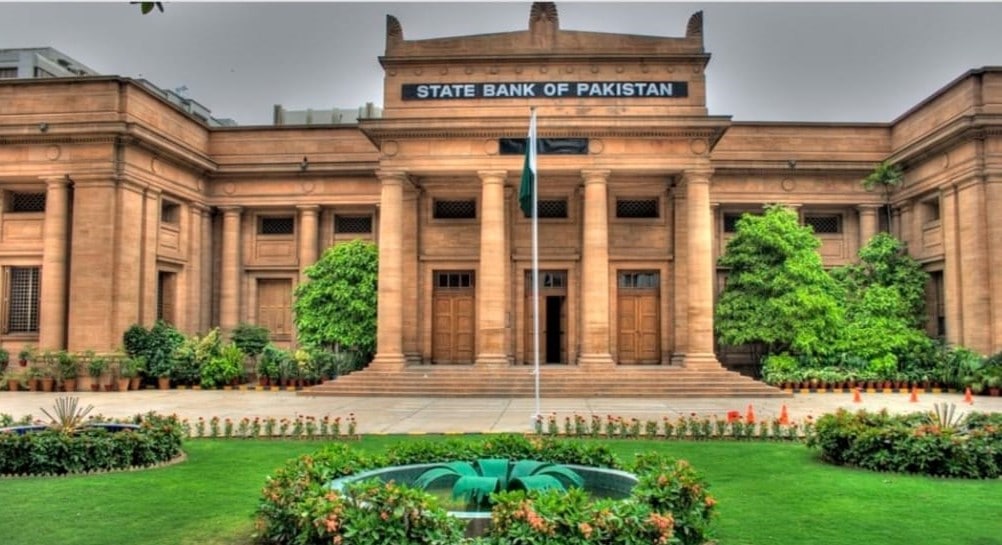

The State Bank of Pakistan (SBP) has decided to keep the policy rate unchanged at 9.75 percent.

This was revealed by Governor State Bank Reza Baqir, in a press conference after the Monetary Policy Committee’s meeting.

“We have taken a number of measures to manage demand, and want to see their impact,” said Dr. Baqir.

“We are observing moderation in demand growth. Our year-on-year headline inflation, for the time being, will stay up because of factors like international commodity rates, oil prices, and related factors. However, our cost projections have lowered. Economic indicators such as LSM Growth exhibited moderation; for example, in September, LSM Growth was 2.5 percent, while zero percent in November. Other economic indicators have also consolidated toward moderation in the past year, which shows that our economic growth is sustainable”.

Regarding headline inflation, the SBP Governor remarked that its momentum was coming down.

MPC decided to maintain policy rate at 9.75%. Since last meeting on 14Dec21 several developments suggest that demand-moderating measures are gaining traction. Together with Finance (Supplementary) Act, this has improved medium-term outlook for inflation. https://t.co/trOL5SUvli

— SBP (@StateBank_Pak) January 24, 2022

The central bank said that monetary policy settings are likely to remain broadly unchanged in the near term now, having already lifted the policy rate by 150 basis points at its meeting on 14 December 2021.

Since the last meeting on 14th December 2021, several developments suggest that these demand moderating measures are gaining traction and have improved the outlook for inflation. Recent economic growth indicators are appropriately moderating to a more sustainable pace.

The Central Bank in its MPC statement said, “While year-on-year headline inflation is high and will likely remain so in the near term due to base effects and energy prices, the momentum in inflation has slowed with month-on-month inflation flat in December compared to a significant rise of 3 percent in November. Inflation expectations of businesses have also declined considerably”.

The current account deficit appears to have stopped growing since November and the non-oil current account balance is expected to achieve a small surplus for FY22. Finally, and importantly, the enactment of the recent Finance (Supplementary) Act, 2022 represents significant additional fiscal consolidation compared to the budget and has lowered the outlook for inflation in FY23, it added.

Looking ahead, and against the backdrop of these developments that have improved the inflation outlook, the Bank was of the view that current real interest rates on a forward-looking basis are appropriate to guide inflation to the medium-term range of 5-7 percent, support growth, and maintain external stability. If future data outturns require a fine-tuning of monetary policy settings, the MPC expected that any change would be relatively modest.

The economic recovery underway over the last 18 months continues, with its pace moderating from a rebased estimate of 5.6 percent in FY21. Since the last meeting, year-on-year growth rates of several high-frequency demand indicators either stabilized or slowed, including cement dispatches and sales of petroleum products, tractors, and commercial vehicles.

Overall, growth in FY22 is expected around the middle of the forecast range of 4-5 percent, slightly lower than previous expectations in light of moderating demand indicators and higher base effects from the upward revision in last year’s growth rate.

The Bank noted that looking ahead, the current account deficit is expected to decline through the remainder of FY22, as import growth slows in response to normalization of global commodity prices and the fuller impact of demand moderating measures.

On the flip side, the bank recalled that headline and core inflation rose in December, both the sequential momentum of inflation and inflation expectations of businesses fell significantly. Together with low base effects, one-off cost-push pressures from energy tariff increases and the removal of tax exemptions in the Finance (Supplementary) Act are likely to keep year-on-year inflation elevated over the next few months, close to the upper end of the average inflation forecast of 9 11 percent in FY22.

The Bank remarked that during FY23, inflation is expected to decline toward the medium-term target range of 5-7 percent more quickly than previously forecasted as demand-side pressures wane faster due to the Finance (Supplementary) Act and recent moderation in economic activity indicators. The MPC will continue to carefully monitor developments affecting medium-term prospects for inflation, financial stability, and growth.