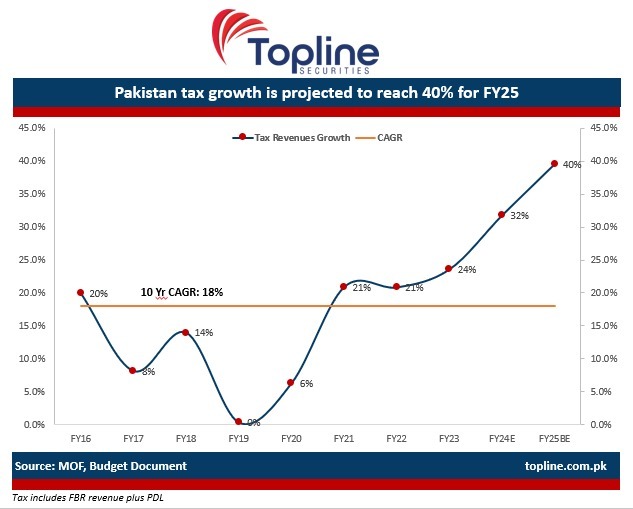

Pakistan’s tax growth (including petroleum development levy) is projected to reach 40 percent for fiscal year 2024-25 compared to a 10-year compound annual growth rate (CAGR) of 18 percent.

According to a statement by Topline Securities, the federal government will achieve its target as any shortfall to the extent of Rs. 300-500 billion, can be managed through cost rationalization i.e. cut in development and/or other current expenses like subsidy, etc or further increase in taxes by mid of next fiscal year.

Tax measures taken under the new federal budget are quite balanced and less inflationary than expected, as earlier it was considered that the government would increase GST by 1 percent etc.

The Federal Board of Revenue (FBR) tax revenue target has been set at Rs. 12.97 trillion, up 40 percent from the estimated collection of Rs. 9.25 trillion in FY24. This is higher than the FY24E growth of 29 percent and the average growth of 20 percent in the last five years.

Although the target is high, it believes the government can collect around Rs. 12.4-12.7 trillion based on the new tax measures.

The remaining gap can be filled through either imposing additional taxes like a further increase in PDL during the middle of the fiscal year (i.e. January 2025) etc. or by reducing expenditures like development spending and/or subsidies/grants etc.

you are in reality a good webmaster The website loading velocity is amazing It sort of feels that youre doing any distinctive trick Also The contents are masterwork you have done a fantastic job in this topic