The Pakistani Rupee (PKR) continued its dismal run against the US Dollar (USD) and posted losses in the interbank market today. It lost 71 paisas against the greenback after hitting an intra-day low of Rs. 177.5 against the USD during today’s open market session.

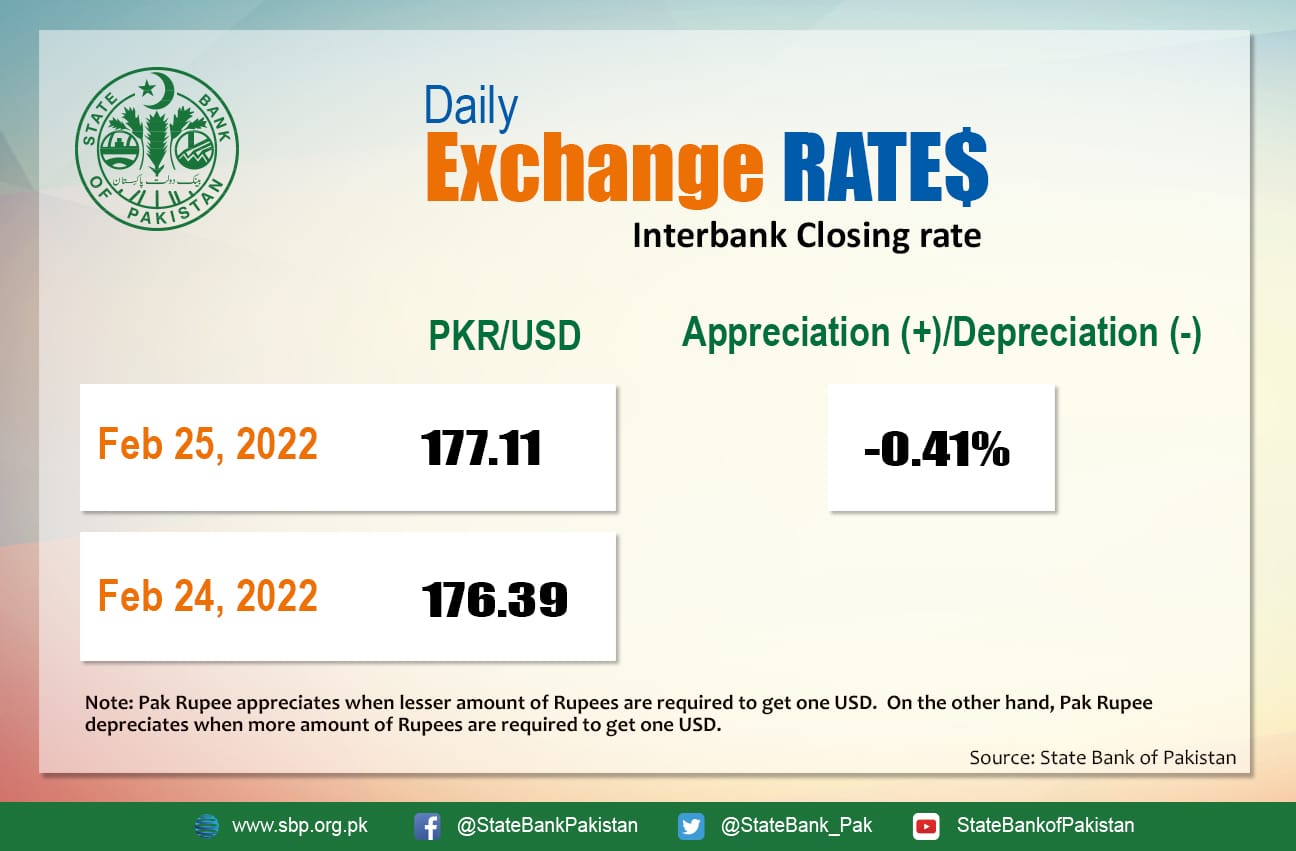

It depreciated by 0.41 percent against the USD and closed at Rs. 177.11 today after losing 23 paisas and closing at 176.39 in the interbank market on Thursday, 24 February.

The Rupee has lost 0.71 percent against the US Dollar on a week to date (WTD) basis. On a month-to-date (MTD) and year-to-date (YTD) basis, it has depreciated by 0.22 percent and 0.34 percent, respectively.

Today’s losses come after US regulators imposed a $55 million fine on the National Bank of Pakistan (NBP) over money laundering and compliance issues.

Globally, oil prices took a breather today after Thursday’s Russia-Ukraine escalation caused prices to surge above $100 a barrel for the first time in seven years, with Brent touching $105, before paring gains by day’s close. Reuters reported that Brent crude futures were down 33 cents, or 0.3 percent, to $98.75 a barrel at 1045 GMT, after climbing to as high as $101.99.

