The industrial sector reported a negative 2.94 percent growth in the first nine months of FY 2022-23 with a 9.3 percent decline in large-scale manufacturing (LSM) between July-April on year on year (YoY) bases and a lot of it had to do with the supply crunch of raw materials, import restrictions, monetary tightening, and currency depreciation.

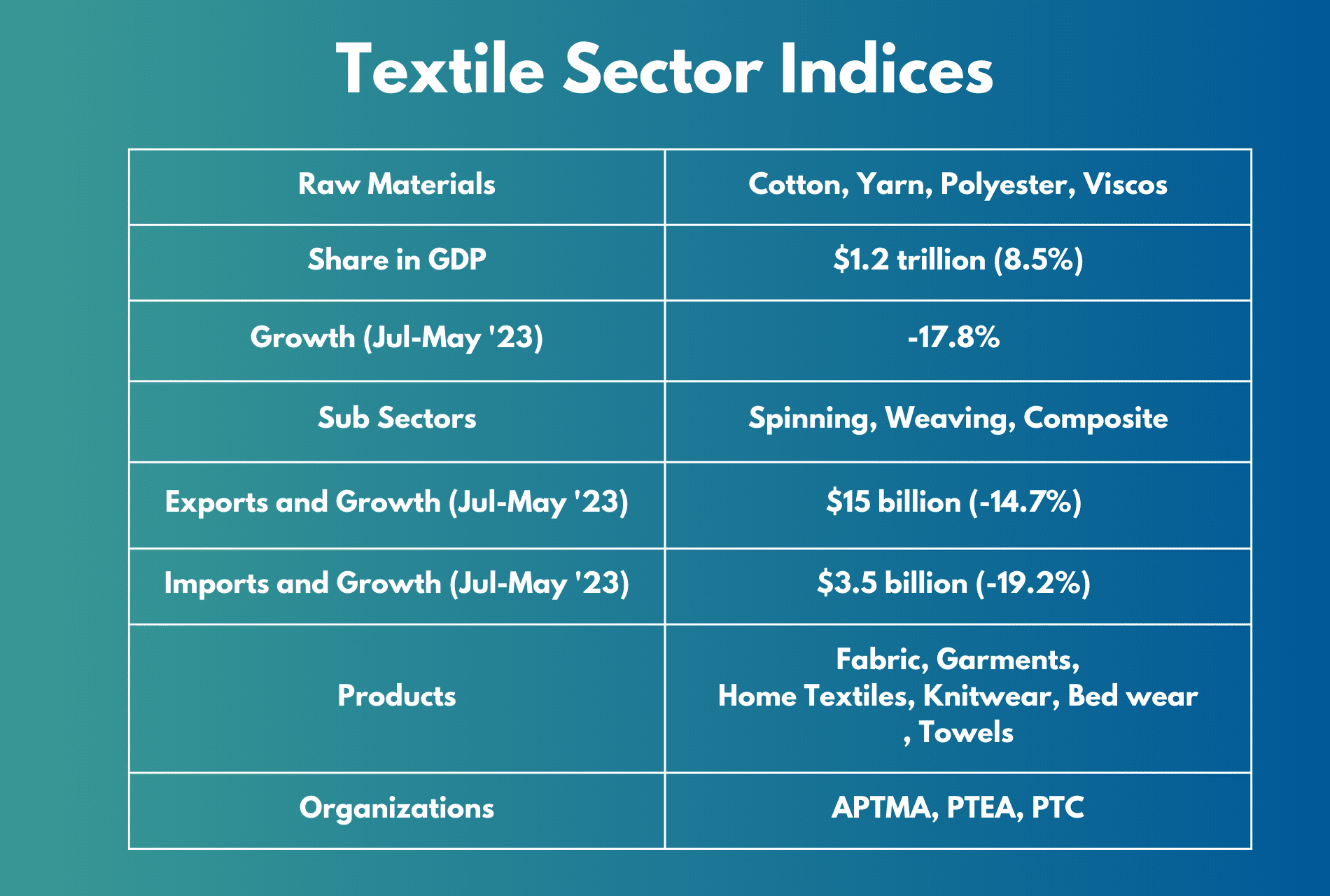

The textile sector is among one of the worst hit by the ongoing economic woes with cotton yarn & cloth manufacturing declining by 20.5 percent and 11.3 percent respectively between July-April in the current fiscal year compared to the same period last year.

The cement industry contracted by 13.8 percent and steel manufacturing also reported a 4.6 percent negative growth in the same period.

