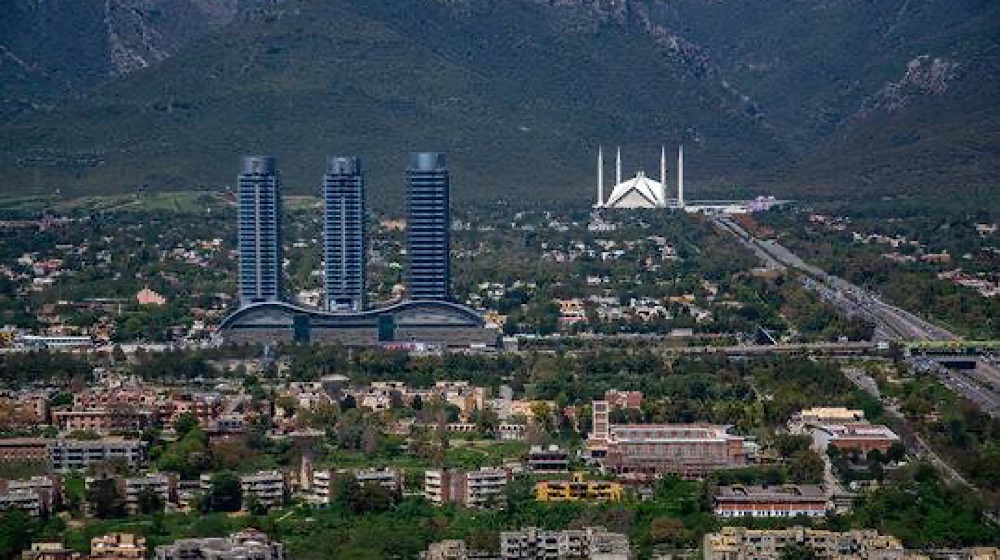

The district administration of Islamabad has directed housing societies to furnish details of stamp and other government taxes, including advance tax, gain tax, and 7 E taxes.

Sources told ProPakistani that DC Islamabad has written a letter to all housing societies with regard to the non-recovery of taxes. It has been observed through a review of recent transactions and interactions that housing societies have not been charging or remitting the required stamp duty and government taxes associated with property transactions.

According to the applicable laws and relations, stamp day must be paid on the execution of sale deeds, lease agreements, and other property-related documents. This duty is crucial as it validates the legal standing of the documents and ensures they are admissible in a court of law.

Additionally, various other taxes, such as property tax & maintenance-related levies, must be appropriately charged and remitted to the government authorities.

These obligations are not optional but are mandated by law, and failure to comply can have significant legal and financial repercussions for both the Societies and their members. It is pertinent to note that the government has imposed a 4 percent duty tax on filers and non-filers.

Similarly, the registration fee is 1 percent each for filers, and non-filers whereas 3 percent advance tax for filers and 10 percent for non-filers. Furthermore, the government also imposed a 3 percent gain tax on filers, 6 percent for non-filers, and 1 percent each tax for 7 E tax.

“You are therefore directed to provide a detailed report of property transaction/transfers conducted since the inception/regularization of societies”, DC Islamabad said.

He demanded that the report must include each and every transaction along with the supported bank challans through which tax is deposited in the government exchequer. The detailed report should reach the office of DC office within a week positively to avoid any adverse legal consequences as per law.

tax tax tax so these useless DC can drive around in government owned Vigos and Landcruisers