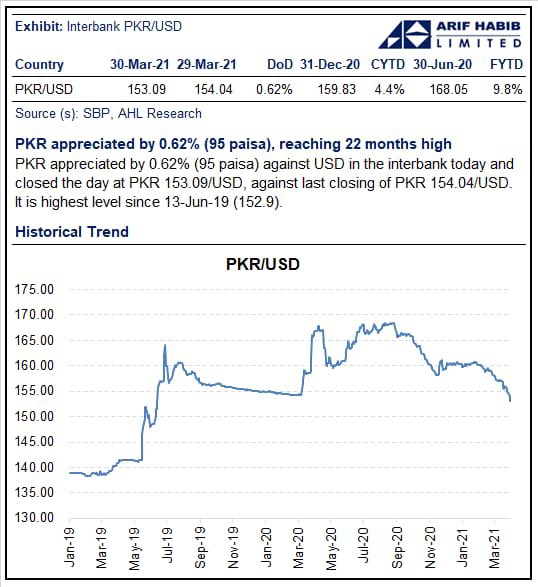

Pakistani Rupee continued its appreciation against the US Dollar on the second day of the week. The rupee opened the week with a gain of 54 paisas against the US Dollar (USD), climbing 95 paisas more against the USD today.

From the lowest exchange rate of Rs. 168.43 to the USD on 20 August, it has appreciated by almost Rs. 15, or 8.5 percent since then. In March 2021 alone, PKR hiked by 3.2 percent against the USD.

According to the dealers, the rupee is strengthening due to improved external position and lower demand for import payments.

The intra-day trading saw PKR in the range of Rs. 152.83 and Rs. 154.25 against the USD today. PKR closed at nearly Rs. 153 to the USD in the interbank market today, appreciating 95 paisas and clocking in at Rs. 153.09 to the USD (30 March), up from Monday’s (29 March) Rs. 154.04 to the USD.

The rupee is currently at a 22-month high against the USD, the level last seen in June 2019.

ALSO READ

Rupee Rises to Its Highest Value Against the US Dollar Since Mid-2019

A.A.H Soomro, Managing Director at Khadim Ali Shah Bukhari Securities, said, “Market supply is higher as travel and imports are still curtailed. Expect more money to clock-in because of the Ramzan factor, remittances, and Roshan Digital Account (RDA). The lesser the travel – the stringent the lockdown – the lower the consumption and higher the dollar supply. Thus, the currency is appreciating. Expect money from the IMF, World Bank, and Eurobonds to further support FX reserves.”

“The potential impacts of this appreciation will be positive for offsetting imported inflation, given rising oil prices in the global markets, and for lowering the debt repayment burden on the country’s foreign debts. However, it may render exports incompetitive in the short run,” he added.

ALSO READ

Rupee Closes Below Rs. 155 Against US Dollar

Soomro said, “There is another peculiar angle to the PKR. Despite, the independence of the SBP, the government would want to muster all the anti-inflationary support it can as it moved to increase electricity prices by a massive 34 percent to meet reduce Circular Debt. Currency managers seem to be extending an olive branch. No sign of major depreciation for a few months, as REER is around approximately 95 rupees as well. Nonetheless, major swings should be avoided either side.”