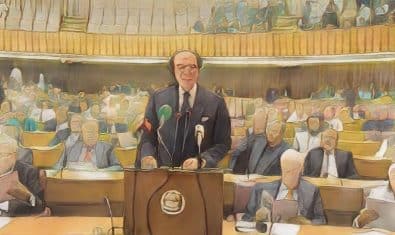

Prime Minister Shehbaz Sharif has likely dented any chances of withdrawal of 15 percent income tax on banks after ordering authorities not to give any relief to the sector in Finance Bill 2024.

This came after widespread criticism from parliamentarians and commentators well-informed on the current budgetary wind-up, reported Express Tribune.

The decision arrives as the government finalizes new tax measures for the federal budget FY25, which is expected to be approved by the National Assembly today. These new taxes are in addition to the Rs. 1.5 trillion in taxes already imposed on June 12th. The government plans to borrow Rs. 24 trillion from commercial banks to repay maturing loans and allocate Rs. 9.8 trillion for interest payments to banks and foreign creditors.

Banks have significantly profited by lending to the government, having excessively lobbied for the removal of the 15 percent additional income tax.

Now, the government is committed to retaining the tax to prevent banks from exploiting tax loopholes. The Federal Board of Revenue suggested calculating the tax liability based on average annual lending to the government, rather than on the last day of the year, to avoid tax evasion by banks.

The normal income tax rate for banks is 39 percent. However, if a bank’s gross Advances-to-Deposit Ratio (ADR) is up to 40 percent, the government charges a 55 percent income tax on investments in government debt. For ADRs of 40-50 percent, the rate is 49 percent, and if the ADR exceeds 50 percent, the normal rate of 39 percent applies. The current average ADR is 41.8 percent, which mandates banks to pay 10 percent income tax.

Follow ProPakistani on Google News & scroll through your favourite content faster!

Support independent journalism

If you want to join us in our mission to share independent, global journalism to the world, we’d love to have you on our side. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you.

Double U Turn