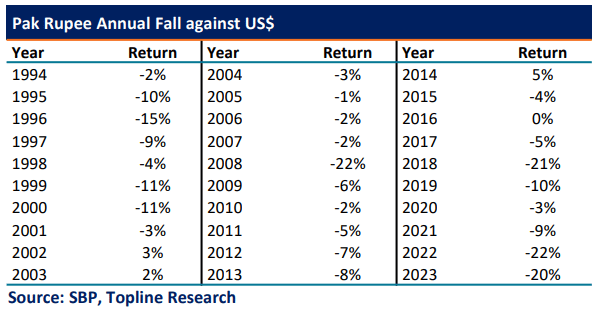

The Pakistani Rupee (PKR) has been under pressure for the last 7 years. In 2023, PKR fell 20 percent against US$ despite some recovery in the last few months.

This 20 percent fall in 2023 is higher than the last 5-year average fall of 13 percent a year and 10-year average of 8 percent, said Topline Securities in a report. Considering Pakistan’s external payment risk and other factors, the report sees PKR/USD in the interbank market to reach Rs. 310 by June 2024 and Rs. 325 by December 2024, said the brokerage house in its report.

External financing gaps, challenging global financial markets, and local political instability have badly affected foreign exchange (FX) reserves and built pressure on PKR.

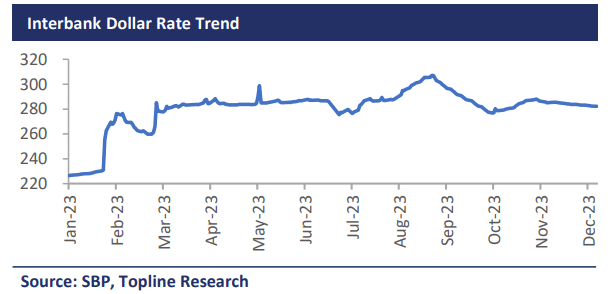

In 1H2023, before the IMF’s Stand By Agreement (SBA), PKR fell by 21 percent from Rs. 226 to Rs. 286 against US$, whereas in 2H2023, it gained 1 percent from Rs. 286 to Rs. 282 post-IMF’s SBA.

In the open market, PKR fell 17 percent from Rs. 236 to Rs. 284 in 2023. In 1H2023, it declined by 19 percent from Rs. 236 to Rs. 290, while in 2H2023, PKR gained 2 percent from Rs. 290 to Rs. 284 against the US$.

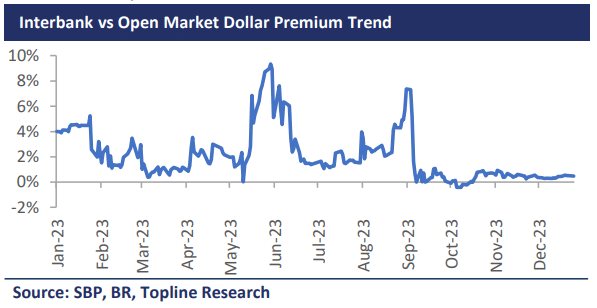

Interestingly, the premium of the open market that reached a high of 9 percent or Rs. 27 in May 2023 is now almost close to zero. In the past, it has remained at 1-2 percent on average. As per the IMF Structural Benchmark, the government was asked that the average premium between the interbank and open market rate be no more than 1.25 percent during any consecutive 5 business-day period.

When the caretaker government took charge on August 14, 2023, the PKR came further under pressure amid speculation that the non-political caretaker setup might allow the currency to fall. As a result, PKR fell further by 6 percent (from Rs. 288 to Rs. 307) in the interbank market, while it plummeted by 10 percent (from Rs. 296 to Rs. 328) against the USD in the open market from August 14, 2023, to September 04, 2023.

The rally in USD after August 14, 2023, was mainly driven by the open and black market where the premium (open market vs interbank rate) increased from 1-2 percent to 8-9 percent.

Considering this trend, the caretaker government, along with the State Bank of Pakistan (SBP), took several measures to cool down the demand in the open market. The measures included

- Tightened security along the border to prevent currency smuggling,

- Closure of exchange companies involved in illegal activities, and

- Increase in the minimum capital requirement from Rs. 200 million to Rs. 500 million for exchange companies.

