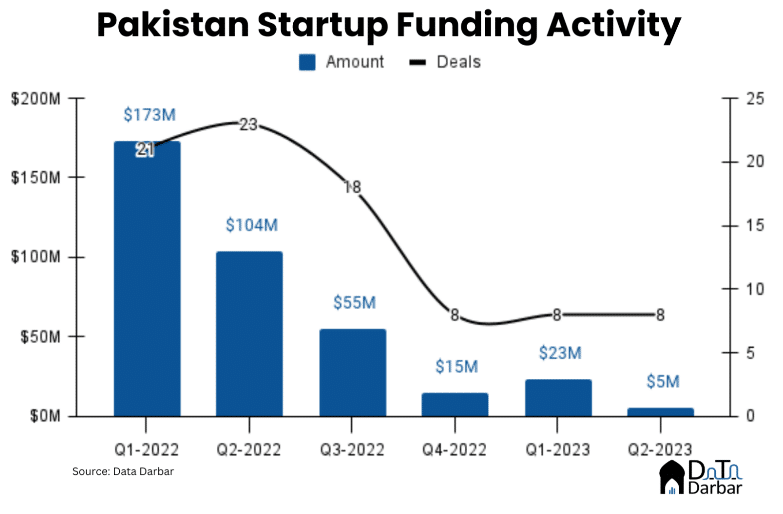

Startup funding in Pakistan had its worst quarter since 2020, with investments in this category falling to $5.2 million during April-June 2023, according to data released by Data Darbar.

This reflects a 95 percent year-on-year (YoY) and 77.5 percent quarter-on-quarter (QoQ) decrease from $104.1 million and $23.1 million, respectively.

Meanwhile, the deal count was eight, down 65.2 percent YoY.

Fundraising has been bleak globally, particularly in Asia, where venture capital investments have fallen below pre-COVID levels. While global data for the most recent quarter has yet to be released, Crunchbase reported that global startup funding decreased 44 percent YoY to $22 billion in May 2023.

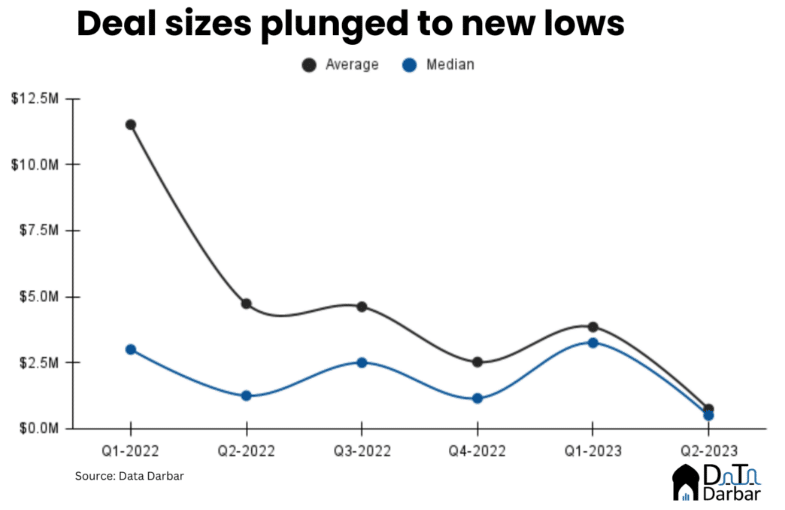

The average deal size dropped to $743,000 in Q2 2023, down from $4.7 million the previous year and the lowest since Q1 2019. The median value was $500,000, the lowest since January-March of 2021. As a result, the size-to-median gap has shrunk to its lowest level of $243,000.

Most movements were early stage, with four seed rounds and three accelerator rounds. Only Abhi’s deal with BlueEx was technically classified as post-IPO.

Fintech was the most dominating sector. It accounted for half or $4 million of the declared investments. Also, there was some variety, with automotive arriving on the radar after a while, due to OkayKer.

Total Investment

Total funding in the space was $28.3 million in the first half of 2023, a 60 percent decrease from the same period last year. The drop was far greater at 98 percent, compared to the $276.9 million raised in the first half of 2022.

The number of transactions has also dropped to 16, from 26 in July-December and 46 in January-June of last year, the lowest levels by amount since 2HCY20 and the joint lowest by the number of deals since 2HCY19.