Textile Sector

The textile industry has a large value chain that starts off by gathering seed cotton from farmers’ fields to 1300 ginning mills across the country where after removing the seeds from the cotton, it is ready to be moved to nearly 488 spinning mills where yarn is manufactured from raw fiber.

Yarn count is also calculated here through different methods which describe its finesse or coarseness, the higher the finesse, the better the price. Nearly 90 percent of the yarn production is utilized within the local industry and the rest is exported, mostly to China. The weaving industry comprises more than 30 organized mills, but the major segment of the sector is unorganized.

The manufactured yarn goes into two main purposes, either knitting or weaving. Weaving means converting the yarn into greige fabric, of which 30-35 percent is exported mainly to South East Asia, Bangladesh, and Turkey, and the rest is consumed by domestic garment manufacturers.

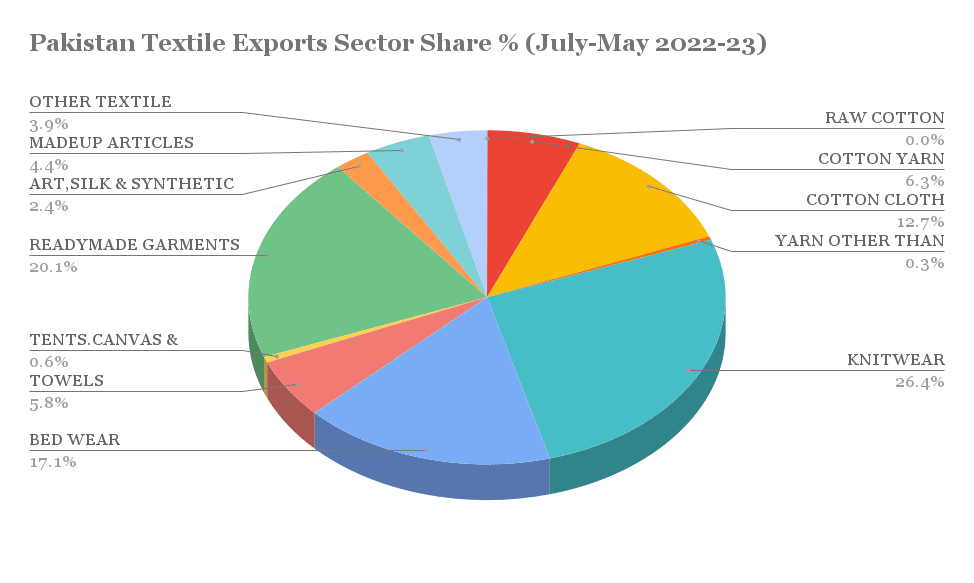

The spinning and weaving industry has a major share (8.8 percent and 7.2 percent respectively) in the manufacturing sector but knitwear, bed wear, towels, and ready-made garments contribute nearly 70 percent to the textile’s export value in terms of dollars. Both natural cotton and synthetic polyester make the raw materials for these industries.

The 41 percent decline in local cotton production in 2022–23 poses the biggest risk to the sector especially to the upstream segment followed by import restrictions, a capital crunch, and an uncompetitive & unreliable energy supply.

The other major issue is the lack of SME clusters, trust deficit, and few linkages within the industry and geographical export concentration.

In other countries, big players outsource their upstream processes to small and medium size companies but in Pakistan, there is a trust deficit as companies often try to grab direct access to clients bypassing the original supplier.

The export orders are often so massive that the single exporters are unable to meet the demand on their own, so they outsource the production to other players in the market,” said Ahsan Ali Khan, co-founder of Zaraye a B2B marketplace that connects the suppliers across different layers of the manufacturing sector in textile, construction, polymers and steel in an exclusive interview with ProPakistani.

Founded by three business graduates from IBA in 2021, Zaraye raised $2.1 million in pre-seed funding in April 2022. Backed by the biggest investors in the industry i.e. Tiger Global Management and Zayn Capital, it operates in five categories and claims to provide suppliers with the best rates and affordable credit to finance their inventories.

Lately, It has decided to venture into the export economy by building a platform where big brands and buying houses from across the world can reach Pakistan’s manufacturers directly. Through this, the manufacturers will be able to tap into new export markets.

“These international clients will be able to get the best rates and complete visibility of the process. We also work with third-party quality assurance companies, all of which lead to smooth business operations for both sides”, added Khan.