As a result of these measures, PKR has gained strength in the interbank market, appreciating by 9 percent from Rs. 307 to Rs. 282 against the US$. Meanwhile, in the open market, the PKR has increased by 16 percent, moving from Rs. 328 on September 04, 2023, to Rs. 284 as of December 27, 2023, stated the report.

As per SBP’s Real Effective Exchange Rate (REER) index, PKR is undervalued. The latest November 2023 REER index published by the SBP stands at 98.18 vs the last 10-year average of 106.6.

Policy Rate Up 6%, T-Bills Up 4% in 2023

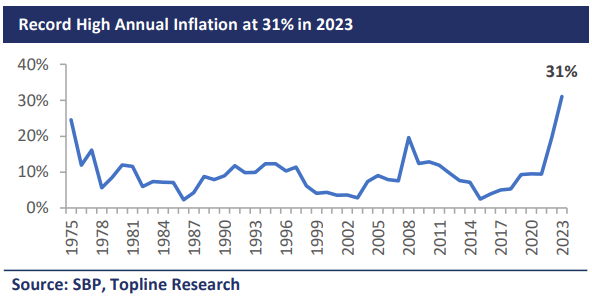

According to the report, Pakistan witnessed a record-high average inflation rate of 31 percent in the calendar year 2023 primarily due to an increase in prices of Food, Gas, Electricity, and local fuel (Petrol and Diesel).

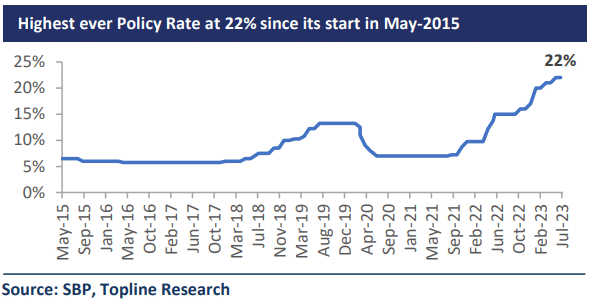

With the rising inflation trend, SBP increased the policy rate by 600 bps from 16 percent in December 2022 to a record-high rate of 22 percent in June 2023.

There was the expectation that the SBP would further tighten monetary policy to curtail inflation and manage the rupee. However, since July 2023, the SBP has kept the policy rate unchanged at 22 percent, citing positive real interest rates on a forward-looking basis.

This decision is grounded in the expectation that inflation will decline significantly in 2HFY24 due to contained aggregate demand, easing supply constraints, moderation in international commodity prices, and a favorable base effect, the report added.

SBP Governor in the post-MPC meeting on December 12, 2023, highlighted that the decision to reduce the policy rate will be data-driven, such as inflation, PKR movement, etc.

The central bank projected an average inflation for FY24 in the range of 20-22 percent while we anticipate that the average inflation for FY24 will be 23 percent and 16 percent in calendar year 2024.

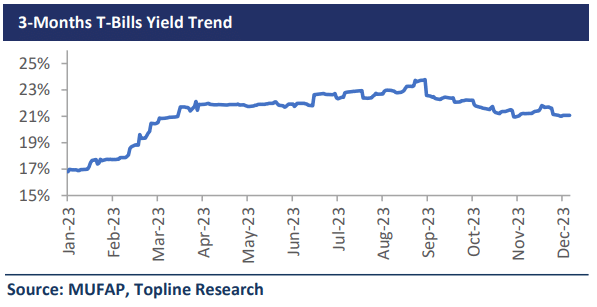

T-Bills yields in 2023 increased by 415-439bps with rates now standing at 21.08 percent, 21.38 percent, and 21.15 percent for 3, 6, and 12 months, respectively. However, in the last 3 months, yields have declined by 270-358 bps from their peak in September 2023, indicating that market participants are anticipating a policy rate cut in 2024.

Similarly yield on 3-year Pakistan Investment Bonds (PIBS) increased by 92 bps to 16.56 percent in 2023, but they also decreased from their peak of 21.16 percent in September 2023.

Considering the expected decline in inflation numbers, the report expects a 700 bps cut in the policy rate in 2024, reducing it from the current 22 percent to 15 percent.