The world just gave Pakistan 11 billion reasons why loans are a bad deal for our economy. The timing is all wrong and no one trusts the government anymore, while ‘tragedies’ like currency pegging, trade restrictions, and external influence are just making it all worse.

Finance czar Ishaq Dar promised a PKR below 200, cheap petrol, and a breather from the International Monetary Fund (IMF) to help Pakistan avert default; at least on paper. On two counts, he failed. On the last one, Pakistan has been assured six months of default-free vacations. Mark your calendars.

Dar — who took the job for the fourth time in September 2022 after his predecessor quit — acknowledged political risks but has yet to prove his mettle. His predecessor Miftah Ismail advocated an IMF model to help the economy grow and to woo their backers in Washington, and perhaps improve their chances of extending tenure for the next 5 years. The picture has changed since his departure.

Pledges and Plunder

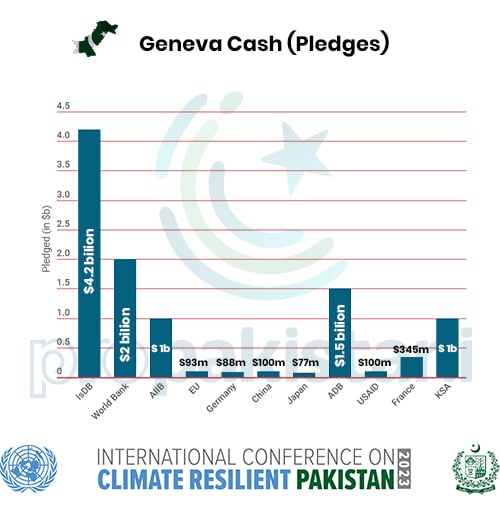

The pledges secured by Pakistan last week are a wake-up call for experts on economy watch. Money will come perhaps next week, or on a bimonthly basis, but in reality, uncertainty is a killer, and every day till June 30th is crucial to see out any placid fears of default. The State Bank of Pakistan’s (SBP) forex reserves sit a little above $4 billion. The scary picture will take shape on the very next day of the new fiscal year.

On condition of anonymity, a finance ministry official told that the pledges were intended as a relief for the masses, but the entire plan backfired. He lamented,

It doesn’t matter what side you’re on, this system is flawed. There’s no fresh injection of funds coming in – neither from the IMF nor friendly countries. PSX was down almost 600 points yesterday. Pledges are hurting market sentiments and there has been no indication of commencing debt restructuring for the next 12-18 months. Oh, and yes, reserves are vanishing.

“We’re getting $11 billion? I think this whole episode has given us 11 billion reasons why loans have never worked out for Pakistan. The next six months are crucial; IMF is demanding development cuts in favor of tax revenue or we will be forced out of the program,” he added.

Powerful blocks are of the view that the Geneva money will be spent for flood victims’ appeasement, but events since October 2022 have shown that the common folk no longer trust the 30-year reign of straddlers and long-forgotten architects of the game. In any case, the $11 billion scheme pledged by lenders in Geneva will give powerbrokers some cash to persuade the public for supporting a regime of their choice, but it won’t surprise most if results go the other way in the coming months.

The urgency of 2023 suggests that how the Geneva cash is spent will depend on elections scheduled for any time this year. A former central bank executive director said,

It’s a tough job for the bank to avoid economic commentary but everyone on the governor’s wing agrees the IMF route is a one-way path to finding economic clarity. Our bookkeepers have recommended debt restructuring at the highest level and a good repayment model for the next 2 years will kill the default gossip for at least until hell freezes over.

It is quite unfortunate where we’ve landed today, and our business partners know we cannot cope. The last time we got a compliment from the IMF was back in 2021 when the outgoing country representative for Pakistan Teresa Daban Sanchez lauded us for curbing the negative impact of the then-deadly COVID through well-timed monetary and exchange rate policies.

Pakistan is looking at a dark and foggy path ahead. Market optics and Dar’s currency pegging have yet to yield a positive result. Having sound economic fundamentals would be the key to getting on a solid footing. The IMF projects Pakistan’s trade deficit to widen over the next five years with imports expected to be about twice the level of exports. Last year’s devastating floods are weighing heavily on these projections.

Given that Pakistanis spend nearly half of their income on food, and a large portion of it on government marketing advertisements, inflation threatens to further marginalize the most vulnerable members of the community. The public no longer trusts the system, which is why the Geneva pledges could cause problems if the money ends up in the wrong hands, and it seems it just might.

The writer works as a Business Analyst at ProPakistani and the views expressed here are solely his own and not of the company.

Shame on the writer for giving a myopic version of the situation. We might dislike a government but that does not give us the right to hurt our country. We are in this condition only because some of us chose financial gains before our country.

Payment coming from Geneva Conf is not loan but an Aid for flood relief.

Anyone can search you on tweeter and see your favourism for PTI, stop spreading your biased, baseless and useless analysis and get some life. Your love for imran khan can be understand but on the stake of sovereignty of Pakistan is unbearable.

propk always promote the disastrous tabdeeli dharna, even after it fails