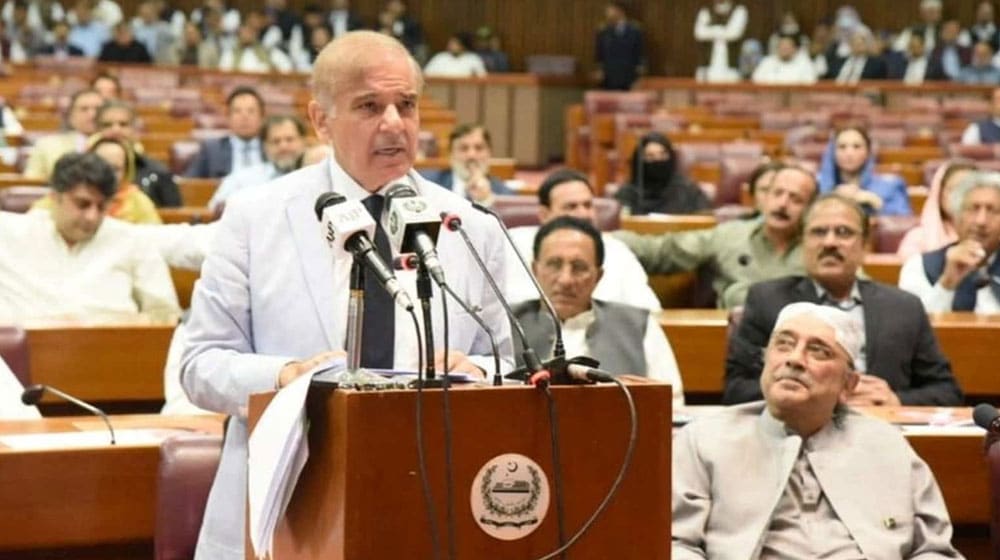

Prime Minister Shehbaz Sharif has directed the Federal Board of Revenue (FBR) to give a presentation on the overall revenue performance, new proposals, initiatives, and ongoing reforms in the tax administration.

In this connection, the FBR has received instructions from the PM Secretariat on Tuesday.

Highly-placed government officials told ProPakistani on Tuesday that the tax authorities including relevant FBR Members remained engaged in the preparation of the presentation to the PM and the new government’s economic team including Miftah Ismail, Musaddiq Malik, and Muhammad Zubair.

The FBR will inform the new government about the strategy to achieve the revised target of Rs 6.1 trillion for 2021-22, policy and enforcement measures, litigation in courts, registration of the retail sector, point of sales and track and trace system.

The FBR will focus on:

- introducing a centralized, risk-based compliance function;

- modernizing the IT system and further advancing automation;

- actively using third-party data, strengthening data cross-checking, and analysis;

- simplifying registration and filing processes;

- modernizing audit practices and taking a more targeted audit approach, and

- further strengthening the large taxpayer approach and expanding the activities of the Large Taxpayer Office (LTO).

Additionally, the FBR will continue the process of sales tax harmonization between the federation and provinces.

The FBR has provisionally collected net revenue of Rs. 4,382 billion during July-March (2021-22) against the assigned target of Rs. 4,134 billion, showing an increase of Rs. 248 billion. There is an achievement of 105 percent of the assigned target during the period of July-March (2021-22).

FBR has collected net revenue of Rs. 4,382 billion from July 2021 to March 2022 of the current financial year 2021-22, which has exceeded the target of Rs. 248 billion. This represents a growth of about 29.1 percent over the collection of Rs. 3,394 billion during the same period, last year.

Refunds worth Rs. 229 billion have been disbursed from July 2021 to March 2022 compared to Rs. 183 billion paid last year, showing an increase of 25.0 percent.

The FBR will further inform that the sales tax on all POL products has been reduced to zero which cost FBR Rs. 45 billion in March 2022. Likewise, the revenue impact of sales tax exemptions provided to fertilizers, pesticides, tractors, vehicles, and oil and ghee come to Rs. 18 billion per month.

Similarly, zero-rating on pharmaceutical products has cost FBR Rs. 10 billion in sales tax during March 2022. Thus, in aggregate, these relief measures have impacted revenue collection by approximately Rs. 73 billion during March 2022. Furthermore, the political uncertainty and import compression also negatively impacted revenue collection during March.