Pakistan’s fuels landscape has been undergoing a strong transformation with prudent steps taken by the Government of Pakistan over the last 12 months.

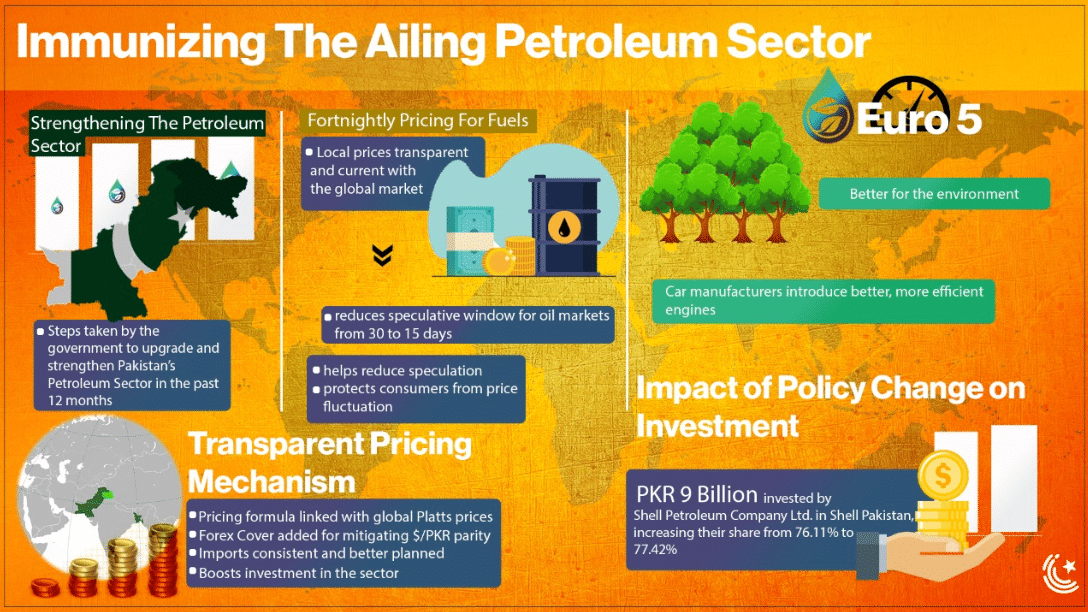

The adoption of Euro-5 standards fuels, a shift to a more transparent pricing mechanism with a fortnightly price announcement instead of the monthly one, and factoring in of the forex changes in the Oil & Gas Regulatory Authority’s (OGRA) price announcement are some key measures taken by the government that has relieved the country’s struggling petroleum sector.

These reforms were a welcome change that was received well and appreciated by the petroleum companies operating in Pakistan. Shell — one of the top OMCs in Pakistan — responded to the government’s supportive measures by enhancing its share in the Pakistani operation. While focusing on tapping into the expanding local market with a diversified demand for energy sources in various industrial sectors, Shell Petroleum Company Ltd. recently invested Rs. 9 billion in Pakistan, increasing its stakes in Shell Pakistan from 76.11 to 77.42 percent.

ALSO READ

UN’s Sustainable Development Goals Are Our Top Priorities: Foreign Minister

The acquisition of enhanced shareholding by Shell, which is a global entity in the local operations, has also shown its growing interest and confidence in the overall system and the local economy which is set to show a positive sign towards development. Besides, this is also a direct contribution to foreign direct investment (FDI) for Pakistan, which has otherwise been deteriorating due to the factors brought on by the pandemic that are pressuring other economic indicators.

The transition to Euro-5 bodes has boded well for the drivers and the environment alike. The new fuels — thanks to their higher RON (Research Octane Number) grade and a significant cut in Sulphur and Benzene contents — promise improved engine health, higher mileage, reduced maintenance costs, and above all, a considerable drop in vehicle emissions to contribute to a greener environment.

Globally, the shift is being matched by carmakers that are now producing smaller, more efficient engines that leave a lower carbon footprint. This change is also gaining momentum in Pakistan as stakeholders are becoming sensitized about and responding to the global climate emergency. Now, with people shifting to new and more efficient cars, Pakistan’s Oil Marketing Companies (OMCs) are responding with compatible fuels that are as friendly to the environment as they are to the vehicles.

Unfortunately, of late, these OMCs have not been where they used to be a few years ago in terms of profitability. In 2019, they had incurred huge losses owing to an unprecedented devaluation of the Rupee against the US Dollar. From 2020 onwards, the losses were only compounded as the pandemic tightened its grip on the world.

Stay-at-home orders and commercial lockdowns had brought mobility to a standstill, and with people locked down, hardly anyone was buying fuel anymore. Therefore, as the oil business saw a deep plunge worldwide, the Pakistani oil sector took an ever tougher hit. The reason was two-fold. First, with the distributor margins of major retail fuels being fixed in absolute terms in Pakistan, the OMCs had not able to make up for the impact of the decline in demand through higher margins. Second, Pakistan’s previous pricing mechanism had also rendered the local OMCs unable to bring in inventory gains because of the monthly lag in domestic pricing.

ALSO READ

Pakistan’s First e-Commerce Awards Conclude

Things needed to change urgently, and the reforms by the government arrived at the right time. As mentioned earlier, the change in the pricing mechanism had allowed the oil companies to procure products within approximately the same timing window as the OGRA now uses to announce its fortnightly price. The move not only helped seal the financial wound of the petroleum sector of the country but also led to an improvement in the overall economic parameters through improved confidence and better fiscal management.

“The reforms were long due and important for a balanced pricing mechanism as well,” shared the Energy Market Analyst at Primary Vision Network, Osama Rizvi. “Previously, due to the monthly revision in prices, the international price of oil and the petrol price at home, at times, weren’t in harmony. It was because of the fact that too much time elapsed between certain events: prices would go up by 20% and then cool down; however, the GoP would only include the changes after a month, resulting in increasing petrol prices whilst international markets cooled down. Also, giving OMCs more leverage will lead to competition – always positive,” he said.

“One thing that is required is to increase our storage capacities. We are well aware of many incidents where the stock wasn’t even kept at the required levels. The ability to buy and store more oil, to build strategic petroleum reserves, can be extremely beneficial for Pakistan,” Rizvi added.

The pandemic has not been kind to the world and the global economy, but for fragile economies like Pakistan, it meant disaster. The damage was across the sectors and petroleum industry that was already ailing and among the worst hit. With commercial shutdowns, all the investment plans were also put on hold, which was not good for the sector. Luckily, the government had intervened at the right time with measures that would help revive the local petroleum industry as things gradually get back to normal.

In such times, Shell’s trust in Pakistan’s economy and its optimism about recovery is also a welcome move. All in all, this has resulted in raising investors’ confidence, improving the FDI for Pakistan which is on a decreasing trend otherwise, and acting in recognition of the efforts being made by the Government of Pakistan to support the local economy during these distressing times.