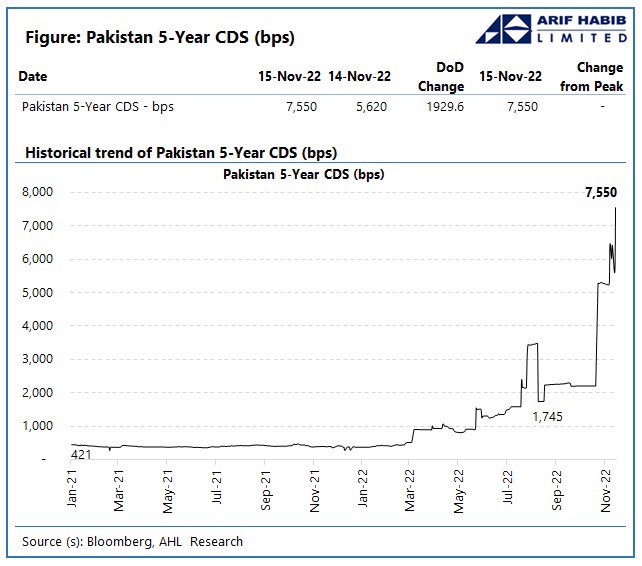

Despite Ishaq Dar’s repeated assurances for Pakistan’s economy to survive this fiscal year’s spiraling money crunch, default risk entered alarming new levels today as the cost of ‘insuring’ the country’s sovereign debt spiked to its highest-ever level.

According to data by Arif Habib Limited (AHL), Pakistan’s benchmark 5-year Credit Default Swap (CDS) spiked on 15 November by a whopping 1,929 basis points to 75.5 percent. The instrument has widened by over 19.29 percentage points in a single day and shows that investors have panicked amid the country’s foreign exchange reserves depleting by over $10 billion in the past 11 months.

This spike indicates that Pakistan’s CDS curve inverted dramatically on Tuesday, a phenomenon that occurs when investors rush to buy protection against a near-term default. While these levels are higher than where the CDS traded on Monday at 64 percent, a drop in the contract yield means the derivatives now refer to a riskier class of debt that is more vulnerable to losses if the instrument collapses.

Investors are skeptical about the country’s upcoming obligation to repay credit holders $1 billion when the Sukuk matures on December 5, 2022. Moreover, expectations for yield growth have dwindled as there is concern that the value of tradeable instruments will not rise in the current environment.

In this regard, an international equities broker told ProPakistani,

The widening shows Pakistan’s chances of defaulting on maturing loans are pretty high right now. The country’s perceived risk of sovereign default has risen to a new high as a result of the worsening dollar crisis, indicating that jittery creditors and markets require more than words to alleviate their concerns. The country’s credit default swap reflects dwindling investor confidence in Pakistan’s ability to repay its $1 billion Sukuk bondholders next month.

She warned that denting investor confidence in government maturities exacerbates fears of the country’s inability to raise foreign investments, which would further slow down growth, a weakness reflected in this week’s maturity breakdown.

The yield (rate of return) on the 5-year Third Pakistan International Sukuk is currently around 75 percent. It was less than 10 percent in January 2020.

As of 15 November, the yield on the five-year third Pakistan International Sukuk Company Limited increased by 620 basis points to 74.8 percent. The yield on a 10-year Eurobond maturing on April 15, 2024, decreased from almost 61 percent to 60.6 percent. The yield on the 10-year Eurobond maturing on September 30, 2025, increased from 43.7 percent to 44.3 percent.

seems like another fake scare as they did before so finally they can bring the sher from London and after that magically everything will be fixed…

Pakistan is scheduled to repay $1 billion against a five-year ‘Sukuk ‘(Shariah-compliant bond) maturing on December 5

State Bank of Pakistan (SBP) Governor Jameel Ahmad, however, already clarified that the country had foreign exchange reserves of “over $9 billion, which are more than enough” to pay for imports and repay foreign debt.