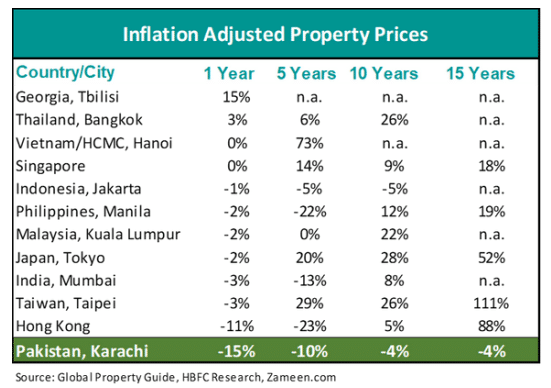

The inflation-adjusted real estate prices in the commercial capital of Pakistan, Karachi witnessed a downward trend in the last five years, as compared to different cities in the region, according to a real study carried out by House Building Finance Corporation (HBFC).

The inflation-adjusted real estate prices in Karachi present a striking contrast when compared to Mumbai and other cities in Asia, reflecting unique economic and market dynamics at play.

Over the past year, Karachi experienced the steepest decline in property prices among its Asian peers, with a 15 percent drop, while Mumbai witnessed a relatively modest decrease of 3 percent, the report stated.

This trend extends over a decade, during which Karachi’s property prices fell by 4 percent, in sharp contrast to an 8 percent growth in Mumbai, indicating the resilience and growth of India’s real estate market.

In the broader Asian context, Karachi’s real estate challenges become even more pronounced. Cities like Tokyo and Taipei have experienced significant long-term growth, with increases of 52 percent and 111 percent respectively over 15 years, demonstrating robust market fundamentals.

Southeast Asian cities like Bangkok and Hanoi have also outpaced Karachi, with Hanoi recording a remarkable 5-year growth rate of 73 percent. The consistent growth of Singapore’s real estate market over 15 years at 18 percent highlights its maturity, whereas the recent 15 percent increase in Tbilisi may signal a rapidly developing emerging market.

From this analysis, it is evident that Pakistan’s property sector is facing challenges due to inflationary pressures, leading to a decline in real property values. This situation starkly contrasts with the more favorable long-term trends seen in India and the resilience of other Asian real estate markets.

For Pakistan, the data underscores the need for strategic economic reforms aimed at fostering market stability and rejuvenating investor confidence in its real estate sector. These reforms are critical for aligning Pakistan’s property market with the positive growth trajectories observed in other Asian regions.

The dilapidated infrastructure, lack of basic amenities, and poor civic services are also attributed to be other reasons behind the lack of investment trend and downward in the prices. The imposition of taxes on the sale and purchase of the property further affected property transactions across the country, including Karachi even in posh localities.

Property Prices Stand Low in Karachi

The real estate market in Karachi, Pakistan, offers an insightful perspective on affordability and market dynamics within Asia. The city stands out for its remarkably low buying price per square meter at $131, coupled with a price-to-rent ratio of 18. These metrics not only define Karachi’s real estate landscape but also prompt a deeper analysis of the economic factors influencing it.

In comparison, cities like Hong Kong and Singapore exhibit buying prices of $25,133 and $18,632 per square meter, respectively, reflecting their status as global financial hubs with high living costs, limited land availability, and strong demand for housing.

These factors lead to significantly higher barriers to entry into the real estate market. Karachi’s real estate landscape, characterized by its exceptional affordability, reflects unique economic, demographic, and policy-driven factors that differentiate it from other Asian cities. Understanding these underlying drivers is key to comprehensively analyzing the city’s real estate market and its potential for future growth and development.

The real estate market in Pakistan in 2024 is at a critical juncture, with declining property prices and high mortgage rates indicating a sector in transition. This period is characterized by adjusting property values and investment strategies. The construction sector’s slowdown, a key economic driver and major employer, has broader economic implications, affecting related industries and potentially increasing unemployment and impacting consumer spending.

The future of Pakistan’s real estate market hinges on balancing various economic, social, and policy factors. The sector’s resilience and adaptability will be crucial, requiring strategic foresight from stakeholders like developers, investors, policymakers, and consumers.

Ultimately, the state of the real estate market in 2024 reflects Pakistan’s overall economic narrative, and addressing its challenges and opportunities is key to shaping the country’s economic future.

The sector also faces rising construction costs due to inflation, necessitating mitigation strategies in 2024. Examining successful international housing models, like Singapore’s, could help address affordable housing issues in Pakistan.

Property has always been overvalued in Pakistan as it is the easiest way to park black money and launder it later.

I hope the trend continues till it reach a fair price.

Not only in Karachi, property in Lahore, Faisalabad, Gujrawala etc also in decline. Real estate agents do trying their best to sell higher then the market value but most of the people losing investments.

Real estate prices in Karachi will keep on dropping until PPP remains in political power and ‘Bhutto still alive’.

There’s a walstreet saying ‘don’t catch the dropping knife’. Investors will return only when the bottom is hit and upward trend begins.