Zaraye has sold goods worth over Rs. 3 billion with more than 6 thousand total users in the last two years approximately. It is dealing in nearly 380 unique products across 24 cities. In recent years, a lot of B2B Marketplaces have emerged claiming to resolve some of the fundamental bottlenecks in the manufacturing supply chain and Zaraye is only one of them.

Surprisingly, another similar B2B eCommerce platform Bazaar raised funding a month before Zaraye and is competing with it while operating under the same umbrella of TGM and Zayn Capital.

When asked, Khan said that while it is not uncommon for investors to invest in similar business models, these businesses were in different markets at the time investments were made and Zaraye was the first to digitize procurement operations for the manufacturing industry.

Zaraye is aiming to resolve another problem in the manufacturing sector which is credit. Khan added that Zaraye is providing loans in the form of raw materials which helps these companies to establish their creditworthiness and access credit from commercial banks as well in the long term.

Commercial banks are often reluctant to lend to SMEs first because the government is the biggest lender, and they have no plans to bet on small players, and secondly, SMEs also make matters worse with their shady accounting practices.

All the manufacturing operations across the sectors are capital intensive, so we often experience boom and bust cycles where it performs great when money is cheap but goes down the moment interest rates hit the roof. Credit access will also address the low BMR of the sector that has resulted in outdated technology and may enable a shift towards higher-value products from socks and towels.

Another aspect is the ‘value chain imbalance’ as we often import not just synthetic polyesters but even yarn and cotton majorly due to low production but sometimes also due to lower quality of domestic raw materials. The dollar-based input costs lead to thin margins while all machinery and spare parts are imported as well which too exposes the industry to economic cycle shifts.

