The Pakistani rupee reversed its 17-day losing streak against the US Dollar today after opening trade at 287 in the interbank market.

At 11:30 PM, it was bearish, treading the 289 level against the greenback after losing ~Rs. 2 during early-day trade.

Later, the interbank rate rose to 287 between 1:30 PM and 2:30 PM before anchoring trends for the remainder of the day. Open market rates across multiple currency counters stood in the 287-289 range today.

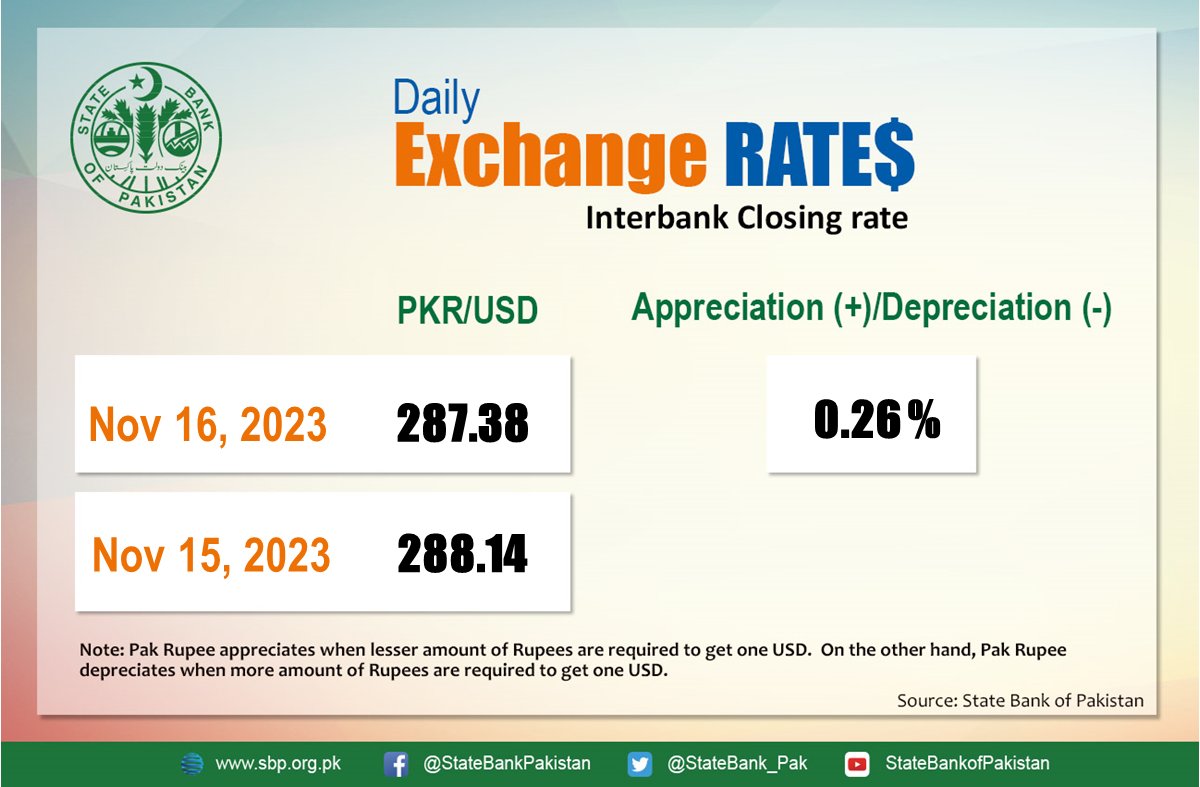

At close, the PKR appreciated by 0.26 percent to close at 287.38 after gaining 76 paisas against the dollar today.

The rupee closed in the green for the first time in 18 days today.

Overall, the rupee is down nearly Rs. 71 since January 2023. Since April 2022, it is down over Rs. 118 against the greenback. As per exchange rate movements witnessed today, the PKR has gained over 75 paisas against the dollar.

Today’s gains come after the International Monetary Fund (IMF) staff and the Pakistani authorities on Wednesday reached a staff-level agreement on the first review under Pakistan’s Stand-By Arrangement (SBA), subject to approval by the IMF’s Executive Board.

“The IMF team has reached a staff-level agreement (SLA) with the Pakistani authorities on the first review of their stabilization program supported by the IMF’s US$3 billion (SDR2,250 million) SBA. The agreement is subject to approval of the IMF’s Executive Board. Upon approval around US$700 million (SDR 528 million) will become available bringing total disbursements under the program to almost US$1.9 billion,” IMF said quoting Nathan Porter, who led the IMF team that visited Islamabad from November 2-15, to hold discussions on the first review.

The IMF remarked that while inflows following increased regulatory and law enforcement helped normalize import and FX payments and rebuild reserves, the authorities recognize that the rupee must remain market-determined to sustainably alleviate external pressures and rebuild reserves. To support this, they plan to strengthen the transparency and efficiency of the FX market and refrain from administrative actions to influence the rupee.

It added that with appropriately tight monetary policy, inflation should steadily decline and the authorities stand ready to respond resolutely if near-term price pressures reemerge, including due to second-round effects on core inflation or renewed exchange rate depreciation.

Follow ProPakistani on Google News & scroll through your favourite content faster!

Support independent journalism

If you want to join us in our mission to share independent, global journalism to the world, we’d love to have you on our side. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you.