The federal government has banned multiple pensions and limited pension paychecks to family members to 10 years.

Under the new measures, the gross pension will be calculated based on 70% of the average pensionable emoluments drawn during the last 24 months of service prior to retirement. This decision aims to address the unsustainable rise in pension expenditures, reported a national daily.

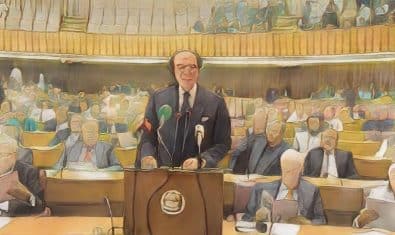

The Pay and Pension Commission-2020 (PPC-2020) was tasked with reviewing the current pension scheme and proposed amendments to curtail future increases in pension costs. These amendments were announced in the budget speech for the financial year 2023-24.

The Finance Division proposed several changes based on the PPC-2020 recommendations. According to Regulation-4 of the Civil Service Regulations (CSR), the government reserves the right to amend pay, allowance, leave, and pension provisions as necessary.

The proposed changes were circulated to the Ministry of Defence, Establishment Division, and Ministry of Interior for feedback. The Finance Division’s proposals include the following key amendments effective from July 1, 2024:

- Gross Pension Calculation: Employees will receive a pension based on 70 percent of their average salary over the last 24 months of service.

- Voluntary Retirement Penalties: Employees retiring after 25 years will face a 3 percent annual pension reduction, capped at 20 percent. This applies to armed forces and civil armed forces only if retiring before the prescribed rank service.

- Pension Increases: Increases will be based on the net pension at retirement, called the baseline pension, and reviewed every three years.

- Ordinary Family Pension: Available for ten years after the spouse’s death, or for life for disabled children. For other children, it continues until they turn 21 or for ten years, whichever is later.

- Special Family Pension: Available for 25 years after the spouse’s death, or for life for disabled children. Set at 50 percent of the last drawn pension and transferable to eligible heirs.

- Re-employment: Pensioners re-employed after 60 can choose between retaining their pension or drawing a salary from new employment.

- Multiple Pensions: Individuals can only draw one pension, but in-service employees can receive their spouse’s pension.

- Annual Increases: Annual increases will be 80 percent of the average inflation rate over the last two years, based on the Consumer Price Index (CPI).

A pension fund will be established using savings from these reforms, and a contributory scheme for new entrants will start on July 1, 2024.

Follow ProPakistani on Google News & scroll through your favourite content faster!

Support independent journalism

If you want to join us in our mission to share independent, global journalism to the world, we’d love to have you on our side. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you.

Now people should avoid doing jobs in any govt institute. Encourage youth to study abroad & send remittance to their family members.