The Pakistani rupee crashed further against the US Dollar during intraday trade today after opening trade at 277 in the interbank market.

At 11 AM, it was initially bullish, rising to 272.35 after gaining Rs. 5.41 against the greenback.

Later, it dropped to the 278-280 level between 12:30 PM and 3:15 PM with the interbank rate tipped by traders earlier today to resume Friday’s plunge.

Open market rates across multiple currency counters surged to the 285-290 range.

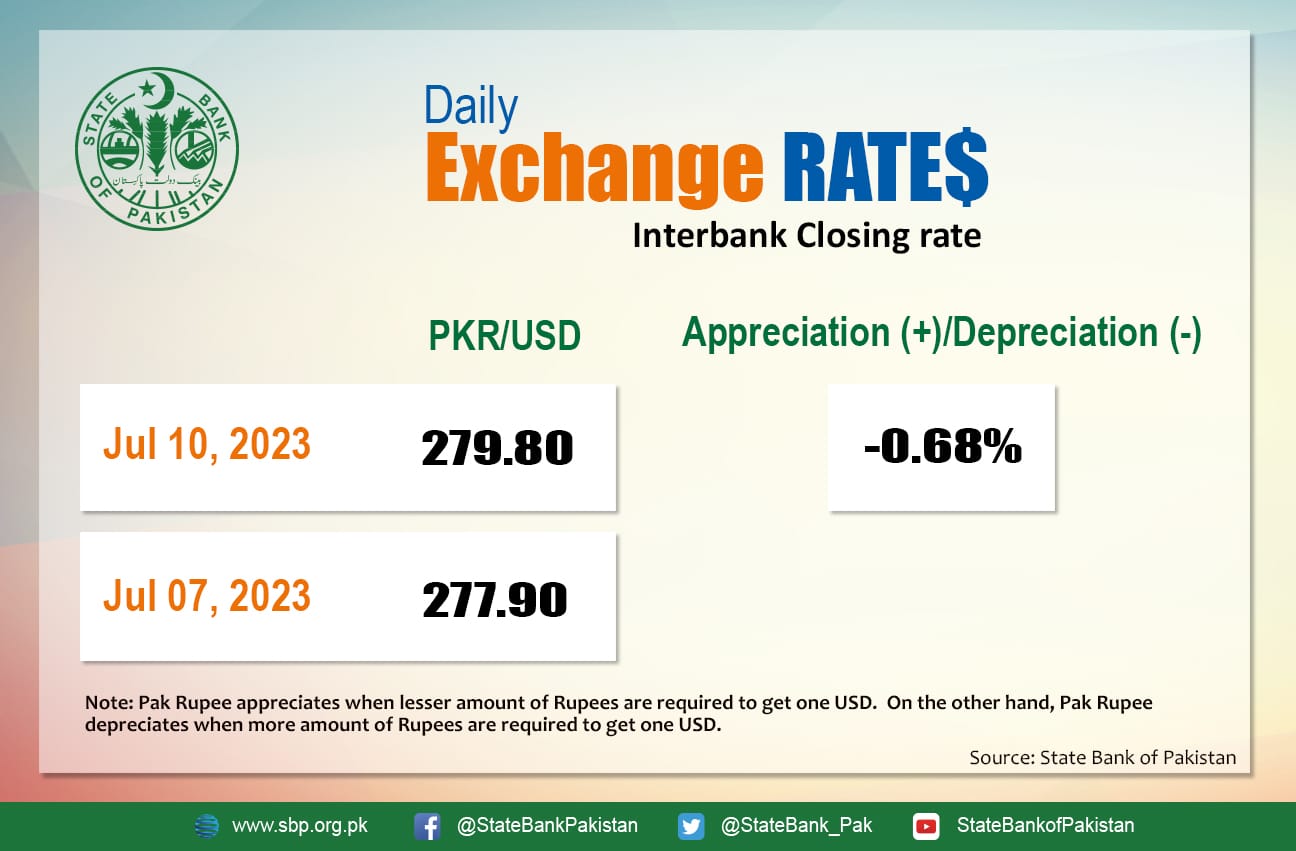

At close, the PKR depreciated by 0.68 percent to close at 279.8 after losing Rs. 1.90 against the dollar today.

The informal exchange rate had recovered massively and at 11:30 AM rose to the 276 level, before falling to 286.

Today’s cash rate per dollar in Hundi surged to the 288-296 band, while many channels (undocumented) reported rates as high as 305.

Independent analyst A H H Soomro told ProPakistani,

The resumption of the IMF’s program until a new government will help improve the currency. Expect more dollars to flow in from bilateral and multilateral sources to keep the currency stable. Inflation has also been somewhat controlled in the last few months reducing implicit pressure on the rupee.

Under IMF, we have to move towards a market-determined currency. While imports are advised to increase by 25%. Commercial banks have been asked to arrange dollars themselves. This is welcome that SBP isn’t going to defend the currency. Nevertheless, at 22% Interest rates, the current account should be close to surplus in the short term as imports remain compressed. Rupee can remain below Rs. 300 against USD for a few months ceteris paribus.

