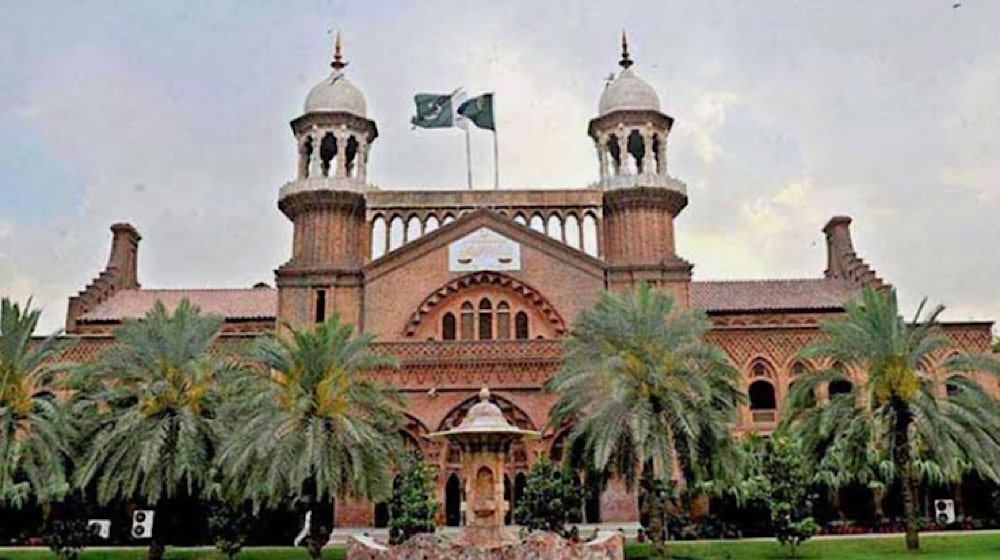

The Lahore High Court (LHC) has rejected an appeal filed by the Chief Executive of Kashf Foundation against the Large Taxpayer Office (LTO) Lahore for withdrawing its Non-Profit-Organization (NPO) status.

The LHC order revealed that the NPO has challenged the withdrawal of approval extended to the petitioner as Non-Profit-Organization (NPO), in exercise of powers under Rule 217 of the Income Tax Rules 2002 (Rules, 2002).

The whole case was related to the loan transaction of July 2008, whereby a loan amounting to Rs. 180.500 Million was extended by the petitioner (foundation) to its associated concern, i.e., Kashf Holdings (Pvt) Limited, offered on uncompetitive and concessional rate of mark-up – different from what has been offered to customers otherwise.

The tax department has cited various reasons for the withdrawal of the NPO status of the foundation, the primary being the key allegation that the assets of the petitioner entity were employed in a manner to confer private benefit / personal gain to another person.

The NPO submitted that NPO status was withdrawn on erroneous assumptions, allegedly declaring that private benefit was bagged by an individual, but no specific instance was indicated, showing the doling out of the alleged benefit. No direct evidence of alleged benefit was established. The nature, objective and context of the transaction under reference were misconstrued.

The NPO was functioning in terms of section 42 of the erstwhile Companies Ordinance, 1984, as a guarantee / non-profit company, enjoying privileges and abiding by the limitations prescribed in law, the petitioner added.

The LHC stated that the scope, context and reach of instant proceedings is to examine if any illegality was committed by tax department, while withdrawing approval under Rule 217 of the Rules, 2002, and while doing so to unravel the transaction for the purposes of ascertaining due compliance of requisite requirements for claiming NPO status.

“The NPO emphasized that the transaction of loan was intended to pursue, a well-defined, welfare purpose, that is the establishment of a Microfinance Bank and in achieving such an objective, if any incidental or ancillary benefit is, unintentionally extended to any person, it will not change the character of the petitioner, being a NPO entity”, LHC order said.

The foundation (NPO) claimed certain exemptions, and privileges attached to and otherwise available to organizations, qualified for NPO status, without appreciating that the conditions, effect of limiting such exemptions and privileges to any NPO regime, require strict application and enforcement.

The NPO is unworthy and not entitled of availing such exemptions or privileges, in the wake of the transactions transacted, having the effect of conferring private benefit, attributable and realized, between two points in time.

Hence, no illegality or apparent errors are found in the orders impugned and no jurisdictional defect manifests in the exercise of powers available under Rule 217(1)(b) of the Rules, 2002. The instant constitutional petition is meritless and same is, hereby, dismissed, LHC order added.