand to benefit most from cellular penetration.

Taxes on Telecom Services in Region

Source: GSM World

“Telecom companies, which are operating in highly competitive environment, have worked hard to make service affordable for masses of the country however, increased taxation negatively impacts the service cost, which has resulted in slow down in the industry”, said Aamer Izhar ul Haq – Vice President Corporate Affairs & Security

“The high taxation on telephony services is amongst the factors that has been negatively impacting the growth of the industry,” he said.

Telenor VP pointed out that telecom industry is the highest tax contributor and source for foreign direct investment in Pakistan. He suggested that a thriving industry will positively impact growth of the industry and will result in increased revenue generation over a longer term for the government.

Over the last few years, cellular penetration has increased significantly as the connections have already exceeded the 100 million mark. The new additions in cellular base came at a time when the market was considered saturated by most. these new subscribers are mostly from the low income group and were able to benefit from cellular technology because the activation tax was absorbed by the cellular operators in order to reduce the upfront cost to these new customers.

Moreover, there has been a lot of reduction in tariffs and call rates over the last few years to facilitate customers’ usage. Various consumer centric offers to further optimize spend were also launched such as Ghanta offers, bundle offers, reactivation promotions etc.

Contrary to this, over the last few years, GST has increased from 15% to 19.5% and Advance tax was also recently increased from 10% to 11.5%. These increases in taxes limit customers’ usage and reduce overall communication level of the customers.

Cellular Industry in the best interest of its customers recommends following: –

- FED: FED of 19.5% applied on cellular industry only needs to be brought in line with other industries having 16% FED.

- Withholding Tax (WHT): Majority of Subscribers don’t fall within tax bracket, however, they are being charged WHT on each refill/airtime used.

- 11.5 % is the highest WHT rate on services. This may be reduced to 6 %.

- Activation Tax: Activation Tax is specific to cellular industry only. This may be abolished in the best interest of general public and growth of cellular mobile industry.

Yup, its absolutely accurate, Government should decrease taxes to help Telecom as well to give relief to Country People…

Yes, we should stand with the cellular companies……so lets share it on facebook….

first companies should abolish 5% tax (jagga tax) on face value of recharge. pehlay khud jagga tax khatam kro phir govt sy kehna. increase of 50 to 1 rupee after 6 to 8 months for helplines charges is a slap to customer (yahan boht sy log ho gy jo companies ka sath dy gain k 1 2 rupee helpline charges matter nhe krtay. agr 1 2 rupee ke okat nhe to 31 rupees ke bhe koi okat nhe)

Mere bhai jab Govt. ne companies par itna burden dala hua hai to unho ne apna kuch burden to kam karna hai na?

itnay TAXES k bawajud dunya ki sab se cheap calls/SMS Pakistan main hai. Ap imagine karein agar yeh TAXES khatam ho jayen to kya banay….

tax ratio fix kar dena chaiye, phir companies ko chaiye k call rates + tax wala chakar khatam kar dena chaiye n clear cut rates ho

We are paying tax on every thing. when we recharge we pay tax. when we make a call we pay tax when we use any helpline service we pay tax. TAX TAX and TAX on every thing. I think telecom sector is the biggest revenue generator sector.

Agreed. Taxes at Telecom Sector should be justified and rationalized.

Moreover all taxes should be deducted on Recharge/Load upfront.

Taxes public pay krti ha na k companies (wo apnay profit per tax dyti hain) so Mohsin sahab ap ka yeh kehna k tax ka burden companies per ha bilkul galat ha. agr cheap call/sms dunya may sb sy acha ha to quality may dunya may kahan per ha hamara telecom sector?

look at China or even India on the chart (Taxes on Telecom Services in Region). That’s why these counties are cursing and we’re just falling year by year. Shame on our economic policy makers