Over the last decade or so, Pakistan’s economy has struggled to maintain a high sustainable growth rate amid mounting pressures from the fiscal and external fronts.

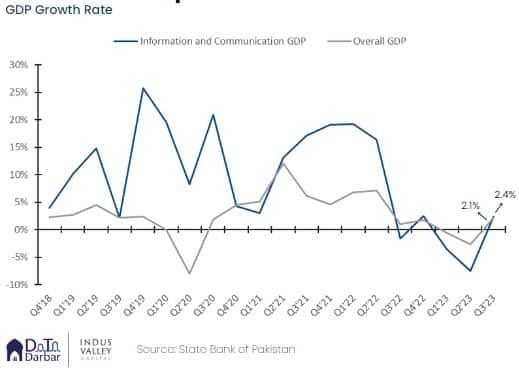

According to data compiled by Data Darbar, the information and communication sector, which includes technology, has largely defied that trend and outpaced the national GDP growth for the most part.

From Q3 2022 onwards, there has been a visible slowdown, in line with the macro trend, as the sector’s GDP even declined sequentially during three quarters.

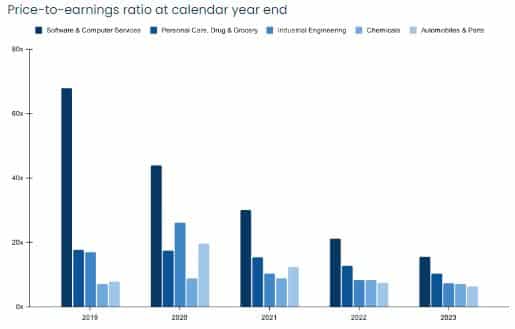

Software Still Hottest Sector for Investors

This dominance is reflected in the price-to-earnings multiples as well where software and computer services continue to trade higher than peers, even if the gulf has narrowed.

As of 2023 end, the sector traded at a P/E of 15.45. This was well above the next best-performing industry i.e. Personal Care, Drug & Grocery at 10.24.

Other manufacturing sectors like industrial engineering, chemicals, and automobiles & parts also made it to the top five.

Public Markets No Match to Venture

Despite the downturn in venture capital. the asset class remains the only viable source of funds for growth-oriented companies, as evidenced by the lackluster public listings over the last five years.

Since 2019, the Pakistan Stock Exchange has only seen $222M raised via initial public offerings. On the other hand, funds worth $858M have been deployed through VC.

While the comparison between private and public is not exactly like-for-like, given the difference in their quantum, it does signify the underlying dearth of traditional financing avenues.

ICT Exports

Arguably the only data point relevant to Pakistan’s tech sector that’s cited more often than venture funding. Since 2014, the country’s Information & Communication Technology exports have increased at a 10Y CAGR of an impressive 19.3 percent.

In 2023, the proceeds reached just over $2.7 billion, of which $2.2 billion came from computer services while telecom contributed the major remaining chunk. However, over the last two years, there has been a noticeable slowdown with average monthly sequential growth declining to only 3.1 percent, compared to 46.5 percent in 2021.

Rs. 100 Billion Deposits

While the increase in technology exports proceeds remains the north star metric, alternative data like the sector’s deposits in banks also point to healthy growth.

As of 2023, total deposits held in banks by Information & Communication companies breached the 100-billion mark for the first time, clocking in at Rs. 103.5 billion. The figure is 190.6 percent higher compared to the 2019-end levels.

Computer programming, consultancy, and related activities accounted for 70.7 percent while the remaining from information services.

Credit to Tech Sector

Unfortunately, the growth in deposits hasn’t corresponded with a proportionate increase in the banking credit issued to tech companies.

As of 2023 end, the total outstanding financing to Information & Communication companies stood at only Rs. 18 billion, up 87 percent over the 2019 levels.

While the current interest rate environment may have some role to play here. it represents the broader lending culture of Pakistani banks and is indicative of a major gap in financing options for companies.

Corporate Activity

Pakistan’s traditional service-oriented IT industry not only brings the much-needed foreign exchange but also employs close to half a million people, even by conservative estimates.

In 2023, there were 4,090 new IT company registrations, making up 14.4 percent of overall new incorporations with the apex regulator. As per the fiscal year data, it was the second-fastest growing sector after trading and has remained the runner-up for a few years now.

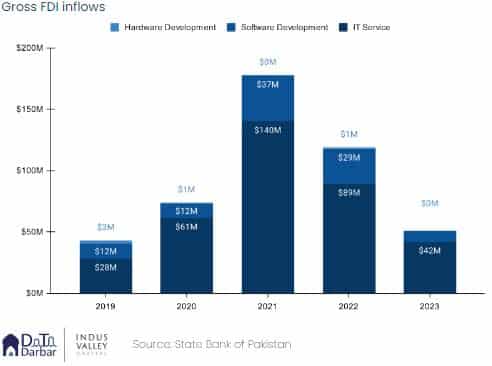

Foreign Investment

Despite a healthy growth in the supply of new companies, there doesn’t seem to be much investor interest in the sector.

This is evidenced by the fact that the Pakistani IT sector managed to attract only $42 million in foreign direct investments during 2023.

Even over a longer horizon, there’s not much to show as the total FDI into the sector was just $517.3 million. Of this, 72.6 percent went to IT services, 25.2 percent to software development and only 1.9 percent found its way towards hardware.

Tech Employment

Talent availability remains the most important determinant of the technology sector’s growth in Pakistan. Over the last few years, the sector has emerged as a major source of employment, particularly in urban centers, according to the data.

As of 2023, there are about 600,000 people in the Information & Communication sector, increasing at a 5-year compound annual growth rate of 12 percent.

While the existing annual pipeline of ~30,000 graduates is manageable at the moment, the country needs to significantly expand capacity, both through formal and vocational training.

Tech Leads Other Sectors by P/E