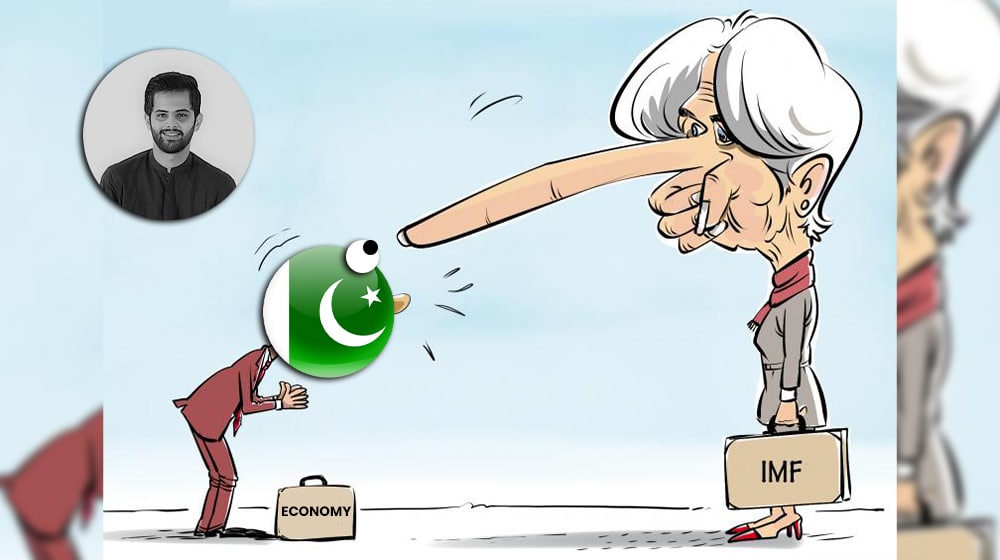

The International Monetary Fund (IMF) has strongly urged Pakistan in three consecutive reviews to allow a market-determined exchange rate for absorbing external shocks, a move that would weed out foreign exchange (FX) shortages and eventually support the rupee (PKR) in the long run.

Despite the lender’s myriad requests, Pakistan’s historical pool of finance ministers has so far failed to deliver. The issue is whether they understand what external shocks actually are.

The real question is whether Finance Minister Ishaq Dar – the PML-N’s choice for interim Prime Minister – is aware at all.

Debt

According to the Economic Affairs Division of the Finance Division, the federal government borrowed $10.844 billion from multiple financing sources during the fiscal year 2022-23 (FY23), constituting a high sovereign risk (external shock #1) for international investors since the country has yet to unveil fiscal policies to incentivizing these inflows.

Kicking off FY24 with a bang, Pakistan received $4.2 billion in mid-July and expects further inflows of $10.5 billion promised by international creditors at the ‘International Conference on Climate Resistant Pakistan’ in Geneva earlier this year.

Pakistan has an extensive record of going off-track on its commitments to lenders. The potential mishandling of fresh inflows, and policy missteps ahead of the October General Elections will further impede investor confidence.

Pertinently, Pakistan’s financing options after July are expected but not confirmed, while foreign repayments remain substantial over the next few years.

Risk Premium

In a volatile economy like Pakistan, poor ratings on sovereign bonds and treasury bills are badly impacting market liquidity, leading to currency depreciation.

On July 10, Fitch Ratings upgraded Pakistan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘CCC’ from ‘CCC-‘, which in layman’s terms can be classified as ‘Junk’ to ‘Less Junk’ (external shock #2).

While it doesn’t directly reflect the risk profile, Pakistan’s current account deficit (CAD) was cumulatively reduced by 85.3 percent YoY to $2.56 billion in July-June FY23. The authorities celebrate this achievement, but the policies behind it have weighed heavily on the domestic economy in terms of the massive decline in manufacturing, slowing down businesses and industries, investment, employment, and inflation.

“The CAD will widen as SBP accumulates more debt from foreign lenders, while gradual liberation of import backlogs, the dependence of the manufacturing sector on foreign inputs, and reconstruction needs after last year’s floods will slow recovery to at least 3 years,” a high profile investment banker said in an emailed response.

“Poor rupee and junk trade will constrain government spending as well as business investment. This is very likely as the country now prepares to reboot industrial operations and will import raw materials in bulk, which will push fiscal expenditure above foreign income in the coming cycles, essentially keeping CAD in the red. PKR will cross 300 in a month or two and stay there,” he added.

On Friday, the PKR/USD interbank rate closed at 286, while open market rates stayed above 290, and informal (undocumented) surged to 305.

The real cost of currency depreciation due to current account imbalances can be larger and have a negative impact on the real economy itself.

Monetary, PKR Contraction

Monetary contraction is so often associated with decreased foreign exchange intervention. The State Bank of Pakistan (SBP) is apparently following quite a restrictive policy by unwillingly allowing the exchange rate to rise to keep the current account in balance.

Unless the central bank fully sterilizes the market by selling bonds and liberating letters of credit, bank reserves will stay under pressure, and the banking system will become less liquid (external shock #3).

The Pakistani Rupee, which is nearing a record low against the dollar, could see further weakness. The informal market is jubilant with the IMF’s latest premium limit of 1.25 percent for interbank/open market exchange rates. “Very easy to make money with this. Peshawar and Quetta counters will be ready. The dollar game at borders will make the move completely useless,” a trader said, adding, “With purchasing power thrashed to a pulp, everyone now wants to make money these days. Remittances will rise but interbank clearance will take hits”.

Pertinently, the PKR has lost more than 22 percent this year after Dar and Co. devalued the currency in January, making it one of the worst performers globally.

Given the high political stakes of the upcoming General Elections in October 2023, the outlook remains grim.

Overall, the impact of the IMF standby agreement is slowing. Such a slowdown, accompanied by painful mini-budgets if the bailout is stalled again, would be the classic prescription for draining the economy of liquidity. Higher interest rates are said to be bitter medicine, so expect SBP to be the villain in its upcoming monetary policy review.

But that is just the tip of the iceberg. Inflation has been moving downward while unemployment has been astonishingly high – an unexpected and unattractive marriage of seeming opposites, like hot fudge spread over makhni handi. It’s no surprise that the government wants to ignore external shocks, but at what cost?

The writer is a Business Analyst at ProPakistani and these views do not necessarily reflect the opinion of the company or its owners.

Imports of raw materials should not be restricted unduly. But imports of non essentials like imports by auto assemblers and imports of high powered vehicles and of course chocolates/cheese/pet food etc should be restricted/prohibited. Do you agree?

not at all. nothing should be prohibited, although they can make the taxation higher to make it more expensive and earn more taxes.

But this has already been happening since decades and we are paying duplicated taxes. The solution is to stop spending money on development projects for some time, do not make unnecessary expenses. Govt employees has been given 30% raise, for what? they are hadharams due to which none of our country organization is working. whole system is collapsing due to incompetent workers.