E-Commerce transactions in Pakistan declined by 8.4 percent in the quarter that ended on 31 December 2022, according to the State Bank of Pakistan’s (SBP) quarterly report on Payment Systems in the country.

The report revealed that mobile banking users increased by 17 percent to 15 million during Q2, while internet banking users rose by 15 percent to 10.1 million during the period in review.

More data suggests the volume of transactions through Point of Sale (POS) increased by 13 percent to 50.3 million accounting for payments of over Rs. 266 billion during October-December last year.

Meanwhile, 25.8 million users registered with the Raast payment system. The P2P payment system facilitated over 21 million transactions worth Rs. 578 billion in the last quarter of 2022. The system processed 11.8 million transactions valuing Rs. 234 billion in the proceeding third quarter of 2022.

Payment Systems Infrastructure

The quarterly review shows an ongoing increasing trend in payments through digital channels. During the quarter, the network of POS machines has expanded by 2.3 percent reaching 108,899 machines by end of Dec-22. The number of Internet and mobile phone banking users registered with Banks/ MFBs has grown by 14.9 percent and 17.0 percent respectively.

Banks/ MFBs have on-boarded 525 new e-commerce merchants making a total of 5,954 as of December 2022. In the same quarter, Electronic Money Institutions (EMIs) opened 433,851 new e-wallet accounts reaching 1.4 million accounts in total.

It bears mentioning that by the end of 1QFY23, there were 17,380 ATMs in the country, a number which has now increased to 17,547 ATMs by end-December. The average up-time of these ATMs during 2QFY23 was 96.4 percent which was 95.6 percent in the previous quarter.

Payment Systems Instruments

Since the past few quarters, an increasing trend in the shift toward payment systems is observed. With the addition of EMIs in Pakistan’s payments ecosystem, people have started to adopt digital instruments for payments. As of December 2022, total payment cards issued in Pakistan stood at 46.5 million of which, 44.7 million are issued by Banks/ MFBs while the remaining 1.8 million are issued by EMIs.

Payment cards in Pakistan can be categorized into 4 categories. As per the data, there are 34.3 million Debit cards capturing 73.8 percent of the share in total cards followed by 10.2 million Social Welfare cards (21.8 percent), 1.9 million Credit cards (4.1 percent), and 0.2 percent Prepaid cards.

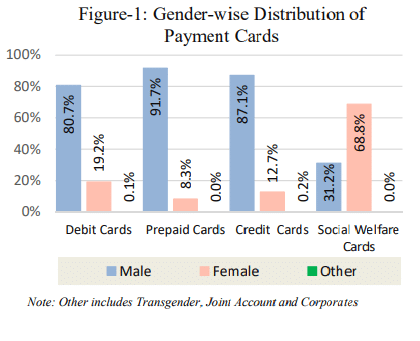

Around 81 percent of all debit card holders are male, 19.2 percent female, and <0.1 percent fall under the Others category Similar trend is observed in Prepaid and Credit cards where the majority of cardholders are male. However, for Social Welfare cards, 69 percent of card holders are female and only 31 percent are male card holders.

Payment Systems Transactions

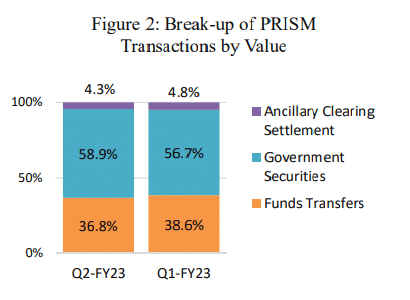

There is an increasing trend in overall Large-Value Settlements (LVS) and Retail Transactions by both volume and value indicating a healthy payments ecosystem. During the quarter 2QFY23, the number of LVS processed through PRISM grew by 5.4 percent with value increasing by 11.3 percent reaching Rs. 150 trillion.

Around 59 percent of all PRISM transactions pertain to government securities and 37 percent to customers and 3rd party funds transfers.

In addition to this, both e-banking and paper-based transactions also witnessed growth during the current quarter. A total of 514.6 million e-banking transactions were processed by Banks/ MFB with a value of Rs. 42.5 trillion showing a growth of 12.6% by volume and 6.5 percent by value.

Mobile Phone and Internet banking volume increased by 19.6 percent and 13 percent while the value grew by 26.0 percent and 1.8 percent respectively. Meanwhile, the volume of e-commerce transactions declined by 8.4 percent but its value increased by 2.2 percent.

Paper-based transactions volume in 1QFY23 was 93.9 million which has increased to 94.9 million by the end of 2QFY23. During the same period, the value of transactions increased by 7.7 percent, reaching Rs. 54.8 trillion.

Raast

Raast has shown positive growth in the number of users and transactions since its inception. As of now (2QFY23), there are 25.8 million registered Raast users which were 21.1 million in the previous quarter. During the quarter in review, the number of transactions processed through Raast increased by 82.2 percent while value grew by 147.1 percent.