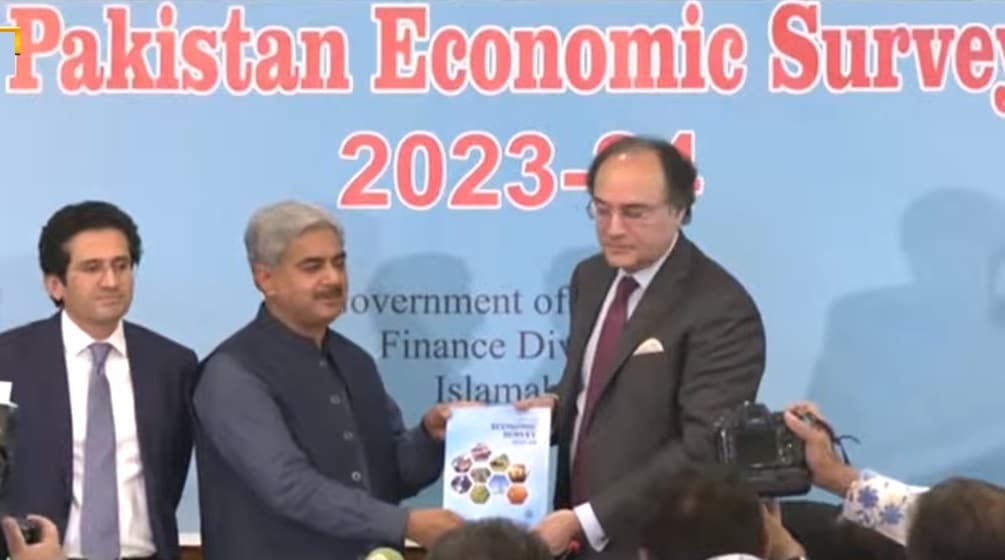

Finance Minister Muhammad Aurangzeb Tuesday unveiled Economic Survey for the outgoing fiscal year 2023-24 (FY24) at a press conference in Islamabad.

He briefly highlighted that in FY23, GDP contracted by 0.2% percent, the PKR depreciated by 29 percent, and foreign exchange reserves fell to cover only two weeks of imports. He shared that in FY24, the country needed to enter a program with the International Monetary Fund (IMF). There was no Plan B, and without the nine-month SBA, the situation would have been very different today.

“Our savior was the agriculture sector, and it will continue to be huge lever of growth as we go forward,” he added.

Key Highlights

- Smooth Political Transition from Caretaker to the Elected Government is boosting the confidence of economic agents thus fostering economic revival.

- The size of the economy in FY24 increased by 11 percent to $375 billion ($338 billion last year).

- The agriculture sector recorded a growth of 6.3 percent – the highest in the last 19 years (FY2005 at 6.8 percent), ensuring food security and price stability.

- Industrial activity started to recover in Q2-FY24 with 0.09 percent growth and further improved to 3.84 percent in Q3 – mainly due to better crop production and an increase in global demand.

- The improved agricultural productivity in FY24 will have a spillover impact on the industrial and services sector in FY25.

- Per capita income increased by $ 129 to $ 1,680, on account of improved economic activity and appreciation of the PKR.

- Inflation is on a downward trajectory from 38.0 percent in May 2023 to 11.8 percent, at a 30-month low in May 2024 – due to exchange rate stability, monetary tightening, fiscal consolidation, smooth food supply, and favourable global commodity prices.

- Food inflation (Urban) declined significantly from 48.1 percent in May 2023 to 2.2 percent in May 2024.

- External accounts considerably improved, with increased exports and contained imports, resulting in a reduced trade deficit, supported by remittances.

- Current Account Deficit (Jul-Apr FY2024) narrowed down by 95 percent to $0.2 billion ($3.9 billion last year).

- CA registered a back-to-back surplus in February ($98 million), March ($434 million) and April ($491 million) of 2024.

- Exports increased by 10.6 percent due to Food export growth (52 percent).

- Pakistan’s IT exports increased by 21 percent to $2.6 billion ($2.1 billion last year) – with the highest-ever exports of $ 310 million (62 percent growth) in April 2024.

- Imports declined by 5.3 percent due to a decline in Food, Petroleum Products, and Cotton.

- Workers’ remittances increased by 7.7 percent (Jul-May FY2024) due to stability in exchange rate and facilitation under PRI. Pakistan is among the top 5 recipients of remittances.

- External sector stability helped to increase foreign exchange reserves by $5.0 billion to $14.2 billion (31st May 2024) with SBP: $9.1billion & Banks $5.1billion, resulting stabilized exchange rate.

- Under Roshan Digital Account (RDA), an inflow of $7.8 billion with 689,650 accounts has been recorded from September 2020 till April 2024.

- With economic recovery and stability in the exchange rate, the confidence of overseas Pakistanis in the economy has been restored. This is evident from the increased inflows under RDA during Q2 and Q3 of FY2024, which rose to $439 million and $465 million, respectively, compared to $427 million and $390 million last year.

- Thus, cumulative inflows during the last two quarters rose by 11 percent to $904 million from $817 million last year. Encouragingly, outflows have been reduced significantly by 77 percent to $79 million during the same period from $340 million last year.

- As a result, PKR/USD parity improved by 2.8 percent during July-May FY2024, against the depreciation of 28.7 percent in FY2023.

FDI improved by 8 percent in Jul-Apr FY2024 to $ 1.5 billion against a decline of 16 percent in FY2023 – Mainly from China (30 percent), Hong Kong (20 percent), and UK (15 percent) – Major sectors include Power (43 percent), Oil & Gas exploration (13 percent), and Financial Businesses (11 percent). - The country’s investment and financing flows strengthened, resulting in a build-up of FOREX reserves, which improved import buffers, from 1 month in June 2023, to currently over 2 months.

- FBR Tax collection grew by 31 percent during Jul-May FY2024 to Rs 8,125.7 billion against Rs 6,210.1 billion last year.

- The fiscal deficit has been reduced to 4.5 percent of GDP during Jul-Apr FY2024 (4.7 percent of GDP last year), and the primary surplus improved significantly to 1.5 percent of GDP due to fiscal consolidation efforts.

- Rs 4,644 billion added in Public debt during July-March FY2024 against an addition of Rs 10,005 billion during the same period in FY2023.

- The growth in debt stock has declined significantly from 20.3 percent (end March 2023) to 7.4 percent (end March 2024).

Now where are all the things that effected us?