Pakistanis have a love-hate relationship with local banks, and banks themselves don’t care much to properly assist customers (non-government) as they should.

At the end of the day, it is the regular man who invariably suffers the most. Banks were one of the most profitable entities in Pakistan even during the COVID-19 lockdowns because of the government support they receive and the unfair policies they have toward the customers, monetizing every little service which is usually offered for free in the rest of the world. With record-breaking profits even during a financial crunch, most banks really don’t care what the customers want and the rest of the article just gives a brief overview of what’s happening in Pakistan’s banking sector.

Bank-wise Breakdown of Complaints in 2020-21

The table below highlights the complaints received against banks during 2020, as published by the Banking Ombudsman in its annual report:

| Bank | Complaints Received through BMP Secretariat | Complaints on PM Portal | Total |

| Habib Bank Limited | 2,654 | 2,663 | 5,317 |

| United Bank Limited | 1,562 | 1,536 | 3,098 |

| Institutions other than banks | 391 | 2,398 | 2,789 |

| MCB Bank Limited | 863 | 1,007 | 1,870 |

| Allied Bank Limited | 530 | 1,009 | 1,539 |

| Bank Alfalah Limited | 638 | 629 | 1,267 |

| National Bank of Pakistan | 630 | 191 | 821 |

| Faysal Bank Limited | 515 | 287 | 802 |

| Meezan Bank Limited | 376 | 383 | 759 |

| The Bank of Punjab | 260 | 499 | 759 |

| JS Bank Limited | 431 | 234 | 665 |

| Silk Bank Limited | 399 | 248 | 647 |

| Standard Chartered Bank (Pakistan) Limited | 366 | 182 | 548 |

| Askari Bank | 209 | 204 | 413 |

| Bank Al Habib Limited | 254 | 134 | 388 |

| Bank Islami Pakistan Limited | 102 | 88 | 190 |

| Soneri Bank Limited | 99 | 65 | 164 |

| Dubai Islamic Bank Pakistan Limited | 95 | 67 | 162 |

| Zarai Taraqiati Bank Limited | 106 | 14 | 120 |

| Habib Metropolitan Bank Limited | 71 | 34 | 105 |

| The Bank of Khyber | 22 | 63 | 85 |

| Summit Bank Limited | 38 | 27 | 65 |

| Albaraka Bank (Pakistan) Limited | 35 | 24 | 59 |

| Sindh Bank | 20 | 28 | 48 |

| The Punjab Provincial Cooperative Bank Limited | 17 | 20 | 37 |

| Samba Bank Limited | 10 | 11 | 21 |

| First Women Bank Limited | 8 | 0 | 8 |

| SME Bank Limited | 2 | 1 | 3 |

| The Bank of Tokyo — Mitsubishi UFG Ltd | 1 | 0 | 1 |

| Total | 10,704 | 12,046 | 22,750 |

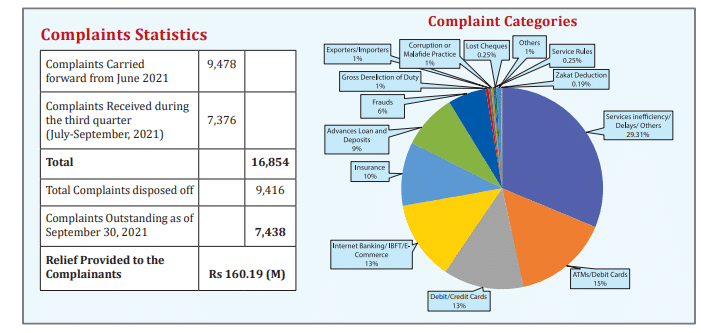

Complaints Statistics for Q1 2021-22

During an investigation of complaints, the Banking Mohtasib (Ombudsman) noticed systemic deficiencies and related weaknesses among banks. The reported issues were forwarded to the State Bank of Pakistan (SBP) for action. In short, the banks had taken little notice of the common customer’s plight and had failed to approach the issues as was expected of them.

Irrational Deduction of Withholding Tax

In one of many similar occurrences, complainants indicated that they had a business account with the concerned bank branch and that they are tax filers with no tax issues. However, a system error or ignorance of the bank staff had caused the concerned branch to deduct withholding tax (WHT) of Rs. 221,495.40 on all the fund transfer transactions made from 23 September 2019 to 8 November 2019.

