Customers at various food chains, both international and local, pay the same price whether using digital methods like credit/debit cards or cash.

A survey conducted by ProPakistani revealed that astonishingly, the electronic bills generated through payment of 5 percent sales tax (cards) or 16 percent sales tax (cash payment) are the same at some food chain outlets.

If a customer is making a payment in cash, the sales tax rate of 16 percent is charged. On the other hand, if payment has been made through digital cards, a 5 percent sales tax is charged.

However, the outlets are charging different base prices on cash as well as credit cards for collecting the same prices on payment of 5 percent of 16 percent sales tax. The bottom price has been kept the same by using the technique of charging different base prices on cash as well as credit cards.

The purpose of this fraudulent technique is to collect the same amount from customers paying a lower rate of sales tax or a higher amount of sales tax. The prices are inflated to ensure that the customer making digital payment should also indirectly pay higher rates of 16 percent sales tax.

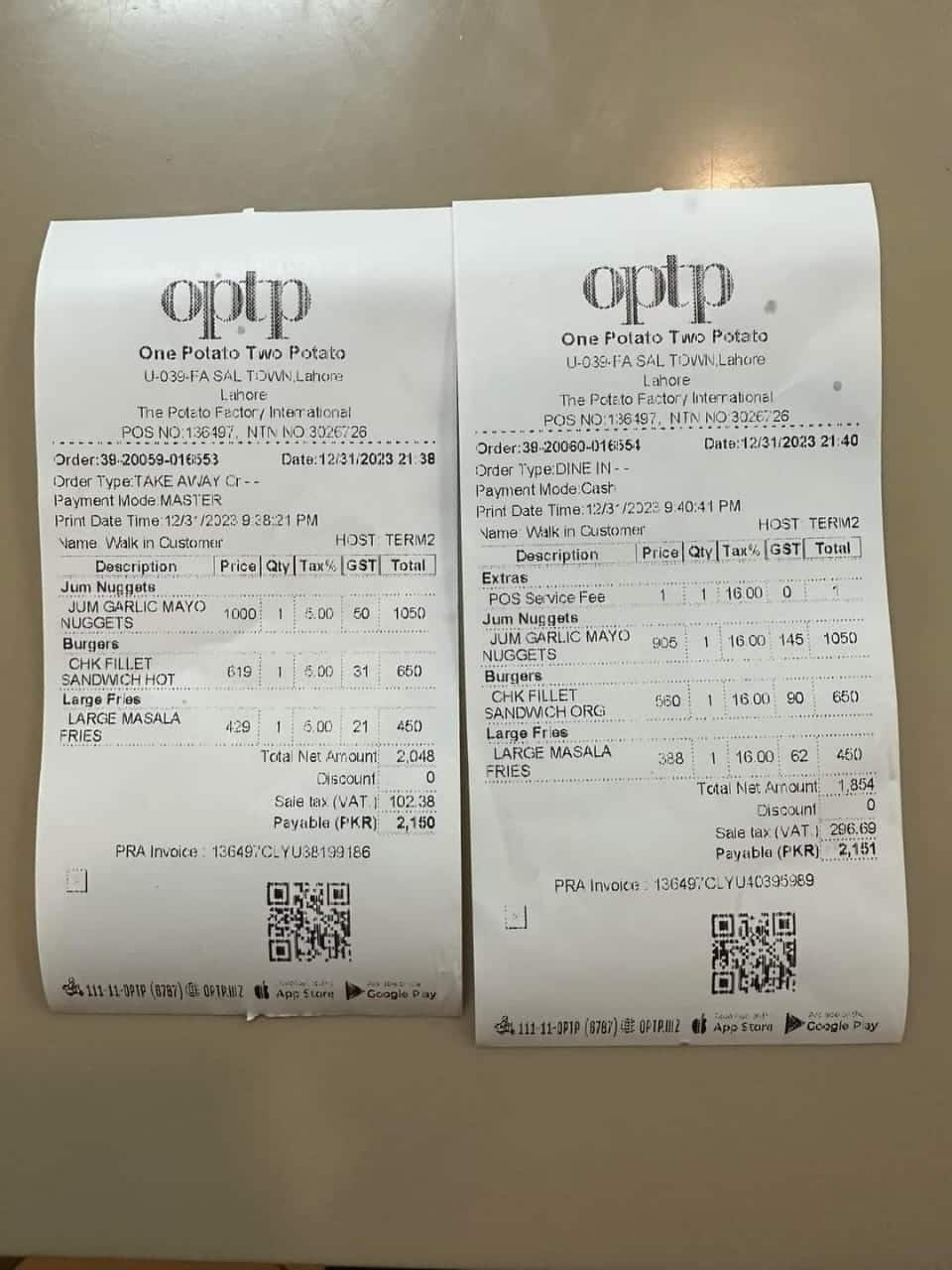

In one case at OPTP, a comparison has been made of both receipts issued for an identical set of products from the same restaurant. One is for cash payment, where 16% sales tax is supposed to be charged, and one is for a digitally paid order where tax is supposed to be charged at 5%. When a customer opts to pay by card, the restaurant in question inflates the price by the difference instead of passing on the intended savings to the consumer.’

In response to a query by ProPakistani, an OPTP employee said all base prices are fixed and the system generates receipts without bias. “The full receipt is calculated by determining whether the payment method is via cash or card. Either way, the system will generate the same bill amount. We do not over-charge,” he argued, while the following comparison of the same bill (cash/card) says otherwise:

Both receipts are for an identical set of products issued minutes apart, as seen on the time stamps above. One is for cash payment, where 16 percent sales tax is being charged, and one is for a digitally paid order (via card) where tax is 5 percent. NOTE: The receipt on the left tells us that the restaurant is NOT reporting card transactions back to FBR.

