The International Monetary Fund (IMF) wants Pakistan to further jack up interest rates to bring down inflation.

The lender in its regional economic outlook for the Middle East and Central Asia painted a bleak picture for the near-term future of economies in the region. “The MENA economies and Pakistan are expected to go through a soft patch this year, reflecting tight policies in many countries to restore macroeconomic stability,” it said.

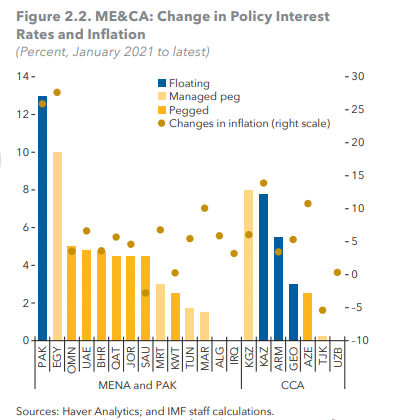

“In countries where inflationary pressures continue and the stance is loose, a tighter monetary policy should be considered (Egypt, Pakistan, Tunisia),” the lender noted.

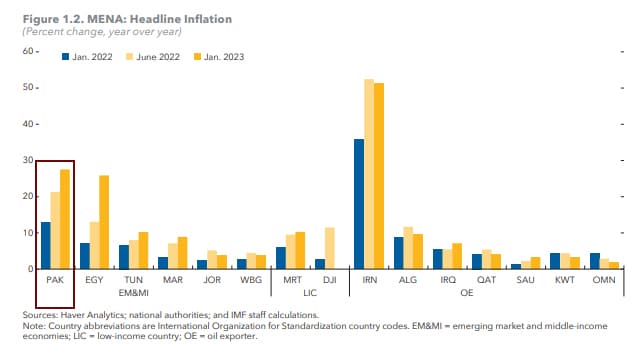

In the report, the lender explained in detail that headline inflation continued trending upward in most EM&MIs (Egypt, Morocco, Pakistan, and Tunisia, partly reflecting the impact of past exchange rate depreciations and persistently elevated food prices, but also broadening price pressures as underscored by the rise in core inflation amid loose monetary policy (Egypt, Pakistan, Tunisia).

In Pakistan, policy interest rates stood at levels below model-based estimates of natural rates, suggesting that monetary policy stances were still loose at the end of 2022 and further hikes were needed to bring stability, according to the lender. Pertinently, the State Bank of Pakistan has already raised interest rates to 21 percent in order to contain inflation, which reached 36.4 percent in April.

Pakistan undertook a sizable fiscal expansion in 2022. In low-income countries, primary fiscal positions deteriorated in most countries because of higher commodity prices, the report noted.

Vulnerabilities Persist in Low-Income Economies Like Pakistan

The lender observes that higher inflation was the main factor in containing public debt in most MENA EM&MIs and Pakistan in 2022. Debt ratios declined slightly in Egypt and Jordan as higher nominal GDP growth more than offset interest costs. By contrast, public debt-to-GDP ratios continued to rise in Pakistan and Tunisia, reflecting the combination of still-large overall fiscal deficits and the impact of exchange rate depreciations, offsetting the eroding effect of high inflation.

“External vulnerabilities remain elevated, especially in EM&MIs. Current account deficits for MENA EM&MIs deteriorated from 4.7 percent of GDP to about 5 percent of GDP on average in 2022. However, the widening in Pakistan was more marked (rising from 0.8 percent of GDP to 4.6 percent of GDP), reflecting rising import bills because of higher commodity prices,” it said.

Overall, the slight easing of financial pressures across the MENA region and Pakistan since October 2022 was reversed by the tightening of global financial conditions in March amid global banking turmoil. Meanwhile, sovereign bond spreads have widened, and borrowing costs have increased sharply on the net in many EM&MIs (Lebanon, Pakistan, Tunisia) relative to October 2022.

“Pressures on exchange rates and international reserves remain significant, with sharp depreciations in some EM&MIs (Egypt, Pakistan) since October 2022,” it remarked.

The report added that Pakistan’s growth rate is expected to slow materially from 6.0 percent in 2022 to 0.5 percent this year, reflecting challenging macroeconomic conditions, including damage from widespread flooding, broad-based inflationary pressures, and tighter monetary and financial conditions.

Inflation

In Pakistan, inflation is projected to more than double to about 27 percent this year, reflecting broadening price pressures, the lender said.

According to the IMF outlook, external vulnerabilities remain elevated in the region’s EM&MIs, underscored by large current account deficits and dwindling foreign exchange reserves in some countries in 2022. External financing needs for MENA EM&MIs and Pakistan are projected to stay large.

On a separate note, the lender wrote that financial markets in the region have moved in line with global trends, though countries with large debt burdens have seen a larger impact. Equity markets have declined across most of the region, with Egypt, Jordan, Oman, Pakistan, and Qatar experiencing the largest declines.

keep it up well done good for banks