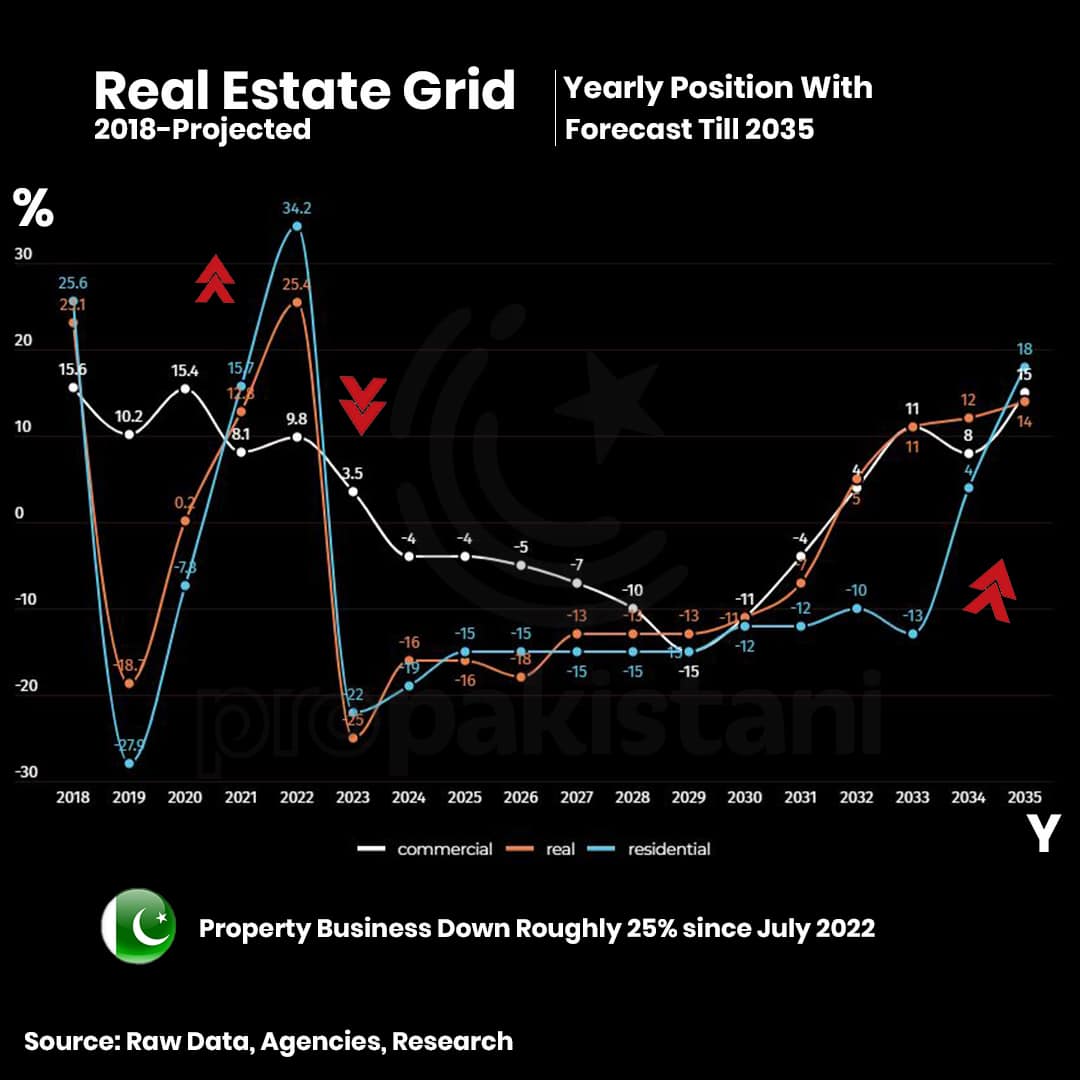

Pakistan’s commercial real estate business is officially dead and will not recover until after 2030, thanks to poor government policies and out-of-fashion treatment of the sector.