U.S. West Texas Intermediate (WTI) crude was down 30 cents to $92.51a barrel, after hitting a session high of $95.64 earlier today.

At home, the ongoing geopolitical situation has wider implications for Pakistan due to the likelihood of another rally in the prices of energy, food commodities, and semiconductor chips, and a direct impact is evident in Pakistan’s import of wheat from Ukraine.

To recall, Pakistan imported 39 percent of its total wheat imports from Ukraine in FY21 and any disruption in the imports can potentially result in elevated prices of food and energy in the region, and with effect, impede fiscal growth.

Discussing the local currency’s performance earlier during the day, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi, remarked that further conflict in the region might have massive ramifications for oil-importing emerging market (EM) economies. Importers will be bitten by Russia and Ukraine, two key wheat exporting countries.

He warned, “Pakistan’s C/A deficit could go haywire”.

Int-BANK

The consequences of conflict could be immense on OIL importing EM’s economies.Russia/Ukraine are also major wheat exporting countries that will bite importers. Pakistan’s C/A deficit could go haywire. I have been constantly pointing it in all my SBP SURVEY QUESTIONNAIRE

— Asad Rizvi (@asadcmka) February 25, 2022

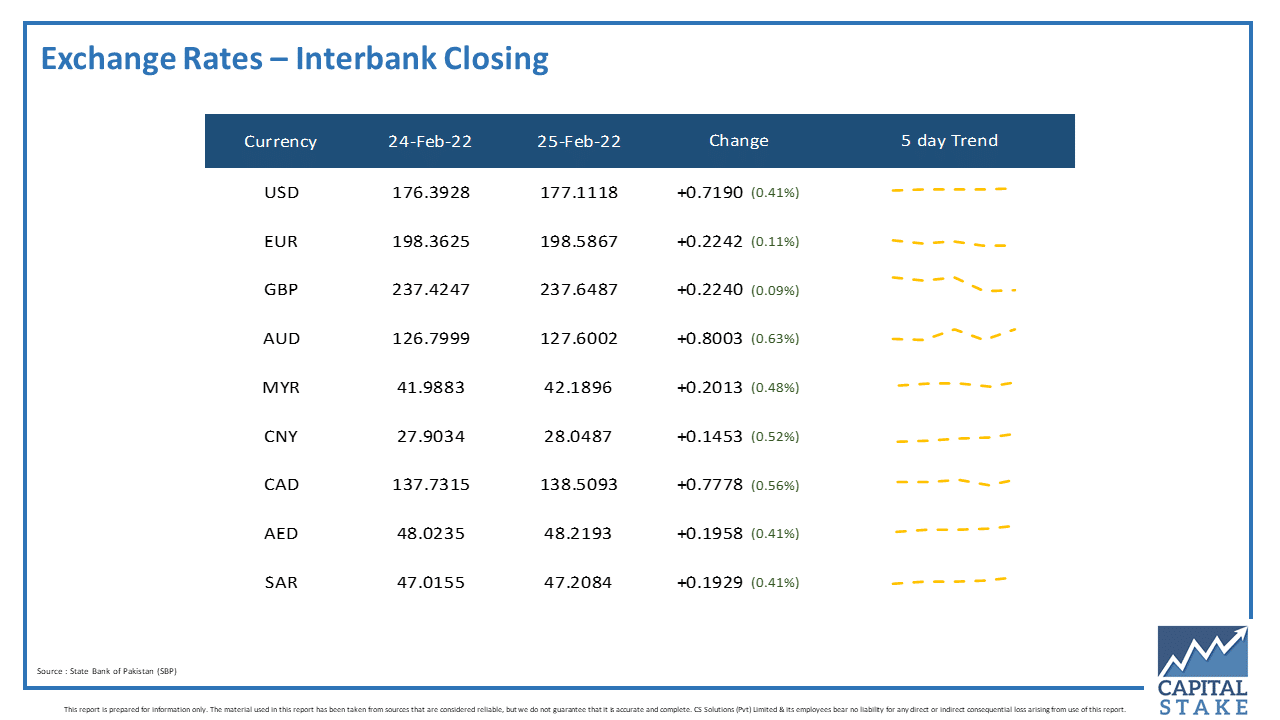

The PKR reversed gains against the other major currencies and reported losses in the interbank currency market today. It lost 22 paisas against the Euro (EUR), 22 paisas against the Pound Sterling (GBP), 77 paisas against the Canadian Dollar (CAD), and 80 paisas against the Australian Dollar (AUD).

Moreover, the PKR lost 19 paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED) in today’s interbank currency market.