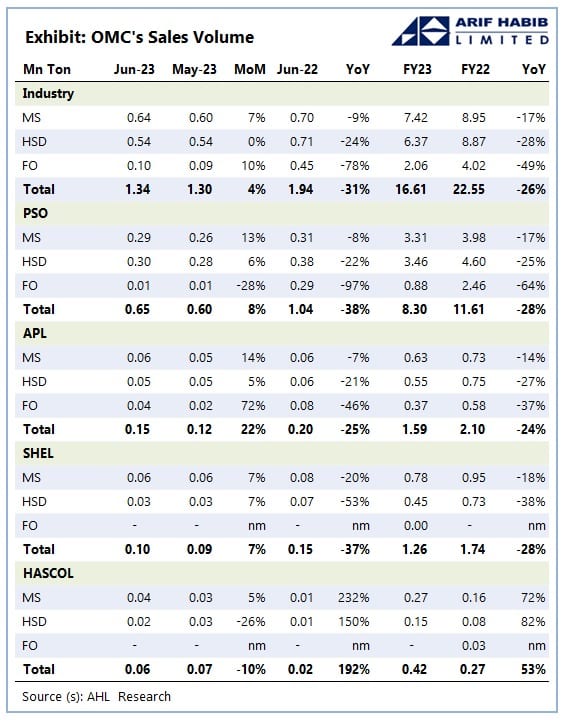

Pakistan’s petroleum sales witnessed a significant decline of 26 percent on a year-over-year (YoY) basis and stood at 16.61 million tons during the fiscal year 2022-23 compared to 22.55 million tons during FY22.

During the month of June 2023, OMC industry sales increased by 4 percent month-on-month (MoM) but showed a 31 percent YoY decline to 1.34 million tons.

At 16.6 million tons for the full financial year, this is the lowest ever sales (excluding COVID) since available data (FY07), according to Arif Habib Limited (AHL).

OMC Industry sales declined by 26% YoY to 16.61mn tons during FY23, this is the lowest ever sales (excluding COVID period FY20) since available data (FY07)@Pakstockexgltd @PSOPakistan#OGRA #PSO #APL #SHEL #Pakistan #AHL pic.twitter.com/4gu2ktdVPY

— Arif Habib Limited (@ArifHabibLtd) July 4, 2023

FY23 Figures

During the 12 months of the financial year 2022-23 (FY23), MS petrol sales witnessed a decline of 17 percent YoY, reaching 7.42 million tons. HSD sales suffered the second biggest blow with a decline of 28 percent on a YoY basis, while FO sails slid by 49 percent YoY to 2.06 million tons.

The decline in diesel sales across all markets suggests that smuggled diesel saw a volumetric increase from Iran to Pakistan via the Iran-Pakistan border.

Other reasons may include the economic slowdown witnessed since April 2022, high retail prices of petroleum products, and low FO-based power generation.

Company-Wise Sales

The company-wise analysis shows that Pakistan State Oil (PSO) sales declined by 28 percent YoY from 11.61 million tons to 8.3 million tons in FY23. Under the government-run entity, MS sales witnessed a decline of 17 percent YoY, reaching 3.31 million tons. HSD sales declined by 25 percent on a YoY basis, while FO sales collapsed by 64 percent YoY.

Sales under Attock Petroleum Ltd. (APL) registered a significant decline of 24 percent on a YoY basis in FY23 on the back of decreased FO, HSD, and MS sales by 37 percent, 27 percent, and 14 percent, respectively. Conversely, overall sales jumped by 22 percent MoM during June 2023 amid a resurging offtake of MS, HSD, and FO during the month.

Shell’s offtake declined by 37 percent YoY in June 2023 as the sales of HSD and MS dipped by 53 percent and 20 percent, respectively. For FY23, overall offtake dropped by 28 percent YoY on the back of low MS and HSD sales.

Conversely, HASCOL’s sales increased by a massive 192 percent on a YoY basis in June. During the period in review, MS sales witnessed an increase of 232 percent YoY, reaching 0.04 million tons, while HSD sales showed a 150 percent YoY growth. The company’s sales increased by 53 percent YoY to 0.42 million tons for the financial year that ended on June 30, 2022-23.

FY24 oil sales may see another 20-25 percent YoY drop, mainly due to the overall slowdown in the economy despite a few improved macros. Demand will continue to remain stunted due to elevated commodity inflation levels and the jacked-up petroleum development levy of Rs. 55 per liter, which may reach Rs. 60 per liter in the coming months.