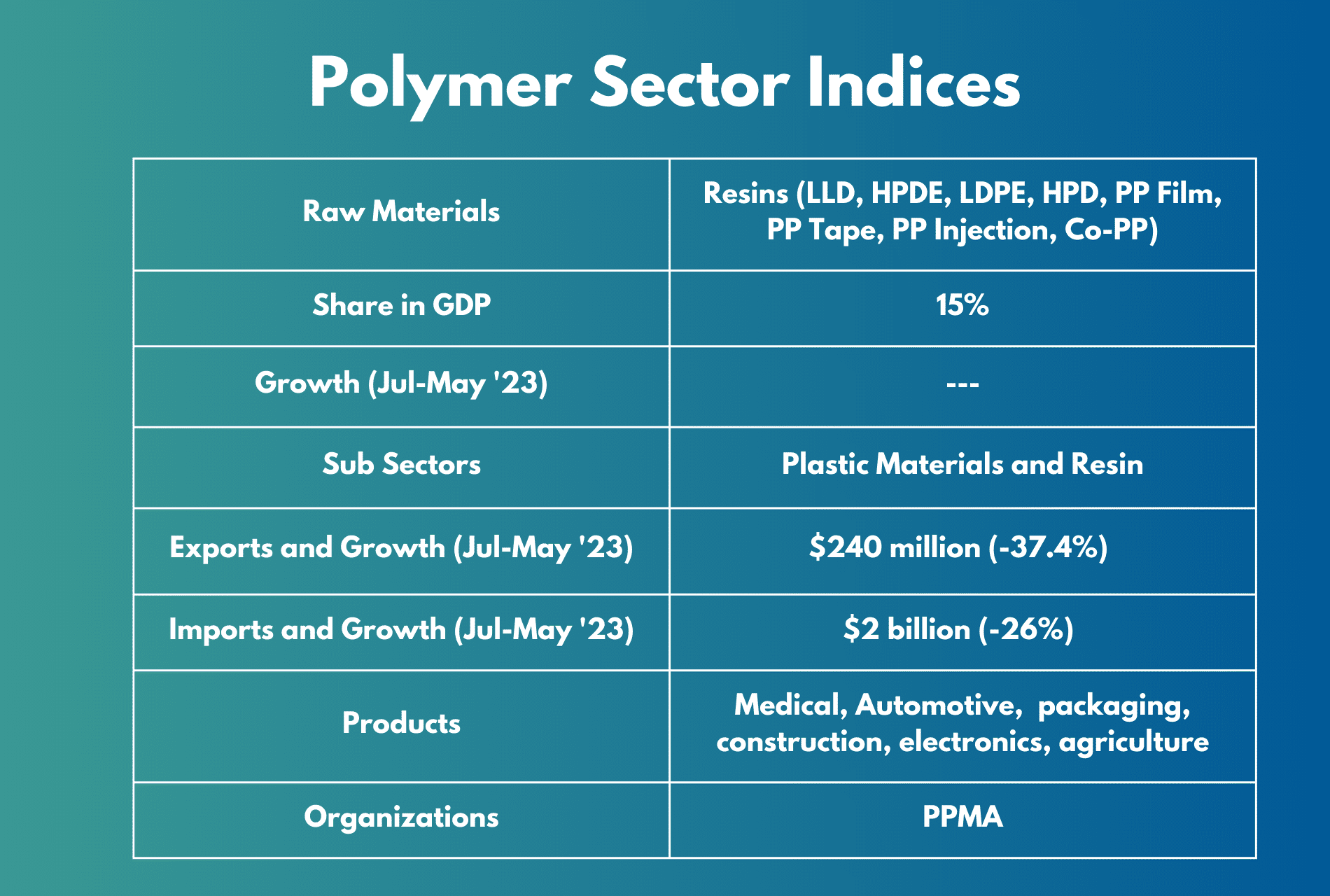

Polymer Sector

Pakistan imported $3.1 billion worth of plastic materials during FY 2021-22 while in the first eleven months of FY 2022-23, plastic imports crossed $2 billion despite the import restrictions due to its massive importance in packaging, construction, electronics, medical, agriculture and consumer goods.

Pakistan has shifted from the United States to Gulf-based imports lately due to logistical issues and 70 percent of the imported resins are consumed by Punjab.

The imported resins are often bought by traders who have certain liquidity which has resulted in a trader-based market which means by the time raw material reaches a manufacturer in Faisalabad and Gujrat, it gets far more expensive compared to if the manufacturer had gotten it at the port.

“Zaraye is connecting manufacturers directly with commercial importers so the time, money, and margins lost between all the trading operations are cut and manufacturers get the best rates”, added Khan.

He pointed out that it’s the practice that happens across the manufacturing industries and results in inaccurate price discovery but Zaraye provides small and medium manufacturers with complete symmetry of the market information.

But in the past year, matters have worsened due to the supply crunch due to import curbs which caused raw material prices to nearly double over time, and that brought recycled plastic to the forefront. There are a number of companies and startups that are providing recycled plastics, but it comes with significant challenges.

Globally, the plastic recycling rate is just 9 percent and the market share of recycled plastic is less than 10 percent, but these are expected to increase as countries tighten environmental restrictions and move further towards sustainability. Secondly, it is still uncompetitive in most circumstances and there are strong concerns about its quality and purity.

“The quality and consistency of recycled plastic depends on the waste used and most of it is sometimes medical waste which is then often used to make products including children’s lunch boxes”, added Khan. He explained that Pakistan has no structure for disposing and sorting the materials and required regulations to oversee which waste will be used for which purpose.

He pointed out that some companies are starting to appear which are doing great things, but the scale of the problem is big and our government and industries have a reactionary approach. He said that manufacturers are moving towards recycled plastic now because they have to but there is still a lot that needs to be done.

Recycled plastic resins are mostly sold in the same market as virgin materials, but these products will be needing incentives in the form of taxes on the use of virgin materials, recycling standards, consumer education, and awareness to stimulate the demand.

