The incumbent Pakistan Tehreek-i-Insaf government has made tall claims about increasing the tax net since coming into power last year in May. Prime Minister, Imran Khan has urged the nation, time and again, to pay their taxes as responsible citizens, however, it hasn’t borne much fruit.

To facilitate the masses, the National Database and Registration Authority (NADRA) has launched a Tax Profiling System in collaboration with the Federal Board of Revenue (FBR), which allows the registered users to view their tax profiles. The system integrates data including property, bank accounts, utility bills, travels from multiple sources.

The step has been taken to make tax payment a hassle-free process, however, it is just a start, which can integrate other useful data, such as credit history and loans, to offer everything in one place. The portal’s launch will not directly be used for assessing tax worth, however, it gives the citizens an account of the information available with the government.

What this means is that the government has shared the list of assets, expenses and other data, of 53 million people, available with multiple government departments and the citizens can see their profile. With this data, the government can easily increase the tax net and deliver on its promises.

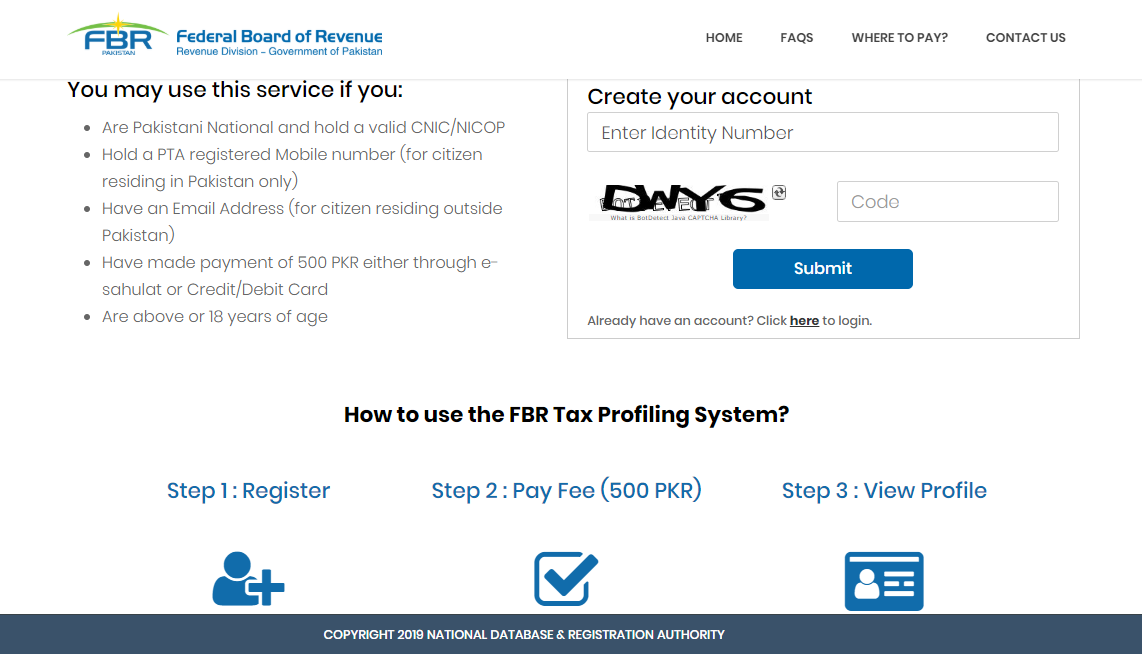

Here’s how the portal looks:

Registration Criteria

You may use this service if you:

- Are Pakistani National and hold a valid CNIC/NICOP

- Hold a PTA registered Mobile number (for citizen residing in Pakistan only)

- Have an Email Address (for citizen residing outside Pakistan)

- Have made payment of 500 PKR either through e-Sahulat or Debit Card

- Are above or 18 years of age

Easy 3-Step Process

To have access to your data available with the government, you will have to register on the Tax Profiling System by filling in your data and answering multiple questions, for security reasons.

The registration process further includes three steps:

- Personal information – CNIC, PTA-approved mobile number

- Email/mobile verification – Verification code through mobile/email

- Citizen verification – Two secret questions related to your family for verification

