The Pakistani Rupee (PKR), the emerging markets’ worst performer in the past few months, is likely to extend losses in the next fiscal year, having lost over Rs. 102 against the US Dollar since April 2022.

A high-profile investment banker, who in October predicted the PKR to fall below 250, has made another blood-curdling bet that the rupee could crash beyond 300 against the dollar in May and to as low as 310 by June.

“The 300-310 band feels like just a few weeks away since the formula doesn’t work anymore. A controlled current account deficit in the next fiscal year will keep the rupee happy-go-lucky, but it won’t stop further devaluation until industries reboot. The IMF cash is a short-term solution, so elections may offer more clarity”, the banker said in a conversation with ProPakistani.

Ever since the government reluctantly relaxed currency controls in January, markets can’t predict exchange rate movement as investors thought they would. The government has been fulfilling the International Monetary Fund’s (IMF) requested changes for a billion-dollar bailout, which have resulted in commodity/energy price spikes in the short term and made lives miserable for the people.

“Pakistan is experiencing a balance-of-payments crisis, as analysts are calling it. The country has been spending more on trade than it has brought in, depleting its forex reserves and lowering the rupee’s value. These dynamics, coupled with import and forex restrictions, raise interest payments on foreign debt which we’re incurring heavily, and the default gossip is no longer a joke,” the banker noted.

Some of the issues that the country is dealing with are unique to Pakistan. “Political peril and artificial efforts to prop up the PKR have weighed on the economy heavily. Politics and self-interests aside, authorities should announce elections to deal with domestic factors. Feels wrong to put it this way, but instability and polarization since spring last year have only heightened uncertainty which is hurting the PKR”, he added.

Rupee Collapse – Is There a Solution?