It is evident that when a customer wants to pay via card, the restaurant is inflating the price by the difference as opposed to passing on the intended savings to the consumer.

The reduced sales tax on digital payments was first introduced as a tax break and to encourage a cashless economy. But restaurants want to increase their profits when the customers should be getting the benefit.

The regulators, especially FBR, must take prompt action against such outlets, which are charging the same amount for selling food products despite payment through digital cards.

PRO WORK….thanks

Same is done by Cheezious

Thanks for exposing this scam.

This fraudulent practice is widespread. Shame on so called “educated” lot who run these so called well managed restaurants. I argued with Boradway Pizza about the same and they had no answers. Basically, when we pay via card instead of passing the savings to us they move it to their own pockets. Same with Jalal Sons.

I would also like to mention businesses that do pass the savings to the customers. Savour foods, Daily Deli, Sub Way. These are from the top of my head.

Pro Pakistani this is the sort of things you should be publishing. Identifying patterns of oppressive practices of anyone in Pakistan. Well done.

KFC and Mcdonald are also not passing on the digital payment benefits to customers. Unfortunately, there seems to be a lack of concern for the public among individuals in our country.

Thank you for doing actual journalism. This is exactly what Pakistan’s jounalistic landscape has been lacking. Bravo!

this post was posted on Voice Of Customer. PP picked the news from there and elaborated it.

Please keep doing the same, Good Work

If ProPakistani manages to do this sort of journalism, it might become Pakistan’s number 1 news blog. I urge the elusive owner of Propakistani to encourage this kind of journalism and expose the corrupt elements of the society (the whole society) and ensure they get sentenced for such crimes.

I also urge the masses to refrain from buying anything from McDonalds or KFC. Our local brands are better than their tasteless and often expensive menu items. Boycott them so they can close their blood-soaked shops and move elsewhere.

To be honest I even don’t know that there is difference in Sales tax by paying through Card or paying through Cash. Now onwards I will be more vigilant. thank you this is what we want to see here.

“Price mein tax included hai.”

“Final rate yehi hai jo menu pe likha hua hai, system khud hi adjust kar deta hai.”

We are dishonest people jiska jahan da lagta hai laga deta hai.

Guys, discourage going back to the businesses that do this practice.

I read in the comments that Daily Deli does not do this so they just made their usual customer very happy and while we are at it, love their loyalty points reward system I got to have multiple free(not entirely free but like at 70,80% off) meals after saving enough points.

Look for alternatives and play your role, however you can.

Same is done by Papa Johns

I don’t know what is the FBR requirement but Payment Mode is written on top of the receipt “MASTER”. What else fbr need?

ProPK Staff do your homework before posting an article as you have a huge user base. The note is invalid here because this bill is for OPTP lahore outlet and they are submitting tax to PRA. They don’t need to submit to FBR. This is sales tax not income tax we are talking about.

OPTP is a fraud. They have been doing this from some time. Boycott it!

Try getting the “Sales receipt” even from any major restaurant in Karachi. All of them will give you only “Proforma”. The behavior of the waiter/manager will change. Business Norm or Corruption or whatever you say in the land of Paks :)

This is what journalism should be about. Well done

McDonalds is doing the same and their justification is that FBR did not send them a notification.

The same issue exists as Papa Johns as well, where they are charging 16% sales tax either you pay by cash or by card. Already have argument with them twice but they say this is being set in our backend system and we have no authority to change this value. But these outlets are looting money without any fear and also the receipts are generated by their system doesn’t show QR reference to FBR site rather shared QR code redirects to their own website.

FBR or other corrupt tax related govt official may involved in this scam.

because in Pakistan (SAB MIL KAR KHATE HEN) only one or two or three cann’t benefit from it.

I have an argue with KFC and McDonald as they charge 16% on both cash and card. They said we are not a Pakistani Company and didnt fall under the rule of FBR and they charge their customer 16% GST in who are paying by Card. My experience is in Punjab (Lahore).

even When i called FBR helpline (051-111-772-772) to know about whether MNCs like KFC and McDonald can charge 16% when people pay by card, they didn’t answer it by syaing we have no idea about that.

Just one more reason to Boycott these foreign fast food chains. They sell unhealthy junk food, charge extra and on top of it result in money taken out of Pakistan.

Great journalism.

Burger Lab also does the same

Some others restaurants are charging card fee in name of bank charges from customers if payment is made through card. I experienced it on TKR where extra money was charged and mentioned as bank charges in bill. However, they reduced the GST amount by 10% and passed the benefit.

In addition to over charging, some food outlets first present bills that are without FBR logo, but sales tax charged to customers, meaning they are simple bills that have no link with FBR POS. If a customer is not aware of it, and pays the bill, the sales tax amount goes to the restaurant’s kitty but if a customers asks for proper bill from FBR POS, the restaurant will ask to pay first and then they will bring them the other bill. When they do, they often return some amount to the customer, saying there was some calculation error earlier. Some restaurants that are doing this, are Chezious, Chai Khana, Habibi, Papasalis. I am sure there are others doing it also. I also suspect that such malpractices like tax theft etc are not possible without the involvement of FBR officers.

You should allow people to add pics to share their experience and will see whole Pakistan will come with such scams. Now restaurants set menu price indicating taxes are inclusive in the price which is 16% and people paying by card have to pay 16% forcefully.

KFC Thokar Lahore doing same. Charges 16 percent irrespective of payment method.