The Pakistani Rupee (PKR) dropped to a new all-time low against the US Dollar (USD) and depreciated by two paisas against the greenback in the interbank market today. It hit an intra-day low of Rs. 178.55 against the USD during today’s open market session.

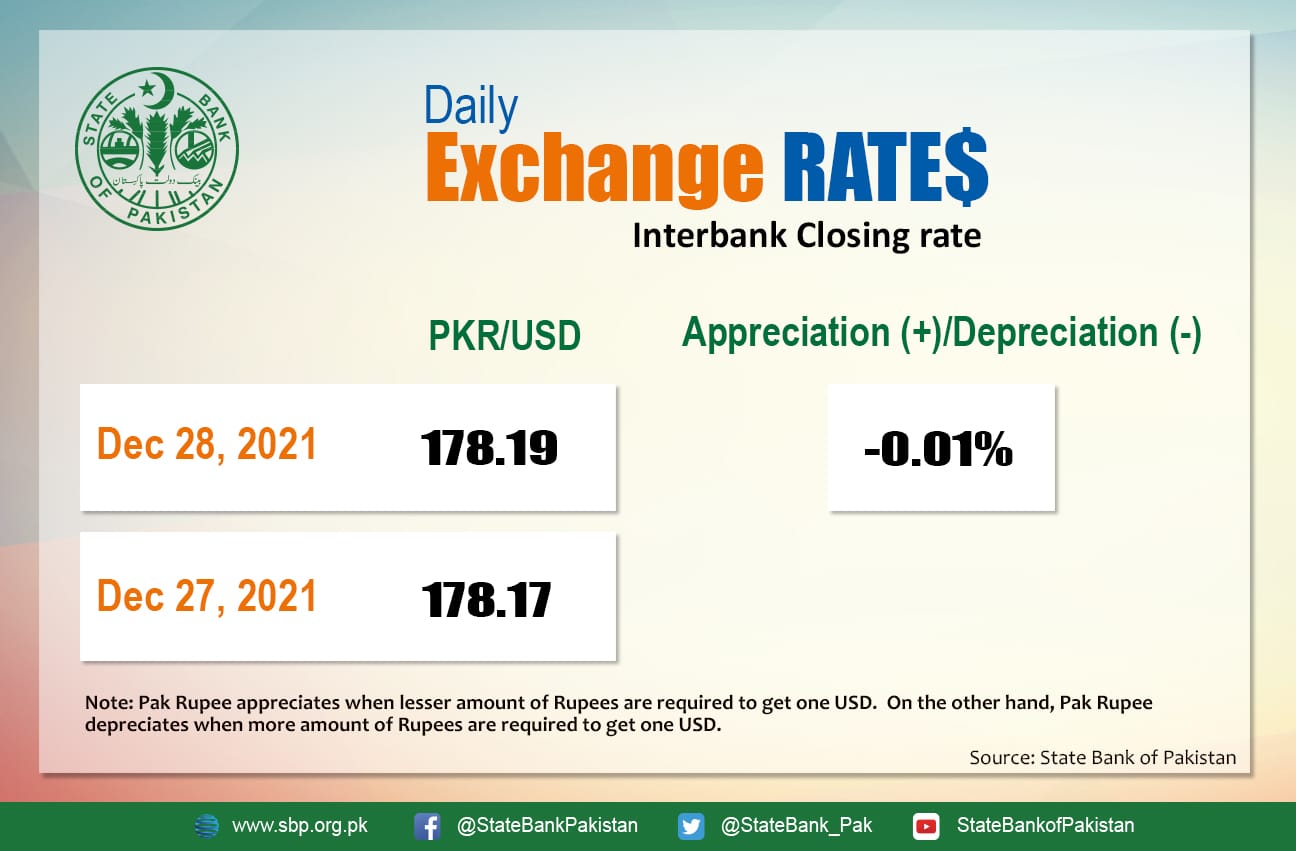

It depreciated by 0.01 percent against the USD and closed at Rs. 178.19 today after taking marginal hits and closing at 178.17 in the interbank market on Monday, 27 December.

The PKR continues its historic drop against the USD despite various steps by the government and the State Bank of Pakistan (SBP) to mitigate the exchange spillover. Moreover, headline inflation is expected to track the near-term economic outlook in double digits due to factors that include higher global commodity prices, electricity charges, house rent, and transportation costs.

The current account posted a deficit of $7.1 billion (5.3 percent of the GDP) for July-Nov FY2022 against a surplus of $1.9 billion (1.6 percent of GDP) last year.

