The Pakistani Rupee (PKR) halted losses against the US Dollar (USD) and posted marginal gains during intraday trade today.

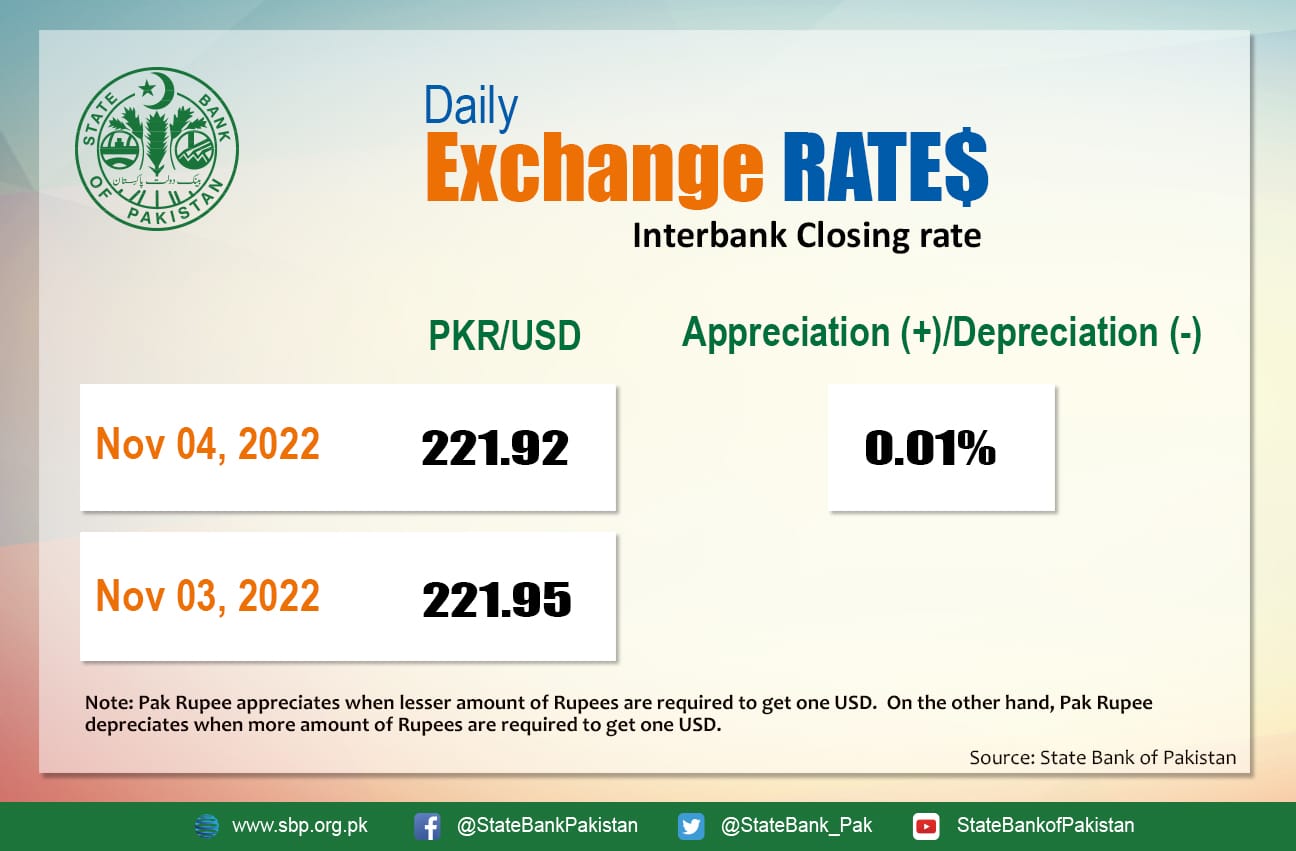

It appreciated by 0.01 percent and closed at Rs. 221.92 after gaining two paisas against the greenback. The local unit quoted an intraday low of 222.50 against the greenback.

The local unit was stable in the morning against the greenback and resumed trade at 221.46 in the open market. By midday, the greenback went as high as 222.125 against the rupee. After 1 PM, the local unit stabilized and stayed on the 221 level against the top foreign currency before the interbank close.

The rupee halted losses against the US Dollar today after a few days of consecutive losses.

Importers purchased dollars to make payments and their demand for the dollar has been incredibly high since it appears that the central bank authorized the opening of LCs. Money changers say the latest trade data hasn’t been well received by the market and the PKR will not appreciate until political clout loses steam, which is unlikely.

