The sugar sector is a ‘gift’ that keeps on giving. The crushing season is yet to begin at full pace in most of Punjab and it hasn’t been long since I discussed everything that has already gone wrong in the sugar industry this year but there is more.

Pakistan Sugar Mills Association (PSMA) has requested the government to either purchase the 1.13 million tons of surplus sugar available in stock through the Trading Corporation of Pakistan or allow it to export the second batch of 250,000 tons agreed upon under the previous government.

Millers note that while the surplus is sufficient to fill the needs of another two months, given the average consumption, the storage capacity of most of the mills is already filled.

PSMA argues that strict restrictions on inter-provincial movement of sugar, unresolved bank liabilities from undisposed sugar stocks, coupled with high-interest rates and banks squeezing credit lines for grower’s payments because of the recent court decision in JS Bank case have added to cash flow issues.

The Land of Coincidences

For those unaware of the background, last year too Sugar Advisory Board (SAB) noted a surplus of 1.25 million tons and the government allowed to export of 500,000 tons. The country exported some 220,000 tons but witnessed the commodity smuggled nearly 800,000 tons more as per figures cited by Punjab Food Department in the media.

When SAB later tried to fix the sugar price at Rs. 98 per kg, Millers secured a Lahore High Court gave a stay order with a hearing date of four months later in September. Meanwhile, sugar prices in the retail shot through the roof clocking at even Rs. 220 per kg at places with Ex-Mill prices recording as high as Rs. 17,000 per 100kg.

It also must be remembered that in September, the Punjab Government sacked Food Secretary Zaman Watto on the grounds of ‘misstatement and committing misconduct in the sugar crisis and both federal and provincial governments promised strict action against culprits. The Federal Investigation Agency (FIA) also initiated an inquiry on behalf of the caretaker government into sugar mills.

Interestingly, the FIA investigation is also unexpectedly halted without any reason this week, just as PSMA is seeking export permission again. As per Express Tribune, millers allegedly earned nearly Rs. 550 billion through profiteering. Well, maybe that would’ve proven wrong if the investigation had continued but again, Pakistan is a land of coincidences.

Same Old Story?

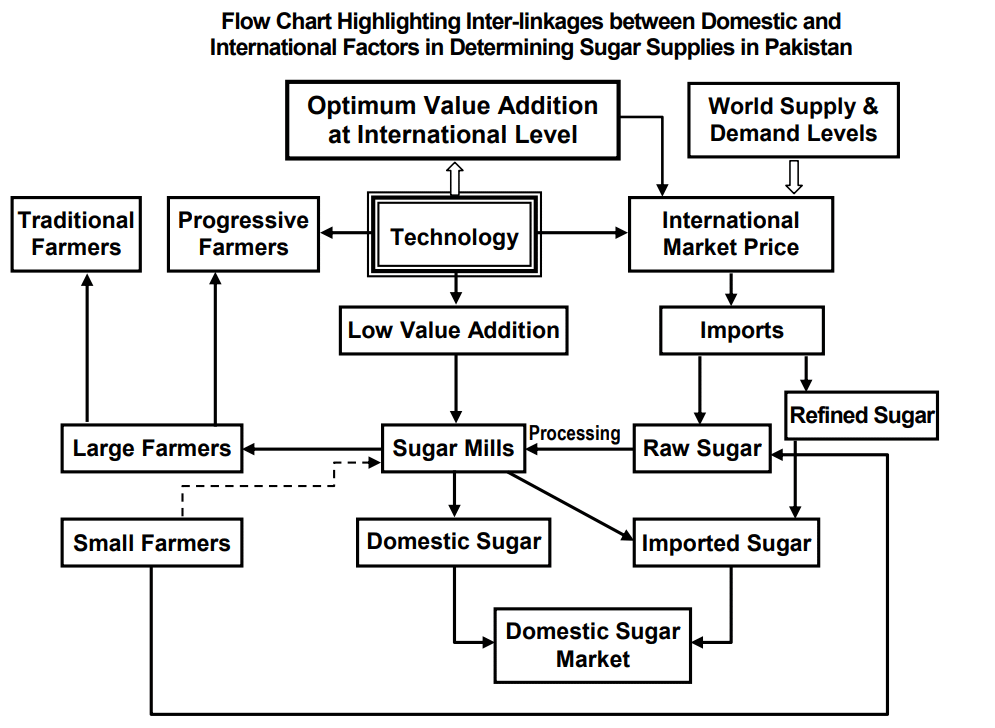

If anyone is having a little déjà vu at this point, don’t worry, this has been the same story every year for decades where surplus sugar has been exported even with low international prices, from time to time as carryover stocks instill a liquidity crisis for the industry as well as being a storage issue. But sometimes sugar has also been imported as well in the same years it has been exported, reflecting a strong likelihood of the government misjudging the numbers or being misinformed about it.

