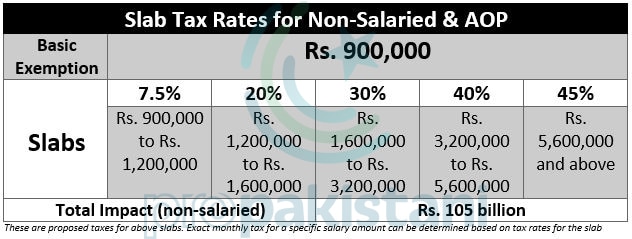

The federal government has introduced revised slab tax rates for non-salaried persons and Associations of Persons (AOP) with the basic exemption limit set at Rs. 900,000, sources told ProPakistani.

Tax rates for non-salaried persons are proposed to be enhanced to a maximum of 45 percent. Meanwhile, income of up to Rs. 900,000 per annum or Rs. 75,000 per month is proposed to be exempt.

According to details, different income slabs are subject to varying tax rates. For income between Rs. 900,000 and Rs. 12,000,000, the tax rate is set at 7.5 percent. This rate increases progressively with higher income brackets, reaching up to 45 percent for annual income above Rs. 56,000,000.

The detailed breakdown of the tax slabs is as follows: Income from Rs. 9,000,000 to Rs. 12,000,000 will be taxed at 7.5 percent, 20 percent for income between Rs. 12,000,000 and Rs. 16,000,000, 30 percent for those earning Rs. 16,000,000-32,000,000, 40 percent for Rs. 32,000,000-56,000,000, and 45 percent for those earning Rs. 56,000,000 and above.

Sources said the federal government is targeting Rs. 105 billion in total revenue collection from the non-salaried class in the upcoming fiscal year.

Meanwhile, tax rates for salaried individuals are proposed to be at the maximum rate of 35 percent per the existing regime. Income up to Rs. 600,000 per annum or Rs. 50,000 per month is proposed to be exempt. Per month, the tax to be charged is Rs. 2,500 on income of Rs. 100,000 per month.

For live updates on everything about the Federal Budget, visit this link.