The Pakistani Rupee (PKR) continued its historic drop against the US Dollar (USD) and reported losses in the interbank market today. The local currency lost 40 paisas against the greenback after hitting an intra-day low of Rs. 182.50 against the USD during today’s open market session.

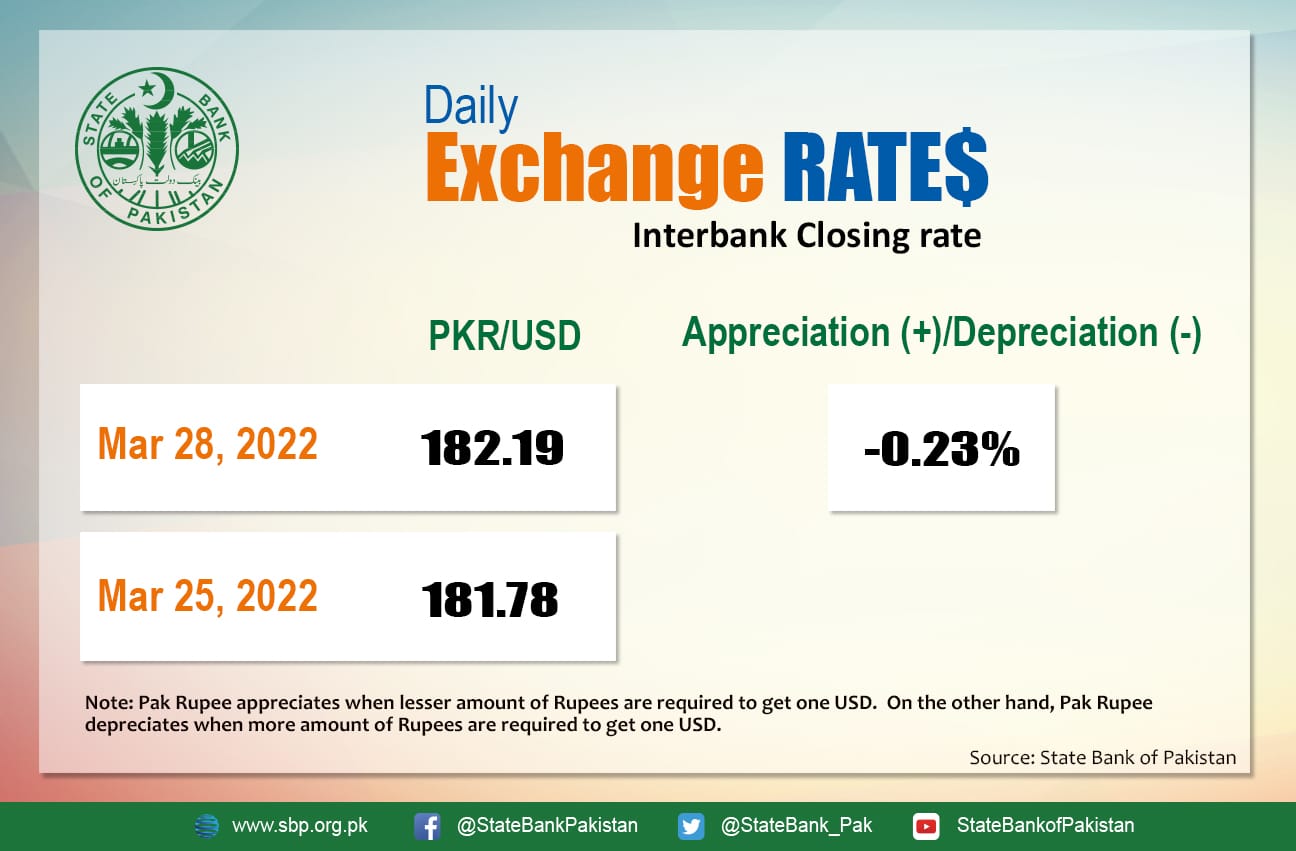

It depreciated by 0.23 percent against the USD and closed at Rs. 182.19 today after losing five paisas and closing at Rs. 181.78 in the interbank market on Friday, 25 March.

The local unit has dropped by 16.42 percent since its calendar year high on 14 May 2021, while on a fiscal year-to-date (FYTD) basis, it has lost 15.64 percent or Rs. 24.64. Since January 2022, it has lost 3.21 percent or Rs. 5.67.

The rupee crashed to another all-time low against the dollar today despite a sharp decline in global oil prices as concerns about weakening fuel demand in China rose following a lockdown in Shanghai to combat a rise of COVID-19 infections.

At the time of press, Brent futures stood at $115.8 a barrel (-4%), and U.S. West Texas Intermediate (WTI) crude fell to $108.8 a barrel (-4.5%).