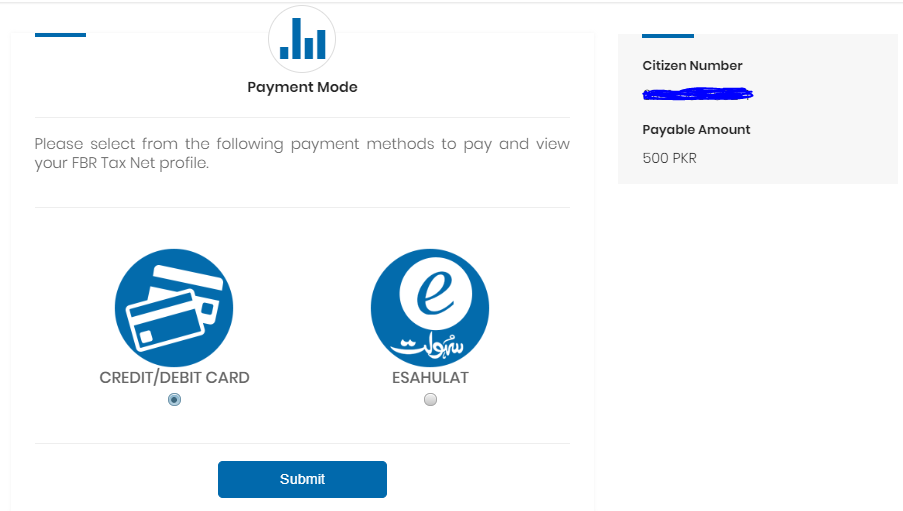

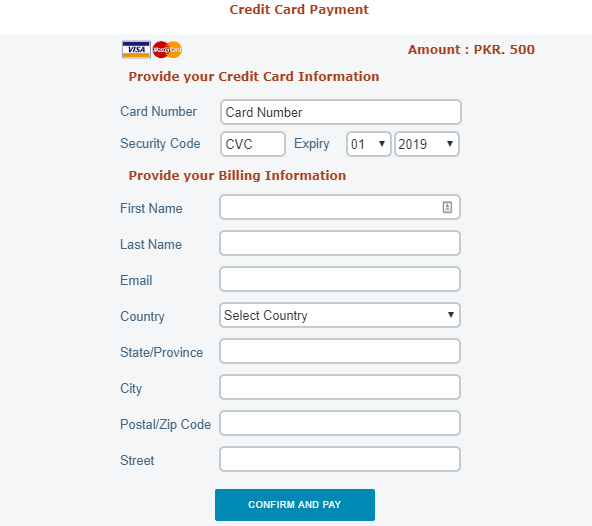

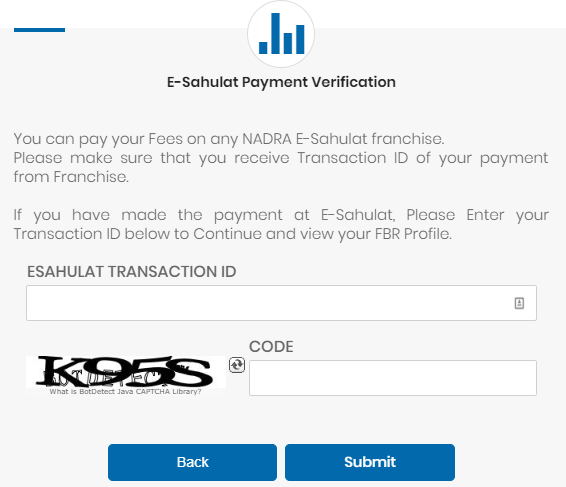

Once you are done, you have to make a payment of Rs 500 either through a credit card or by visiting any e-Sahulat center.

Following the payment of fee, you can download your tax profile.

Tax Profile

The tax profile includes all the details from bank accounts to previous utility bills and taxes paid, your properties, the car or bike you drive, and the domestic and international trips.

The tax net profile enables the users to accurately declare their assets with the FBR and play their part in the economic uplift of the country.

Pros and Cons

Integration of data from multiple government sources on a single platform is a first of its kind achievement and saves the citizens the hassle of visiting multiple government offices to assess their tax profile. The information can be used to correct the return filing data if incorrect.

According to the official statements, the system has been made fully secure and no other person can access information. If needed, the security could be further enhanced. The ultimate objective of the portal is to bridge the gap and provide information to the people at their doorsteps.

The step would serve as a first link in the chain for a greater tax net, provided the government shows resolve and further improves data security.

The downside is the Rs 500 fee, which might hamper the process. It could serve as an obstacle to an otherwise useful process as a number of citizens would be reluctant to pay a fee for the process. Slashing the fee would help ensure maximum participation from the masses.

this has already been hacked. i guarantee the nsa has this data. what a bunch of fools putting this data online. it’s criminal level of irresponsibility.

So what? We should use this as excuse to avoid implementation of this system?

Improve our encryption system

Some One Tell Me Benefits / Disadvantages for this Service in URDU ?

do we need to pay Rs. 500 each time we view our profile, or is it just a one-time payment?

I paid the amount, it’s valid only for 5 months. Then you have to repay

one time on registration.

It is valid till 6/30. You will need to pay again if you want to see any new updates after 6/30. So far it only shows Mobile number, Passports and Vehicles registered under your name. All other details like Bank Accounts, properties etc. declared or undeclared are missing. Also, it says that Nadra esahulate centers can be used for payment, but if you go to the center, they are not accepting payments, only Credit/Debit card seems to be working.

i sign up today and it showing

Please note your payment is valid to view your profile till 30-11-2019. You will be asked to pay again to view any updates in your profile after the expiry date.

Why should I create this profile? What would be benefits of this profile?

Anyone can explain what is the use of this site? :/

I was thinking the same. Just to check my my tax profile why would I pay 500?. Lol

Learn to read.

If you pay less tax as compared to your tax profile, you are encouraged to bring your tax payment up-to par with your income.