“The property market has gone down the worst in the past two years. Many hope for a revival but it is too soon and unlikely before 2030. The domestic real-estate scene, while down 25% in the past year alone, will recover at a painfully slow rate from its deepening downturn with the same team of policymakers tipped to table more anti-development policies in the upcoming budget,” a prominent real estate developer told ProPakistani.

Values of immovable properties are unlikely to rebound to their peaks until the next decade thanks to the strengthening work-from-home trend, high central bank interest rates, and zero attempts to promote policy that helps move cash from the informal property market into banks.

It’s very easy to see values take much longer to get back to those levels, and actually, the GDP rate we’ve assumed to get back to the peak after the size of the fall we’re expecting over the next few years is higher than the rate in the last 10 or 20 years, in my view. So it’s quite possible to see that recovery will not start until 2030 we’ve penciled in and it could be well into the 2035s even. Both domestic and global events point towards a seismic economic calamity before recovery.

The commercial real estate industry has been under stress since the country’s regional banking sector started facing a bout of turmoil. Regional investors like doctors, judges, and land mafias, which hold arguably the biggest stack of petty cash in the country (besides banks), are struggling with tightening credit conditions and higher interest rates. Land files and plots have lost value by over 50 percent and losses incurred by overseas Pakistanis have stifled further investments in the sector.

CEO Hussnain Associates, Kumail Abbas, told ProPakistani on Thursday that the pain is just beginning for commercial real estate – and tumbling prices could fire up another banking crisis and hurt the economy.

We went to the IMF, inflation rose and the rupee deteriorated. Cement rates and labor costs have drastically increased since then. Construction/property activity was around 65% during the 2018 government’s tenure. Now it’s barely 12% and the industry is suffering.