Oil prices were also influenced by hopes for reconciliation from peace talks between Russia and Ukraine, which, according to Russian media, might begin in Turkey on Tuesday (tomorrow).

Domestic factors also played a role in impeding exchange rate consolidation as both geopolitical and fiscal outliers continued to put pressure on the rupee. For starters, the disagreement on four critical issues has become an impediment to the successful conclusion of the ongoing seventh review meeting between Pakistan and the International Monetary Fund (IMF). On the flip side, the ongoing political turmoil has added to the fears of market players who remain ever-hesitant to injecting funds into capital markets.

Moreover, tens of thousands of activists from Pakistan’s ruling party and opposition groups have descended on the capital, Islamabad, ahead of a vote seeking to topple Prime Minister Imran Khan, further fueling economic uncertainty in the days ahead.

Economic Analyst, A. H. H. Soomro, told ProPakistani,

Pressure on the Rupee is likely to remain due to high trade deficit, oil prices, FED tightening, war risks, political uncertainty and IMF’s next review. Perhaps the next SBP monetary hike and successful IMF review can halt the decline. Till then, Rs +181-2 seems to be the base case, especially as energy markets are far from balanced. All eyes are now on OPEC’s next meeting which is on 31 March.

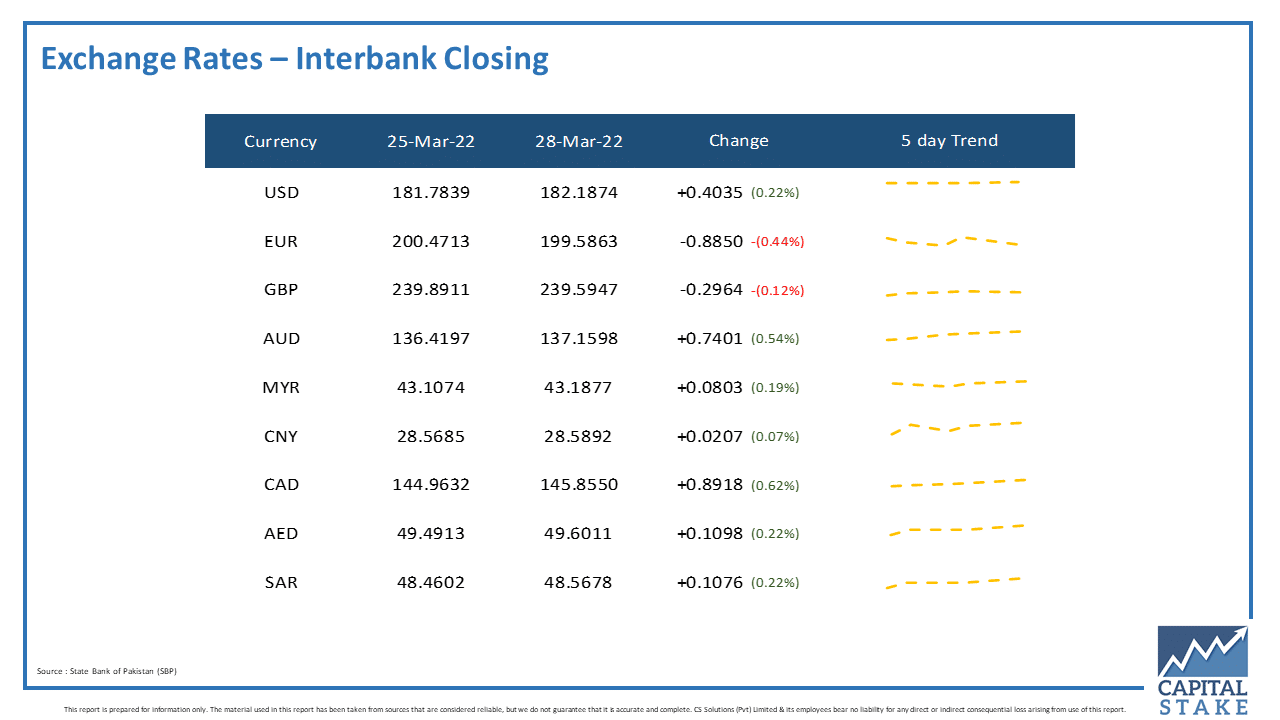

The PKR struggled against most of the other major currencies and reported losses in the interbank currency market today. It lost 10 paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED), 74 paisas against the Australian Dollar (AUD), and 89 paisas against the Canadian Dollar (CAD).

Conversely, it gained 29 paisas against the Pound Sterling (GBP) and 88 paisas against the Euro (EUR) in today’s interbank currency market.