Multinational companies working in different sectors of the country could repatriate only $58.1 million in profits and dividends during the first quarter of FY23 as compared to $478 million during the same period of the last fiscal year. Analysts say this is due to an informal decline in services exports as foreign players are reluctant to engage the hardworking cream of the country.

Globally, oil prices rose on Friday as the dollar fell and supply concerns remained, though recession fears and China’s COVID outbreaks kept a lid on prices.

At 3:30 PM, Brent crude was up by 2.61 percent at $97.14 per barrel, while the US West Texas Intermediate (WTI) soared by 3.03 percent to settle at $90.84 per barrel. Both benchmarks rose more than $1 on Wednesday, helped by another drop in US oil inventories, despite the US Federal Reserve raising interest rates by 75 basis points.

With the greenback falling, both contracts rose. A weaker dollar increases demand for oil by making it more affordable to those who hold other currencies. While concerns about demand weighed on the market, supply is still expected to be tight, with Europe’s upcoming embargoes on Russian oil and a decline in US crude stockpiles.

The increasingly bleak macroeconomic outlook is creating significant headwinds for the oil market, and without the supply cuts announced by OPEC+ in October, we would most likely be trading at much lower levels.

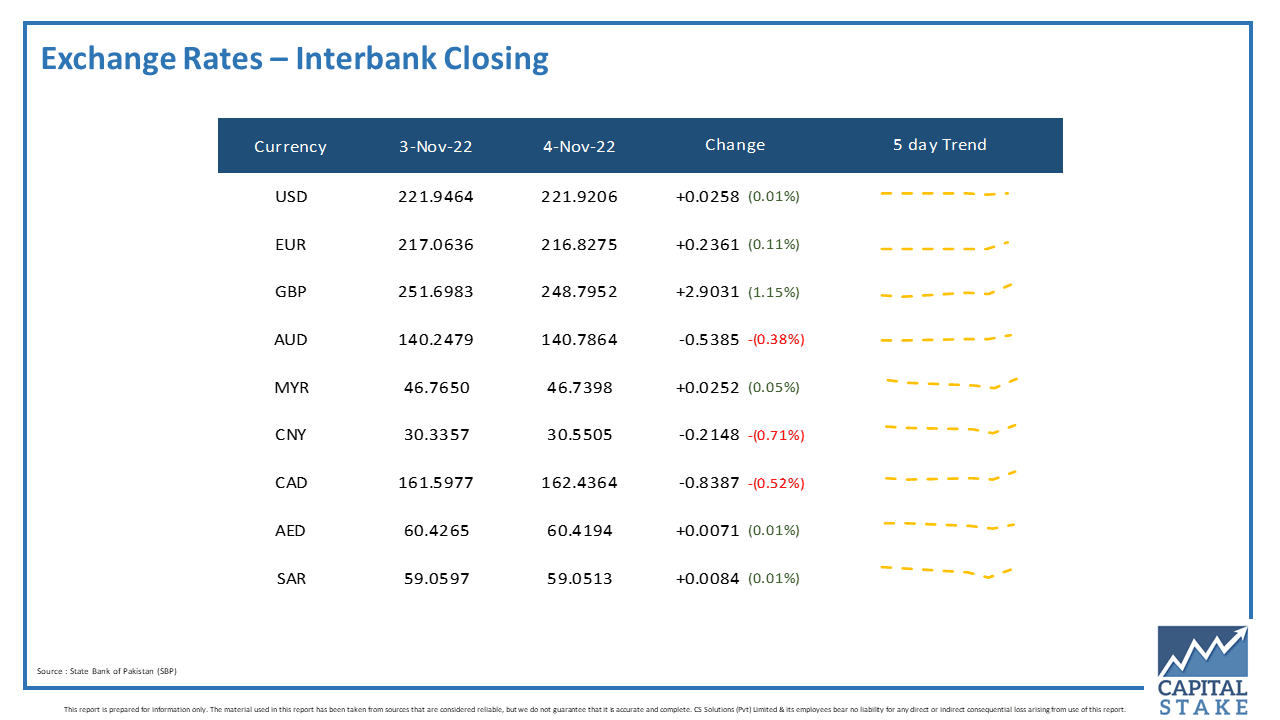

The PKR was bullish against most of the other major currencies in the interbank market today. It held out against the Saudi Riyal (SAR) and the UAE Dirham (AED), gained 23 paisas against the Euro (EUR), and Rs. 2.90 against the Pound Sterling (GBP).

Conversely, it lost 83 paisas against the Canadian Dollar (CAD), and 53 paisas against the Australian Dollar (AUD) in today’s interbank currency market.