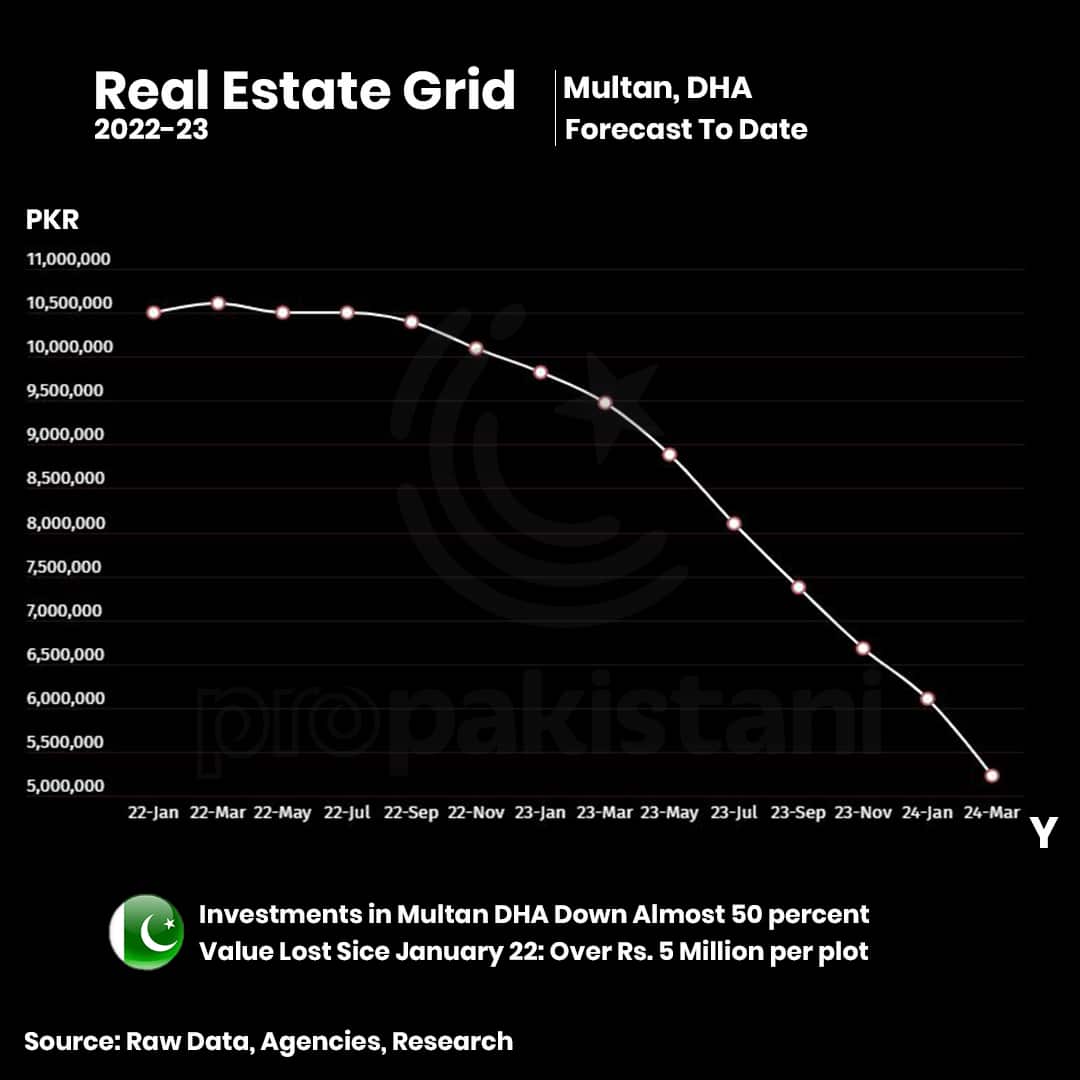

He said rates in Multan DHA, just like other housing projects, are subject to relentless manipulation. “Multan has lost 41% of its property value, roughly around Rs. 6 million lost per plot, in just 2 years. Files were egregiously misused which hurt us,” he added.

The rising distressed commercial real-estate assets are adding to concerns a crisis may be brewing in the sector. Agents are selling their investments at a loss to survive the current wave of crushing inflation.

For a sector that is estimated to be worth over $2 trillion, the majority of the assets here may be at risk of turning bad, he added.

The consultant forecasts retail properties, which have been suffering the most so far, to see another drop in value by the end of this year.

More Bad News?

Inflation is on its way back to State Bank of Pakistan’s (SBP) target, with markets getting slower and more boring as the budget exercise nears. Yet, nearing mission-accomplished on inflation won’t be the reason the central bank cuts rates, according to an Islamabad-based investment banker.

He says that the ongoing commercial real estate crisis will force the State Bank to finally chain the property market but it still won’t help the black cash holders in the sector put their money in banks.

“I see what I call a real estate pullback that is coming,” he predicted. “It may be 5-6 years, plummeting somewhere in the first half of the current year. That’s why I believe the April/June SBP meetings for when rates would be cut, but the property scene is a lost cause.”

Lessons from the post-flood crisis from 2022-23 show that SBP should cut sooner rather than later to avoid the worst of the pain to real estate investors. Private sector lending in this category has been falling, he added.

According to SBP data, consumer financing for house building declined by 3.5 percent (Rs. 8 billion) to Rs. 207 billion by end-January 2024 from Rs. 215 billion in January 2023.

“Don’t act like you did after the flash floods, allowing real estate agents to re-stock files at a premium without them paying good money for it. Banks still haven’t seen most of that money in their system. If authorities had acted prudently, the current drop would not have been as severe as it turned out to be.”

New Govt And Expectations

Fears of a crisis among Pakistan’s real estate agencies were rekindled in the last few weeks after the 2022 policymakers regained public office. Agents have either started pulling investments or discouraged buy-ins at a premium in expectations of the real estate scene to get much worse after the new budget.