The complainants protested this misconduct by the branch staff and asked for a refund of the entire amount of Rs. 221,495.40 that had been deducted as WHT. The bank had then refunded an amount of Rs. 117,993.00 only and was hesitant to refund the remaining amount of Rs. 103,501.47.

As the matter remained unresolved, the affectees lodged a complaint with the office of Banking Mohtasib Pakistan. Upon the receipt of the complaint, the matter was taken upon the merits of malpractice.

Insurance Policy Issued Without Consent

In another instance, a complainant stated that he had been maintaining his Profit & Loss Sharing (PLS) account at the branch of a bank and had been working in Dubai since 2008. In his absence, the then-branch manager had connived with an insurance company to get a life insurance policy amounting to Rs. 1,307,500 issued in the customer’s name without the latter’s knowledge and consent.

When the complainant returned to Pakistan in 2017, he learned of the problem and filed a complaint at the Office of Banking Mohtasib Pakistan after the bank failed to address the issue.

Refund of Unclaimed Deposit

In another example, a complainant alleged that he had an account with a Pakistani branch of a bank but had been unable to use it for a long time because he was in England. A sum of Rs. 1,393,916.55 had been transferred to the State Bank of Pakistan in an unclaimed account in 2015 while he was away. When the complainant returned to Pakistan in 2016 and realized the matter, he filed a complaint with the Office of Banking Mohtasib Pakistan (BMP) after the bank in question failed to address the issue.

Bank Fraud

Similarly in another case, a complainant stated that he had visited the branch of a bank on 27 March 2017 to partially repay his loan and markup against which the Agricultural Field Officer (AFO) had given him deposit slips for Rs. 51,500, Rs. 524,000, and Rs. 40,000. He had submitted the full amount to the AFO to deposit it into his loan account, and the AFO had then passed the amount on to another bank employee.

However, on 1 August 2017, the complainant received a notice from the bank that the sum of Rs. 524,000 that he had requested had not been put into his account. The complainant went to the BMP office to get his issue resolved. The BMP office examination indicated that the complainant’s deposits of Rs. 40,000 and Rs. 51,500 on 27 March 2017 had been credited to his markup and current accounts but it refused to account for a loan payment of Rs. 524,000 for which the complainant had a valid deposit slip.

The bank also denied the customer’s claim on the basis that his deposit slip for Rs. 524,000 lacked the branch’s official stamp, which rendered it ‘invalid’. The bank’s position in this regard is untenable because the manager was allowed to conduct banking activity on behalf of the bank.

Fraud through ATM

A complainant approached a Banking Mohtasib office, stating that she had tried to conduct an ATM transaction at Bank ‘A’ (Acquirer of funds) on 9 November 2019 but her card had gotten stuck in the ATM. Meanwhile, a person had entered the ATM vestibule and she had refrained from entering her pin code in his presence. She had approached Bank ‘A’ and the staff had said that her card would be delivered to her parent bank’s branch.

Later on, the complainant discovered that an unauthorized sum of Rs. 250,000 had been removed from her account after a few days. Even after she complained about it to the bank, the problem remained unsolved. Bank ‘B’ (Issuer Bank) reported that the complainant had verified that she had not blocked her card after it was reportedly recorded at the bank’s ATM in response to an inquiry from Banking Mohtasib’s office. Her private ATM PIN code had also been acquired via shoulder surfing by the suspected perpetrator.

Fraudulent Transaction through ATM

This case of fraud was largely overlooked by a bank that will remain undisclosed. The complainant stated that she had an account at a bank branch in Gujrat. She had received a call on her cell phone from the bank’s official number on 4 February 2019, inquiring about her account information and ATM card pin code, which she had provided. She then discovered that an unauthorized amount of Rs. 78,000 had been transferred from her account to another account.

She had complained to the bank about it multiple times but to no avail. She then filed a complaint with the Banking Mohtasib office, after which her complaint was taken up by the bank as soon as it was received.

No Profit on Fixed Investment

The complainant stated that he was solicited by a bank to invest Rs. 1,400,000 in Fund Managers for a period of two years, with the assurance, that he would receive the invested amount with a substantial profit at the end of the period. However, he had received only Rs 1,113,615 at the end of the period in 2019, and the bank made no profit on it.

He had filed a complaint with the bank in question but it was an unsuccessful attempt. As a result, he complained about the matter to the Banking Mohtasib office.