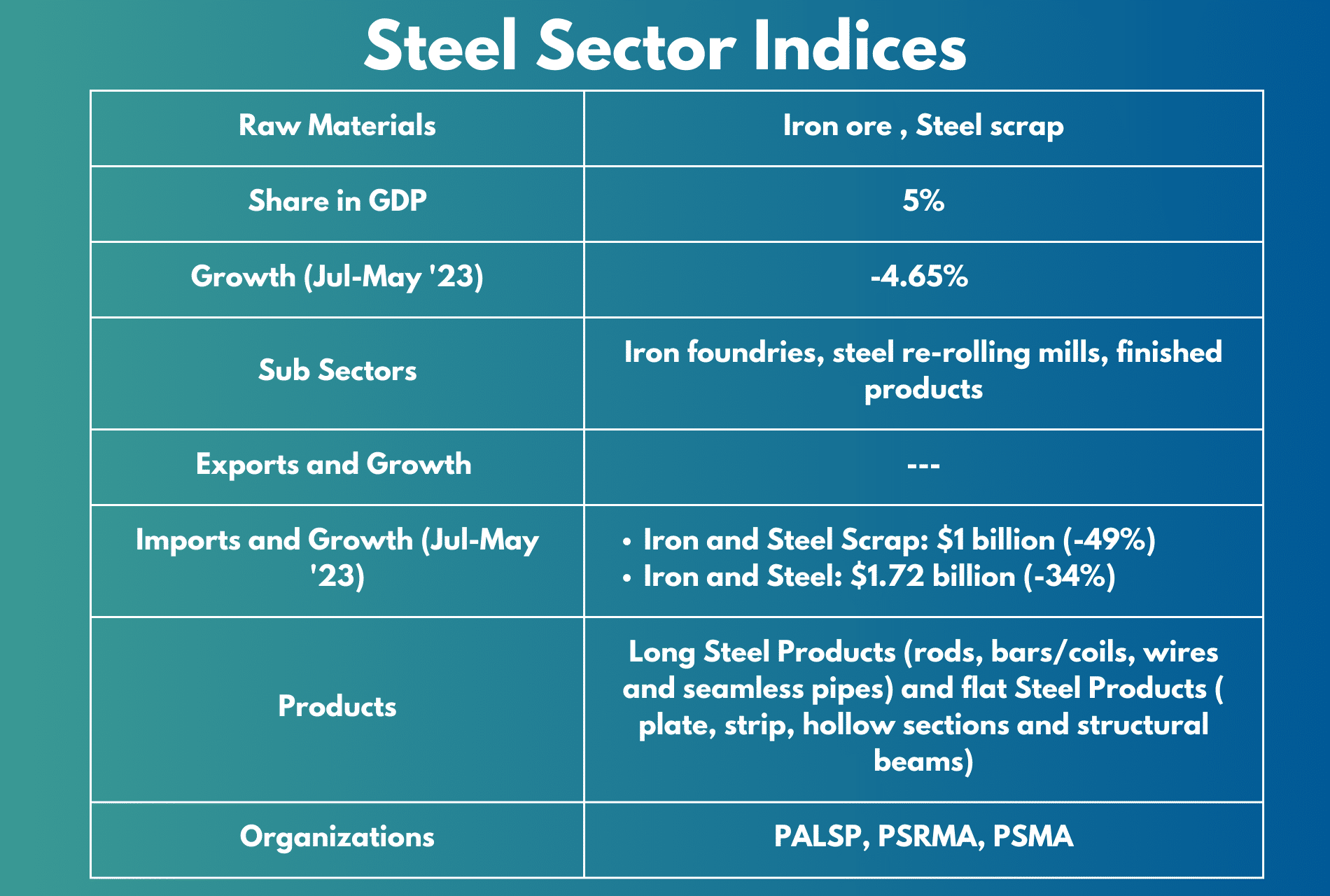

Steel Industry

Steel is primarily an alloy of carbon and iron and is used across construction, automotive, machine building, packaging & transportation, consumer appliances, and the power sector. The annual national demand hovers around 13.5 million tonnes, nearly 73 percent of which is met through local production while the rest is imported.

There are nearly 173 steel manufacturers registered with Pakistan Steel Re-Rolling Mills Association (PSRMA) but only 20 of them account for 40-50 percent of production. It is manufactured by either Basic Oxygen Furnace (BOF) process where molten iron is combined with scrap steel and oxygen in the furnace and Electric Arc Furnace where electric current is used to refine molten steel scrap.

The finished products include flat steel products (plate, strip, hollow sections, and structural beams), long steel products (rods, bars/coils, wires, and seamless pipes), and steel pipes & tubes. Pakistan’s steel and steel scrap imports have experienced the biggest hit due to import restrictions with a 49 percent and 33 percent decline respectively in terms of value between July-March 2022-23.

Zaraye is also connecting suppliers and manufacturers with prospective buyers across the industry as it is cursed with the same national habit as in the polymer sector where investors with better liquidity prefer trading the materials over and over ultimately jacking up the costs for the downstream manufacturers across the sectors.

Steel manufacturers are sometimes criticized for cartelization practices, especially in such challenging times and while the Pakistan Association of Large Steel Producers (PALSP) claims that it’s impossible because there are 400 manufacturing units, the fact is only 20 major market players account for 80 percent of the market share.

The import of finished steel products at dumped prices from China, Ukraine, Canada, and Russia and competition from untaxed steel players located in the FATA region is a major challenge for local industry. It has benefited the construction sector to some extent over the years but has subdued the growth of domestic steel manufacturing.

To address the former, National Tariff Commission has levied 6.18 to 17.25 percent anti-dumping duties that were extended for five more years in 2022 but the threat of the untaxed FATA region still exists. Last month, steel manufacturers claimed that producers in the FATA and PATA region evaded Rs. 150 billion in taxes as 90 percent of their production is smuggled to other areas.

Article is a bit long but quite insightful! Seems like one of the few well thought out start ups