For example, investments in Multan DHA have crashed by ~50 percent and lost roughly Rs. 5 million per plot in value since January 2022, with losses in part stemming from exposure to the rupee plunge against top currencies and fall in overseas Pakistanis’ investments through remittances which have slid in value over time.

In contrast, housing societies like Dream Gardens in Lahore have surged over 68 percent in the past year mostly due to politicians purchasing land as a hedge against complications in their EOBI contributions, a realtor claimed in a brief note to this scribe.

Overall, commercial property investments have declined by nearly 60 percent since the post-flood slump of end-2022, Region-wise, commercial stakes in both Lahore and Islamabad have surged 150 percent in the past 18 months despite the nationwide slump, with individuals mostly buying shops in exchange for rent/business.

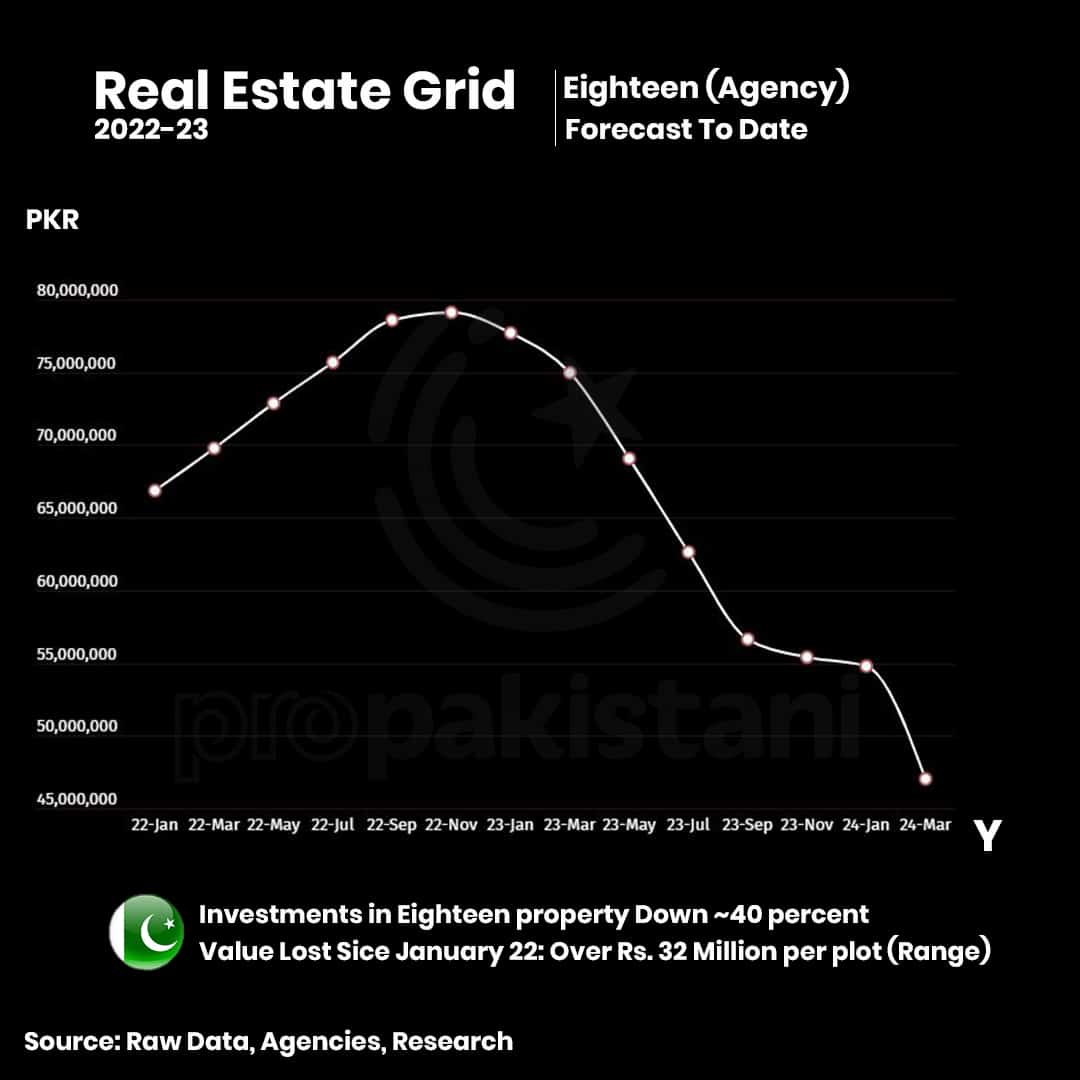

Eighteen, an up-and-coming real estate agency that bet big on Islamabad last year, has incurred over Rs. 25 million or a 40 percent drop in valuation of property in its inventory, with the biggest change of Rs. 32 million observed to date.

Another trader said investments in the property sector have declined by nearly 30 percent during 2024 to date and the slump will only get worse as investors seek other avenues for parking cash in the long run. Gold is a preferred choice despite extortionate rates above Rs. 210,000 per tola (24-karat).

Are We Doomed?

Recent developments in the property sector have stirred concerns in financial markets, with rising interest rates and unstable asset values potentially leading banks to grapple with a surge of troubled loans as borrowers struggle to meet obligations on their real estate investments. This trend prompts reflection on why banks often opt to lease rather than invest in property.

While some officials and banking experts are optimistic about the agricultural aspect of real estate, projecting a consistent 2 to 3 percent growth in real GDP for FY24, others view this focus as a significant risk. The systemic nature of the issue, encompassing not only agriculture but also broader segments of the real estate market, has been a subject of concern for some time.

With the current trajectory indicating a looming crisis, there are doubts regarding the new government’s ability to mitigate the situation, particularly given its previous experience when the mess occurred in the first place.

