Atif Iqbal Sheikh, President FPCCI, has voiced strong concerns about the recently announced Federal Budget 2024 – 25 vis-à-vis the information technology industry; stating it will worsen brain drain in the IT sector due to high taxation, stifling growth and innovation.

Alongisde the FPCCI President, Muhammad Zohaib Khan, Chairman Pakistan Software Houses Association (P@SHA), maintained that one key issue is that remote worker tax regime further undermines the government’s revenue goals. Remote workers, often paid in foreign currencies, face lower tax burdens compared to domestic employees, incentivizing companies to reclassify senior staff as remote workers – leading to inefficiencies and tax revenue loss.

Zohaib Khan added that to address these discrepancies, P@SHA proposes a competitive tax rate for payroll, such as a flat 5 percent, for P@SHA and PSEB-registered IT companies. This would encourage formal employment and prevent talent drain. Additionally, implementing clear policies to ensure remote workers pay their fair share would create a level playing field for local businesses.

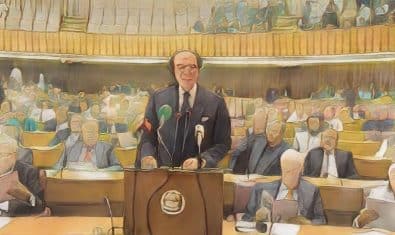

Atif Ikram Sheikh added that FPCCI emphasizes that despite repeated assurances from the incumbent government, the budgetary proposals from the IT industry have been completely ignored.

FPCCI Chief said that the new finance bill confirms two things; one, the finance division’s short-sightedness vis-à-vis the IT industry and that it will derail the IT industry. He acknowledged that over the past 10 days, the Pakistan Software Houses Association (P@SHA) has expressed its concerns on various platforms, including national and international media and decision-making forums.

Saquib Fayyaz Magoon, SVP FPCCI, apprised that P@SHA was also invited to present its position during a crucial meeting of the Standing Committee on Finance and Revenue. The association highlighted that the higher income tax burden on the salaried class could lead to a brain drain. This issue is compounded by the remote worker tax regime, which undermines the government’s goal of increasing revenue and expanding the tax net.

Saquib Fayyaz Magoon highlighted that Rs. 79 billion allocated in the budget is primarily for government projects and IT parks; neglecting the broader IT industry. The situation regarding taxes and human resource availability is already alarming and P@SHA has consistently presented relevant proposals to the government.

Zohaib Khan stressed that P@SHA puts forward the need for reforms to facilitate smoother foreign remittances for the IT industry and broader economy. The association points out anomalies in current tax laws, such as increased GST on laptop and desktop imports – depicting a bleak future for Pakistan’s IT industry.

P@SHA draws attention to tax anomalies faced by IT exporters. These exporters, under the Final Tax Regime (FTR), face additional tax rates on payments abroad, hampering their efficiency and competitiveness. P@SHA proposes avoiding double taxation; promoting the use of Exporters Special Foreign Currency Accounts (ESFCAs) and making ESFCAs more attractive for IT companies.

Follow ProPakistani on Google News & scroll through your favourite content faster!

Support independent journalism

If you want to join us in our mission to share independent, global journalism to the world, we’d love to have you on our side. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you.

PASHA shouldn’t propose to increase remote worker tax. Remote work / freelancing has its own category.

People will keep their dollars abroad otherwise.

The overall tax bracket should be addressed.

PASHA should stick his nonsense to IT govt cannot collect tax if tax is collected on foreign salary.PASHA wants 5% tax which also shows PASHA is short sighted.

They impose tax on IT industry and lose much much more than what they dream of stealing money in legal manner from those who not only bring remittances but also zero burden the govt for local jobs which hardly pays off food and energy.