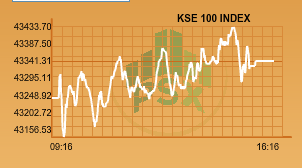

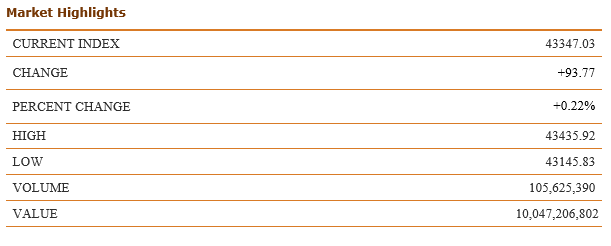

A very steady upward trend continued for the KSE-100 index as it closed in green for the 3rd consecutive day of the week with good volumes. At the end the benchmark index closed with +93.77 or + 0.22% to close at 43347.03 points.

The market for a while went down in the negative zone with the intraday low of 108 points and touched the intraday high of 182 points. The market remained range bound throughput the trading session today with overall better volumes.

The index tested the day’s high at 43435.92 points .The day’s low came to 43145.83 by the close of the day.

Ghandhara Industries Ltd. announced Financial Results for the period ended June 30, 2017.

The company’s Sales for the period increased by 84.37 percent in the outgoing year, whereas the Profit after Taxation for the Period increased by 6.72 percent.

The board has recommended a final Cash Dividend for the year ended June 30, 2017 at the rate of 150% i.e. Rs. 15/- per share. The board issued no bonus or right shares. Earning per share increased to Rs37.36 as compared to35.01 last year.

Golden Arrow Selected Stock Fund also announced Financial Results for the period ended June 30, 2017.

The company’s Total Income for the period increased by 333.11 percent in the outgoing year, whereas the Profit after Taxation for the Period increased by 425.21 percent.

The board has recommended a final Cash Dividend for the year ended June 30, 2017 at the rate of 22% i.e. Rs 1.10/- per share. This is in addition to the interim dividend already paid at the rate of 66% i.e. Rs. 3.30/- per share. The board issued no bonus or right shares.

Earning per share increased to Rs 5.51up by (424.76%) as compared to Rs1.05 as of last year.

Trading volumes of All share index surged to 222.9 million shares which were better than yesterday’s closing Overall, stocks of 372 companies were traded on the exchange, of which 194 gained in value, 159 declined and 19 remained unchanged. In KSE 100, volumes increasing with 105.6 million shares were traded with a net worth of Rs 10.04 billion.

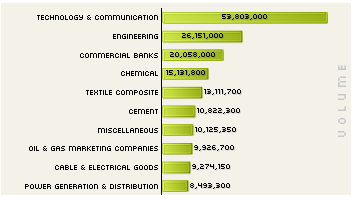

Top traded sectors:

World Call Telecom was the volume leader with 26.47 million shares, losing Rs 0.28 to close at Rs 3.37. It was followed by TRG Pak Ltd with 24.44 million shares, gaining Rs 0.21 to close at Rs 40.97, Dost Steel Ltd with 14.29 million shares, losing Rs 0.55to close at Rs 12.67 and Pace Pak Ltd 8.65 million shares, losing Rs 0.15 to close at Rs 7.19.

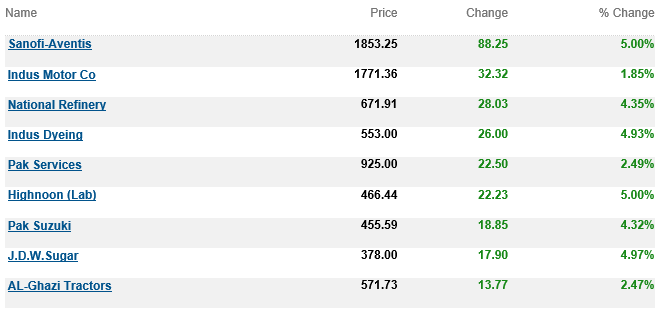

Top Advancers of the market were:

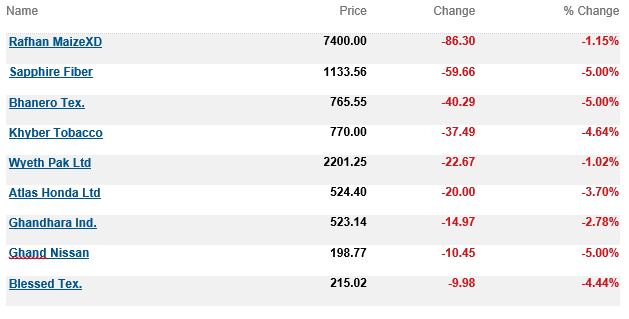

Top Decliners of the market were:

Prices for oil rose in the international markets on Wednesday as Iraq’s oil minister hinted that the country is considering output cuts in line with the OPEC deal. Iraq and Ecuador are some of the few member countries who made lenient cuts owing to the domestic strife and economic condition within the countries.

U.S. West Texas Intermediate (WTI) crude futures were up 62 cents, or 1.24 percent, at $50.52 a barrel. Brent crude futures climbed 23 cents, or 0.4 percent, to $55.37.

Iraqi Oil Minister informed that the country is currently considering extending or even deepening supply cuts to curb a global glut. Alternates currently being considered by OPEC members include an extension into cuts by much more volumes or even extending the cuts beyond March. Some producers are of opinion that the cuts should be deepened and prolonged into the coming future beyond March next year as agreed upon

Official figures on stockpiles and refinery runs will be released by the U.S. Department of Energy later on Wednesday.

AO NAWAZ AO : Point to Uthao :