The period between 2018 and 2021 witnessed a fervent surge in real estate investment, involving various stakeholders from overseas investors to local corporations and individuals across major cities like Karachi, Lahore, Islamabad, and Faisalabad. However, the once-booming sector is now grappling with widespread commercial real estate challenges, indicative of a broader systemic issue that appears to be ignored by SBP.

Despite initial expectations for rate cuts, recent delays in implementation underscore the cautious approach taken by the SBP since July 2023, maintaining a 22% monetary policy under the premise of inflation control.

Some brokerage firms foresee a potential rate cut in March, while others caution against such a move, citing the resilience of the economy and the possibility of maintaining current lending rates until after the federal budget announcement.

What Can Be Done? Kerfuffle, At Least For Now

I must apologize for painting such a miserable picture for everyone. The property squeeze reflects the impact of high inflation and poor policymaking, which is expected to change shape and impact after July 2024, as well as the country’s weak growth and an unsupervised tax net.

Looking at the real disposable income of an average Pakistani on a five-year average basis, the most recent period is the worst since current records began less than 20 years back, our research shows.

Where do we go from here? Get into commodities. If you have a better suggestion, comment below.

The above data and estimates were prepared in collaboration with property marketing agencies.

We need to tax more on real estate minimum tax should be at least 10% from 3%.

@Test totally agree. Tax more so that speculation and illegal flipping can stop. Every Pakistani deserves land and houses. Make it affordable to every Pakistani and not just to some elite only.

Taxes will push up prices and reduce affordability.

Well, only land getting cheaper will not provide housing. The construction rates are sky rocket high.

excellent, please tax more and save our land from investors. make it easy for real home needy poor to get a roof.

Bahria and DHA should be closed

Poor cannot get home see the prices of property in Bahria unfortunately poor should sleep on

footpath otherwise they have no option.

When you say BHarris then person with money over200 million is NOT POOR??.