Filer Treated as ‘Non-Filer’

The affectee in this instance had complained that he had a current account in his company’s name with a bank and that he was also a filer with a registered taxpayer status, which was evident from his appearance on the FBR’s Active Taxpayer List (ATL). On 23 January 2019, Rs. 600 was debited from the company’s account by the bank’s branch for considering the complainant as a ‘Non-Filer’, which he had objected to.

After carrying out certain procedural formalities, the branch confirmed that from then onward, no WHT on cash withdrawals would be recovered as the account status was that of a Filer, but to the complainant’s surprise, the bank continued recovering WHT, and he was asked to furnish some more documents each time, which he did but to no avail.

Upon the reconciliation of his account, the complainant had found that the branch has recovered around Rs. 293,000 from the account since January 2019 for a tax deduction. When this issue was raised, the branch verbally advised the complainant to file an income tax refund application with the Federal Board of Revenue (FBR), which he considered to be unjust because the branch had recovered the WHT illegally from his account and had not rectified its mistake despite being notified in January 2019.

Note: The aforementioned complaints were resolved after the swift interventions of the Banking Ombudsman (Mohtasib) Pakistan.

‘Credit’ Services

Banks have been singularly unsuccessful in driving the customer journey, being long on capital but short on innovation. Throughout the world, banks usually focus on selling their products/instruments such as credit cards to potential/existing customers without any delays. In Pakistan, the story is actually quite the opposite.

The affectee in this instance had approached the United Bank Limited (UBL) in July via the bank’s customer care helpline to apply for a credit card. Despite countless tries, this individual was constantly asked to wait. Later, the affectee tried the UBL website to apply for the credit card online, even then the Bank didn’t get in touch for facilitation.

Thereafter, the concerned citizen visited a UBL branch to inquire about the status of his credit card face-to-face. After brief due diligence, the affectee was asked by the bank for documents required for approving the credit vehicle, which he provided. A month later, the Bank asked the applicant to re-submit the documents, giving a sense of false hope at the same time that the credit will be issued next month. This happened thrice, and in the end, the bank issued the applicant’s credit card (without asking for his preferred card option) and with a credit limit that was 66 percent lower than what was promised by the bank’s helpline and branch officials.

Unresolved Issue: App & IT Infrastructure

As far as technological integrations in terms of consolidating credit card payments are concerned, most banking applications in Pakistan do not support credit cards. Moreover, bank apps are highly susceptible to cyberattacks, and the recent NBP hack is a prime example.

In end-October, The National Bank of Pakistan (NBP) was hit by two large hacks, damaging its backend systems and servers responsible for communication between branches, as well as the systems that run its ATM network and online banking apps which made debits and cash withdrawals impossible for a few days.

Banks like HBL proclaim to be technology companies with banking licenses and have repeatedly claimed to employ advanced technological tools in their operations and customers services, even though they have miserably failed. All of the major banks regularly suffer outages in digital banking services even though the world has already moved on to next-gen banking technologies. Given the circumstances, what could a customer even do at this point?

From an overall standpoint, many banks interrupted digital banking services during the last two years, which inconvenienced customers. These issues emerged because of the significantly increased use of the internet and mobile banking by their customers as well as the volume of transactions. Ergo, they need to upgrade their services and improve users’ experiences consistently.

Summary: Why Banks Don’t Care

- Banks want you to fill up forms, and simultaneously ask you to repeat whatever you filled electronically via phone, including the spellings of every name and every bit of information for verification purposes (which appears to be flawed in its own way).

- Bankers want to get more customers on board but they treat customers badly and think customers are the ones who ultimately need the bank.

- Banks say they want to improve their customer experience but are laden with regulations and internal politics.

- Bank management thinks the customers are all old and only use tellers and branches to transact. Where are the younger generations positioned?

- Banks make you think twice about even changing certain information, even if you have duly verified that you are a rightful owner of the account and money inside it.

- Banks consider people who have less money as less important.

The list is endless, and the fact remains that this is how banks usually operate in Pakistan. Essentially, any bank’s most important customer is the government itself. Both the parties work happily together, making money off instruments such as investment bonds, treasury bills, and commodity financing, and exploit the benefits amongst themselves for the most part.

The Summit Bank Haidery Branch Strictly Follow ” Why Banks Don’t Care ” Mentioned Points.

Rather Than Investigating Again And Again, The Customer Details, Why Don’t Banks Give A Copy To Customer, Even If Customer Slightly Change Thier Mobile, Address Etc.