The bottom line is that Pakistan lacks a reliable strategic food management system and government figures regarding different commodities, not just sugar, have come under question multiple times. That is bound to result in blind decisions bringing in cyclical crises in both sugar and wheat and the FBR Track and Trace System which was supposed to fix this problem has lost its own track.

However the formal exports of 220,000 tons represent a very small portion of the total quantity of sugar produced during 2022-23, which was 7.05 million tons. The price of sugar has skyrocketed in years when not even a single ton was exported. The bigger problem is the smuggling and the speculative forward contracts that create an environment of shortage even with enough stocks that have been well documented here before.

Thanks to a strict administrative crackdown in September, both avenues have been curtailed to a larger extent and Ex-Mill prices of sugar have dropped to below Rs. 12,000 per 100kg while the retail prices are also hovering between Rs. 130-150 per kg. But still, there is no reliable mechanism to report the numbers of production as PCGA does in Cotton.

PSMA stated in September that at the end of the sugar season of 2022-23, had 8.5 million tons of sugar in stocks and consumed nearly 5.85 million tons between November and July. With current stocks standing at 1.13 million tons as of 31st October 2023, it can be said that Pakistan consumed some more than more than 7 million tons in 12 months.

Even if we factor in the quantity exported formally as per Pakistan Bureau of Statistics, where the 800,000 tons of sugar came from that was smuggled as per Punjab Government statements quoted in the media? The government even blamed the stay order by LHC for failing to stop smuggling while a sitting bureaucrat was also sacked in the matter.

One more thing to ponder is why storage is still an issue even after the fact that Pakistan has largely become self-sufficient in sugar production. The whole business model of sugar mills is to do the crushing for four to five months and trade sugar for the rest of the season so the storage and related things should be pre-requisite.

Nobody To Blame?

Market insiders talking to ProPakistani said that one more reason behind the weak demand, lower prices, and the cash flow problem is the fact that because of administrative action in September, a large number of hoarders lost billions as they were betting on prices to cross Rs. 18,000 to 19,000 per 100kg by Oct-Nov when prices crossed Rs. 17,000 per 100kg in September.

But because of the crackdown, brokers turned their phones off, speculative forward contracts were closed for more than two weeks and markets nosedived as everyone acted for themselves. Even after the media pressure subsided and the Lahore High Court extended the stay order for millers, prices remained the same.

These sources state that since the same people who lost money earlier are not willing or simply unable to start ‘betting’ again, there was no one to prop up the market and smuggling to Afghanistan has been curtailed. So, the current state of the sugar market as far is also to some extent a result of the sector’s own doing.

It’s also plausible that while giving the rationale of exports, millers don’t forget to mention the payments for growers, so the farming community also ends up supporting the case for exports without thinking it through because any positive development regarding exports is likely to bring a rise in sugarcane prices.

Sindh Fixed Sugarcane Price at Rs 425, Punjab at Rs 400

At the beginning of this month, the Sugar Advisory Board which now operates under the Federal Ministry of Industries and Production instead of National Food Security and Research, issued multiple notifications for meetings to review the Minimum Support Price of Sugarcane but both meetings were later postponed, and the matter has been left to provinces, as it should be.

Agriculture is a provincial subject and in some cases, the differential in support prices is needed to facilitate the movement of some commodities from Punjab to Sindh to prevent the shortage. Sindh Government has notified the minimum support price of Rs. 425 per maund and Punjab has also set the price at Rs. 400 per maund this season.

“We had submitted the recommendation of Rs. 450 per maund as sugarcane price in October and when the government set the price at Rs. 425, we chose not to make Rs 25 a bone of contention as we believe prices will eventually stabilize,” stated Mahmood Nawaz Shah, Vice Chairman Sindh Abadgar Board (SAB) while talking to ProPakistani.

Different grower bodies had called for higher production prices while some farmers even sought prices as high as Rs. 500-600 per maund but sugarcane price is mostly determined keeping in view the cost of production and returns of other crops in a similar time frame and given the expected decline in sugarcane production, farmers may receive higher prices at some places.

Unfortunately, Pakistani farmers have been left so underserved and isolated, that the only problems they can see are their output and input prices. Whether we name inflation or something else as the reason, the same is the case with consumers. In a country that is eighth most vulnerable to climate change, if both farmers and consumers are price-sensitive, talking about sustainable practices and promoting such food systems becomes a distant dream.

The discourse in the sugar sector being no exception, also resolves around the same issues of price and the ultimate culprit is the governments, which despite years of crisis and tonnage of investigations, have still failed to put check the above discussed. inefficiencies and loopholes that create problems for both farmers and consumers despite the country being self-sufficient in sugar production.