With these untoward hurdles impeding economic growth, experts suggest the government should deploy policies and reforms to help reduce the exchange rate pressure, and subsequently stabilize the Month-over-Month inflation.

Discussing the local currency’s near-term outlook earlier during the day, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi, stated, “[The] PKR rout may have halted around 178.25, but demand for [the] $ persist[s]. Since [the] last 2 weeks, sellers are choosy to offer $ to banks. During this period, oil prices surged by $8 [per barrel], if it stays higher, it can cause [a] huge trade imbalance. Deficit & inflation could further skyrocket”.

INTER BANK#PKR rout may have halted around 178.25,but demand for $ persist. Since last 2-weeks,sellers are choosy to offer $ to banks. During this period oil prices surged by $8 pb, if it stays higher,it can cause huge trade imbalance.Deficit & inflation could further skyrocket

— Asad Rizvi (@asadcmka) December 28, 2021

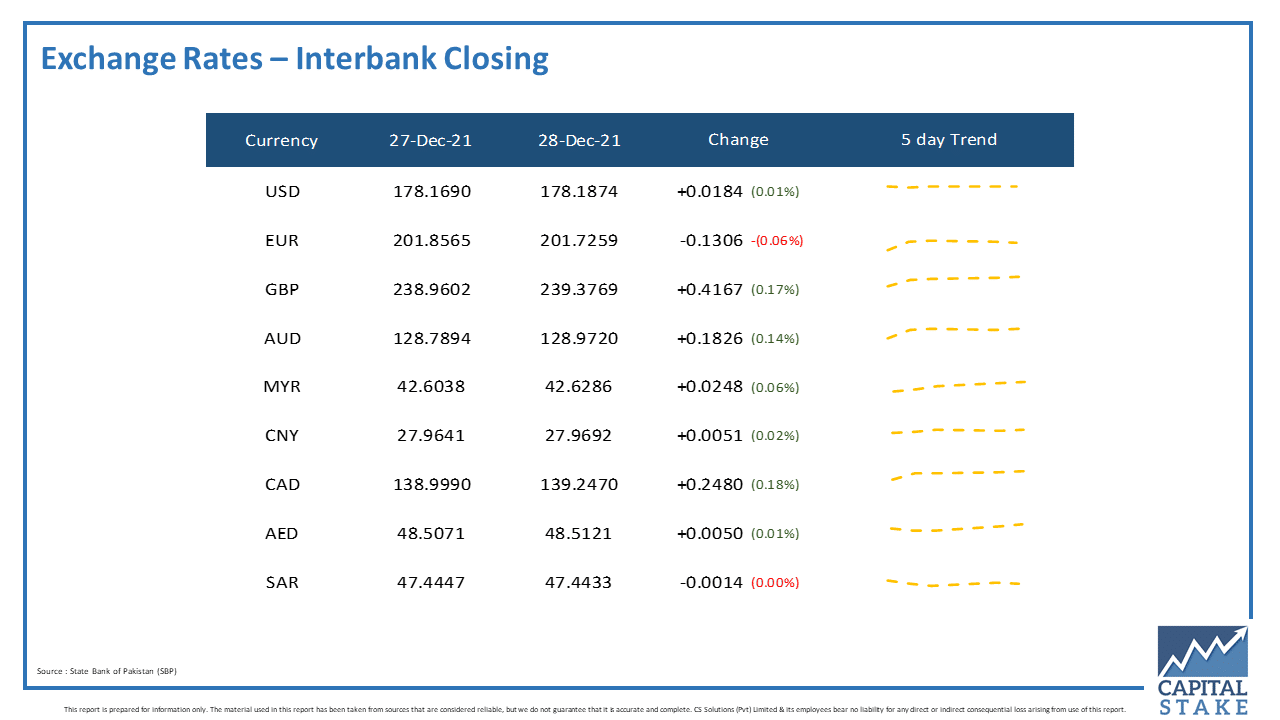

The PKR resumed its declining trend against most of the other major currencies as well. It posted losses of 41 paisas against the Pound Sterling (GBP), 18 paisas against the Australian Dollar (AUD), and 24 paisas against the Canadian Dollar (CAD).

Conversely, the rupee reversed losses against the Euro (EUR) and posted gains of 13 paisas in today’s interbank currency market.

It also held out against both the UAE Dirham (AED) and the Saudi Riyal (SAR) despite the intraday threat.