That’s never going to happen

If deposit in banks your money will loose value more rapidly than inflation. In stocks you will loose almost all your money. In property at least you have something.

100% right

Total bakwas. my saving in bank returned me more in 2 years then my plot in dha multan looses.

Government Finance minister should plan accordingly to the market needs of equal opportunities for real estate Investors and general public hard earned money investments. **Not Only for the Corrupt Elite Classes of Pakistan Generals Judeges Politicians and Dirty Civil Servants!!!

There is no such thing as Real State Industry. Just call it a destruction of Precious Agriculture lands by Pak Army and Civilian Elite. Poor cannot even afford any house right now But money grabbing vulture investors even want to jack up current prices.

The real estate agents are the biggest culprits. They sold plot files and houses to several investors making it artificially too costly for genuine buyers.

Ahsan, what do you mean by “get into commodities.”? Do you suggest we “hold” commodities or “buy and sell” commodities?

Trade commodities. Yeah right.

Business pay upto 40% tax on their profits, real estate should be taxed more than business, so people move away from dumb property investments to productive businesses that stimulate the economy. Screw property investors they have leached the country for far too long.

There should be extraordinary tax like Super tax on sizes above 10 Marla house so that black money is squeezed from such investment area

In fact, the whole country is dead except YE WATAAN TUMHARA HAE, HUM HEIN KHUAMKHA ISS MEIN ARE ALIVE. Either we accept dictations like orderly or hang corrupts? We are a dead nation , Let corrupts to take dictations. Let one category to enjoy . Oh bhae, jab tak nahee niklo gae zulum Kay khelaaf, organized dakoo may continue rule on poor public. Need to take few steps against zulm. Keep paying loans to IMF and organized DAKOOs loot maar may continue. Nobody is ready to come out against inflation, all corrupts are enjoying life, general public is fighting with inflation. Let nation to enjoy life. Estate industry brokers earned billions, now enough money to survive. Estate agents must pay zakaat khairaat to poor’s and fight against inflation. Kashmir, Pelestien and our Pakistan, almost same status. IMF on the way, to provide dollars to feed our organized beloved govt. Money Laundering may continue as long stricktly audit system is not established. All previous Finance Ministers must be hanged before appointing new one. No accountability, means LOOTO AND PHUTTO. LIKE PREVIOUS CORRUPTS.

There are three economic sectors that need to be wrecked if the country needs to be put on the path of economic chaos and anarchy due mainly to massive job losses. These are the energy sector , real estate sector and the retail sector. If job creation is to be a priority in a country with huge job needs, then these sectors should be prioritized on an urgent basis. With regard to real estate, it is a major economic indicator in all major economies, so in my opinion immediate efforts are required to build and open the real estate sector for growth and development. Good luck!

I would also like to emphasize the importance of reducing the size of black money market by allowing funds to be used for real estate investment and development for job creation and growth. Good luck!

This doom and gloom is real and hurting 99% of the 240 million Pakistanis. Beyond leaving Pakistan, there’s no near-future or long-term solution within constantly failing Pakistan. Overseas Pakistanis couldn’t help Pakistani economy since 70’s when this exodus began. Pakistan has already become another Afghanistan or Ethiopia for the commons.

That was much expected because majority property dealers and investors had played like big casinos games in real estate sector for becoming rich quickly in the last decade,they had done it artificially ,by lies and corrupt practices with the customers and has taken the range out of bound for buying a plot or house for a common man.Now All is lost for them as well as for genuine buyers.

Patience,♧Patience and Patience

Overseas Pakistanis are back bone of remittances they sent. They book apartments plots so when they return they have some assets at their disposal, the fall in real estate prices also the reason they had stopped investing in real estate. Now only genuine demand n supply will ascertain the prices of real estate.

Hi,just try to decreased rate of intrust,and decreased construction cost.And also give some good benefit to overseas on property tax.and also give benefits to first time purchaser of property on tax.

We need Islamic state