Today’s losses come after money markets understandably reverted to pre-IMF sentiments ahead of the lender’s upcoming Board meeting on Pakistan’s agenda on July 12. Traders said uncertainty on Wednesday’s outcome while market sensitivity to the economic environment both maintained assault on the exchange rate.

Meanwhile, Finance Minister Ishaq Dar endorsed a tweet saying how the PKR had managed to grow in the past week.

AlhamdoLilah 🙏 https://t.co/mZ7cy3eiAT

— Ishaq Dar (@MIshaqDar50) July 10, 2023

One trader told ProPakistani that Pakistan’s track record on creditor deals for bailouts in the past has pushed IMF filters to the limit today while the socioeconomic and political situation in the country continues to play a role in offsetting gains.

Meanwhile, remittances in June 2023 registered a decrease of 21.4 percent on a year-on-year (YoY) basis and dropped to the $2.2 billion mark compared to $2.8 billion in June 2022.

Policy-induced contraction in imports coupled with demand compression, exchange rate depreciation, and people’s preference for undocumented channels for better profits curbed remittance inflows during FY23 and failed to adequately facilitate expatriate Pakistanis living in different countries. This altogether had an everlasting effect on the PKR in FY2022-23 alone.

Overall, the rupee is down nearly Rs. 54 since January 2023. Since April 2022, it is down over Rs. 102 against the greenback. As per the exchange rate movements witnessed today, the PKR has lost Rs. 1.90 against the dollar today.

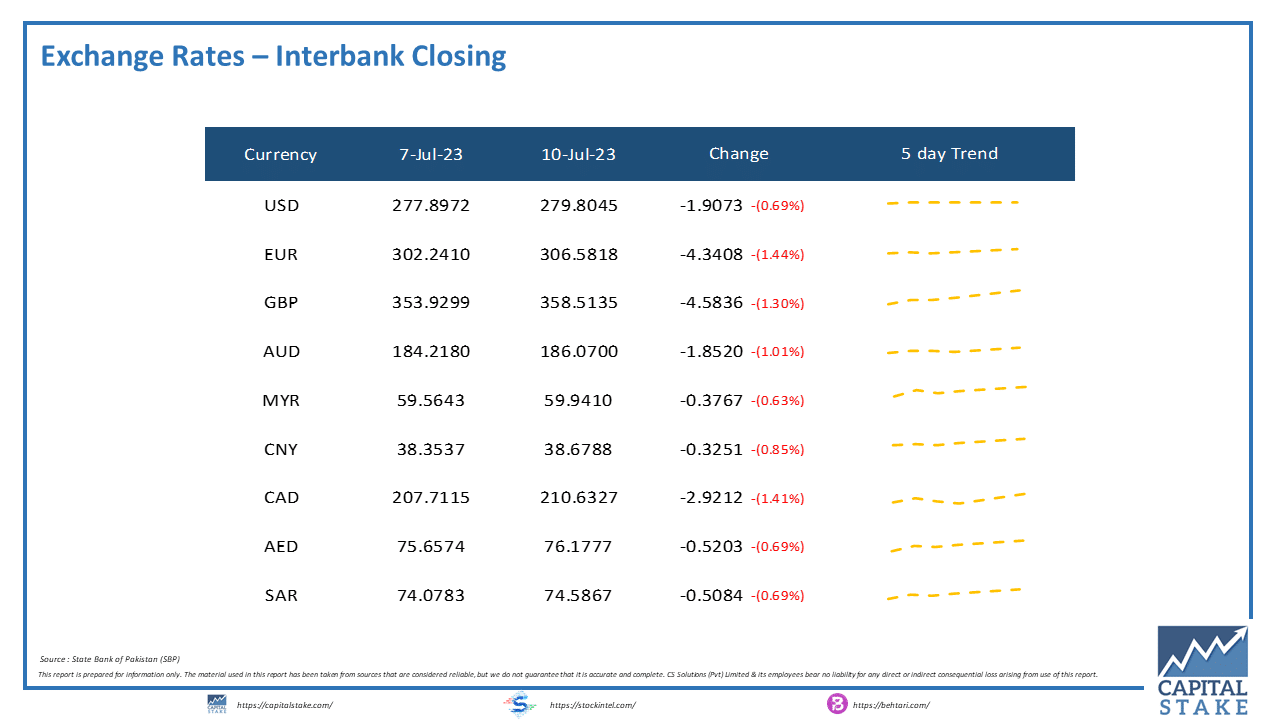

The PKR was bearish against all of the other major currencies in the interbank market today. It lost 50 paisas against the Saudi Riyal (SAR), 52 paisas against the UAE Dirham (AED), Rs. 4.34 against the Euro (EUR), and Rs. 4.58 against the Pound Sterling (GBP).

Moreover, it lost Rs. 1.85 against the Australian Dollar (AUD) and Rs. 2.92 against the Canadian Dollar (CAD) in today’s interbank currency market.

Pre IMF level was 287, it is at 280 right now. Also didnt see such troll induced imageryin articles during IK era.