Instead They Give A Bunch Of Forms To Sign And Say Rest Of Details They Will Fill By Themselves. They Don’t Provide Any Photocopy Or Print Out To Customer For Their Record. If Customer Ask Them To Provide A Copy, Their Face Expressions Become ‘ Sour ‘ !

As A Result, They Make Basic Spelling, Birth Date Mistakes, And Blame Customers.

Visiting any bank for banking services is a irritating experience unless you know manager or manager operations personally.

Banks in Pakistan Can be categorised as frauds, cheaters , disrespectful and uncaring towards customer.

This is my experience of thirty with various Banks across Pakistan.

This has been my experience with the majority of Pakistani people.

No doubt banks are becoming more and more careless regarding customer service.

bankers thinks that people who r visiting bank are stupid they dnt bother to help them or talk to them or guide them.

and Atm are becoming worst nightmare for poor citizens bcz of card capturing machines and old useless machines

What i have noticed is experiences differs massively between the branches. I used to go to ABL’s branch in Pindi Saddar and would get treated like trash. However, would get treated like a saint if i visit DHA or Bahria branch of ABL.

It would be interesting to see the ratio of bank total customers to the complaints.

I have very Bad experience with MCB staff. They are very rude and unprofessional .I want to wave off my credit card fee I made 30 Call to MCB Call center. Totally bullshit.

Same problem with me as well

Without taking opinion of other side how come such a one sides article can one write. Banks are run by humans and human behavior matters. Employee is the most sufferer. Bankers doing suicides, having heart attacks, diabetes and sudden deaths. Why… Because they are loaded with targets. From where they can meet their targets? Customer services. However yes the more money the customer have more attraction. It’s a universal fact. Totally biased opinion of the writer.

Well we can understand that you’re one of a bank employee and you’re pressurised to meet your targets but this statement doesn’t justify those complaints against the banks mentioned above. Secondly banks are not doing any favor on customs by providing their services, as a matter of fact they are charging every customer for their services. Also they’re using the customer money to generate more money on it. Hence this article is not biased but based on bitter reality.

Have a night mare experience with UBL so called . Best bank in Pakistan. Banca Assurance is a common fraud they do in banks.

One person go for saving account and they did EFU plan. So shameful tactics that person have lost all his savings as they don’t have money to pay 2nd installment.

National savings have same issues after post office account transfer

Having same experience with MCB Bank, filled a complaint 20 days ago not yet resolved. If you have personal relation will MB or OM then you can manage your problem. Pathetic service.

To make this Comparison more fair, kindly add Total Nuimber of customers of each bank as well. That way we can easily get the Customer to Complaint Ratio of all banks and better judge them

کرونا کے کے دوران تو بنکوں نے ظلم کی انتہا کردی گرمیوں میں خود اندر اے سی میں گپین ہانک رہے ہوتے ہیں اور کسٹمرز کو باہر دھوپ میں کھڑا کیا ہوتا ہے خاص کر سیونگ بینک تو ایسا رویہ اختیار کرتے ہیں بوڑے اکاؤنٹ ھولڈرز پر ظلم کے پرابر ہوتاہے عملہ اندر موبائل پر مگن ہوتا ہے

The writer shall experience European & Arab world banking & customer dealing… He/She will love Pak Banking, and all other utility services in Pakistan…

Its really another big blow to Pakistani people. Customer care almost zero by banks despite huge profits. No comparison at all with foreign banks. SBP is the one who should push banks for better service

Complaints doesn’t means banks are not taking care of customers. Majority complaints are baseless. Even the customers doesn’t differentiate tax and bank charges. Good information shared gardezi sb.

All the banks are to fleece the public, they are least interested in giving facilities. Staff are not trained, banks are overloading the staff. They are also not giving proper profit.

They are only interested in deduction something from you. They damn care about the quality.

Very strange artical. One sided story only. Why admin allowed such artical where other side statements are included??? Pakistani banks are bad even more than other segments of society say Police, Wapda, Irrigation, Health you just name it!!!!!!!

Banks invest in govt bonds, securities etc. They have no need of retail customers. That pretty much sums up the problem. The writer may wish to investigate and include this fact in his post.

Article is written on the basis of facts and that’s true.

on the other side State bank must execute such policies in which the banks should focus on staff strength, timing and benefits instead of targets and pressurizing them and considering them machines.

State Bank is responsible for all this bullshit.