What the Government think tanks are doing if they are loyal with I.k how they advice to set a payment for gathering information for a wishful filler. Very bad…. just think about if someone have access to this information and he knows that all the shaded income is at wach list. He will try best to be filler before 30th. Coment plz

if the system is for the facilitation of people then why we pay you 500 it should be free for all. what is the benefit of Viewing the data after paying Rs. 500

500 fee? We are ready to pay 25000 fees if this fees is included in our tax paid.

AOA , Can somebody tell me regarding my condition ? i am an oversea Pakistani. i live and work out of Pakistan , i pay huge tax here . i have a plot in Pakistan which has worth approximately 10lac PKR . do i need to do something or i guess govt already knows everything about my source of income which is job in the country i live .

Out of context but bhai wapas mat ana idar its done.

A. Wahid bhai i can understand what you wrote. Per jaisa bhi hai apna hai. Isko hmarey bzurgon ne bacha liya hota tou aaj hum yahaan na hotay. Aaaj hum agar is k liye qurbani dein tou yqeen mano is jaisa poori dunya main koi mulk nahi. Yeh sirf books se parh kr nahi 3 continents dekh k smujh aya hai. Allah janta hai is jaisa koi mulk nahi. Sirf isko sahara chahiye hmara.

Wa alecum assalam. Better to raise this query at Pakistan Citizen Portal. Hope it would be answered by govt officials in a better way. For that you need to download citizen portal app on your smart phone, register your profile and then launch query. Hope it helps.

Thank you bhai jan

The system does not show your complete profile. The just give sample data and ask you to visit FBR for more detail. Don’t waste your money on this

It’s garbage.Putting data of 53 Million Pakistani’s online shall be contested in court.Now any one can access our data.PKR 500 submited just to see ur name ,address as per CNIC and written “for further details visit nearest Regional Tax office.Crap .that too with a validity date of 4 months..I would recommend not to login in this .Just trash of money PKR 500 .Just came to know this has been hacked by US hackers as well

It happened in Pakistan to pay RS. 500 for the information of our assets….wowwwwww….

I registered 3 complains in Citizen Portal 6 months ago and nothing happens, very disappointed portal and i think this will also flop.

آپ کس خوش فہمی میں ہیں ؟کہ لوگ اکاؤنٹ بنائیں گے ؟ اور وہ بھی پیسے دے کر ؟ یعنی آ بیل مجھے مار

TAX FACTS

DREAM/HOPE

A SMART YOUNG MALE/ FEMALE GOVT OFFICER

KNOCKS DOOR AND ASK

DEAR SIR WE HAVE UR CNIC NOW WE GUARANTEE THAT WE SHALL TAKE CARE OF UR FAMILY HEALTH AND EDUCATION AND IF U BECOME UNEMPLOYED WE SHALL PAY U BACK PER MONTH EXPESESS

PL PAY UR TAXES

ALL FMILY MEMBERS SHALL SAY BABA WAY DONT U PAY TAXES.

EVERYBODY WILL PAY TAX HONESTLY AND HAPPILY AND SHALL QUE AT BANKS FOR TEX DEPOSIT.

BUT IF

GOVT ASK THROUGH THEIR BAD LOOKING PERSONALITIES THAT PAY TAX SO THAT GOVT SHALL PAY BACK THEIR LOANS OTHERWISE JAIL

NOBODY SHALL PAY TEX OR PAY WITH DISHONESTY AND NOTHING BUT HUGE LATIGATIONS

PEOPLE SHALL PAY HUGE AMMOUTS TO LOWERS BUT NOT PAY TAX

deepshayari.tk

I offer you 50Rs to show me my info, otherwise get lost you Tax Profiling System.

Those will pay the fee and see their profile who have doubts that they are paying less tax than they are suppose to. It is the reason that it is not free. It is not mandatory to open account if you believe that you have nothing to declare. If you have something and is not declared better pay the fee and cease the opportunity of amnesty scheme. They are really going to come for you after 30th. ?

It is worthless. It doesnot give any record of the property and bank accounts.. it only gives you the mobile connections and recent travel records.

Good effort, but system is showing incomplete information of assets and expenditure. May be in coming days they will be able to fetch and reprort more meaningfull data

One correction, the new government took charge in August 2018.

What is No. of Executive services stands for Indicative Tax net Profile. Unable to find any details.

Did you get any information about this point?

No enough information against 500Rs. Only your home address as per ID card, passport details, PTCL connections, mobile number, vehicle detail, bank account etc.. NO property or paid tax information. It mean FBR does not have any info about peoples paying property tax since ages.

Again government asking people to pay more tax without any incentives.. Atleast introduce some incentives to compensate peoples who are paying tax already and attract new people to taxnet.

how can i see my profile, after registration?

I

i tested the system,

– my ID card address when i was 18 years old as the present address

– No SIM card under my name (i have verified NICOP and cell number)

– Traveling information for non-MPR passports not available

This is the new pakistan

Nice step for information at door step

Nice step by govt for information at door step