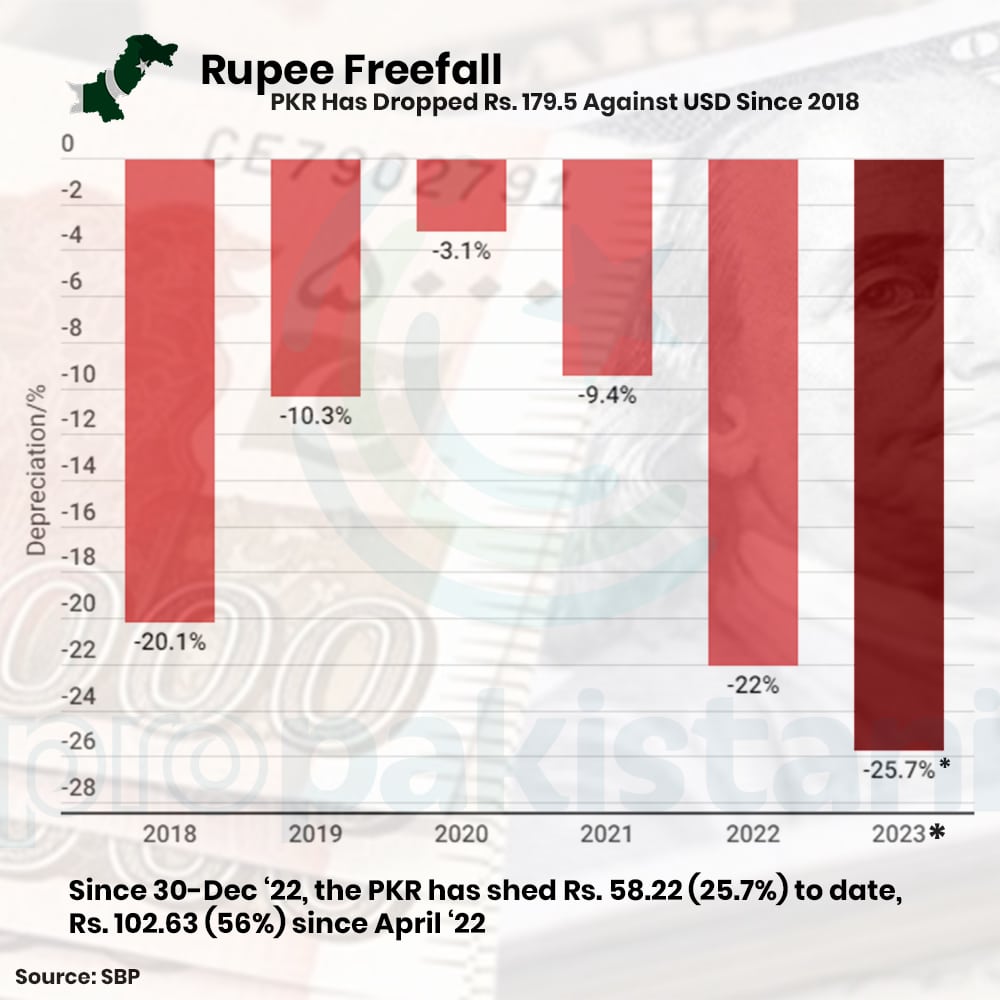

The rupee has declined over 56 percent since April 11th, 2022, falling by Rs. 102.63 from 182.02 to 284.65 to date, weighed by the abrupt political takeover last spring and subsequent struggles of Prime Minister Shehbaz Sharif’s government to save the ship.

From 30th December 2022 to date, the rupee has shed 25.7 percent in value.

In recent months, the Pakistani rupee has been one of the hardest-hit currencies globally. From a low of 105.18 in 2018, it has crashed to the current level of 284.65. The USD/PKR exchange rate has shifted above all moving averages and is likely to continue falling as trends look set for the next threshold at 300.

Economic analyst A H H Soomro told ProPakistani,

The more uncertainty and signs of weaknesses and political uncertainty, the lower PKR can fall. However, IMF’s SLA and FX improvements can very well stabilize the rupee below Rs. 300 for the next few months as the current account moderates to near surplus and speculation reduces.

“For PKR to find its level, we need new elections and structural reforms along with a new 4-year program. It’s a shame we have not been able to keep the rupee stable for a year. It was totally doable,” he added.

Looking Ahead

For an economy estimated to grow by only 0.4 percent in the current fiscal year (FY23), Pakistan hasn’t avoided grappling with rampant price hikes and a massive dollar shortage. The State Bank of Pakistan recently hiked its key interest rate to 21 percent in a bid to clamp down on annual consumer inflation of almost 35.4 percent, the highest inflation reading recorded in Pakistan since April 1965. Still, the outlook remains bearish.

The central bank may mop up any inflows to boost its foreign-exchange reserves, a move that may also work in favor of PKR, but only temporarily. The IMF’s endless delay in bailing out Pakistan has made market participants skeptical of the possibility of funding, causing importers to panic and purchase dollars at higher prices.

In summary, the balance of risks to Pakistan’s overall outlook remains tilted to the downside, with a lot of scope for lower growth, higher inflation, PKR depreciation, and other imminent adverse risks. While Finance Minister Ishaq Dar on Saturday underscored that “Pakistan is a member of the IMF and not a beggar”, the availability of the IMF loan is critical to bring down the pressure and converge to more stable levels.

But will the IMF cash be enough to support the PKR? Let us know in the comment section below.

Yes, I endorsed because there is no medium or long-term planning right now .

Existing Government are planning up to election terms and is still trying to avoid short-term reforms .

A key decision makers of Pakistan that is obviously Establishment are overconfident and out of reality, and they don’t realize that they have lost the image badly .

There are no reforms right now, and only War is going now for power balancing between Establishment and Political Class .

Every Nation have to face such situations in their developing times and Pakistani Nations are learning….

The only Questions left that who will win this Games …. Old mindsets Establishment and reformers….

Let’s pray 🙏 for the blessings from the Allah