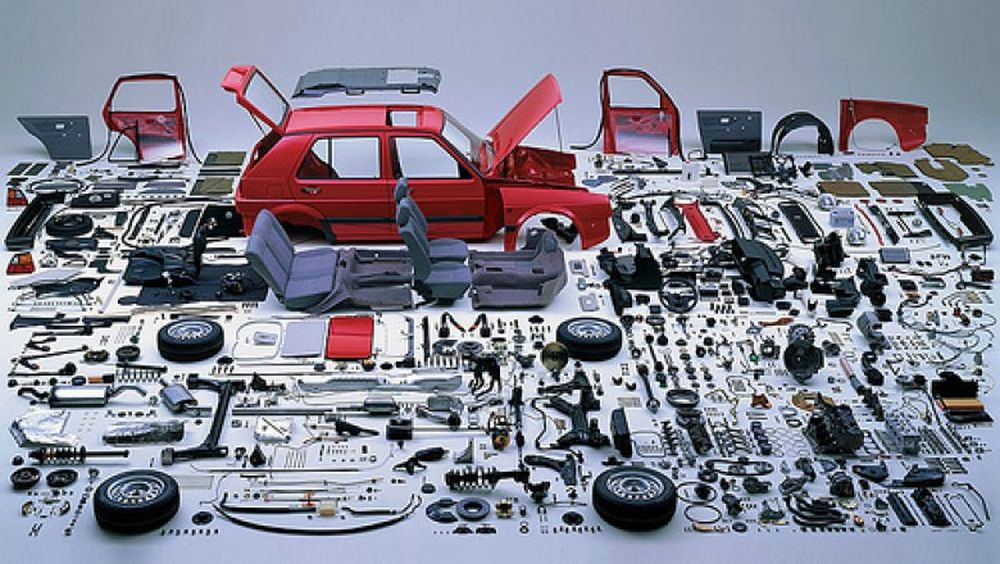

The government has reduced customs duty on the import of equipment for small vehicle assembly. The revenue division has issued an amendment notification in this regard as well.

The notification suggests that the customs duty for the assembly kits of cars with 1000cc or smaller engines has been reduced from 30% to 15%. Also, the customs duty on the imports of tire tubes has been reduced from 25% to 16%.

Moreover, the government has reduced the customs duty for older models with similar engine displacements from 32.5% to 30%. The notification adds that the 15% concession is valid for three years and for the Engineering Development Board (EDB) certified new model cars only.

Relaxation of Auto-Sector Imports

The State Bank of Pakistan (SBP) has eased the import sanctions on Completely Knocked Down (CKD) kits for local car assemblers.

In an official notification, SBP stated that the central bank has decided to undo the import restrictions from January 2, 2023. The decision is to allow for the acceptance of import transaction requests already filed with the SBP.

The removal of import sanctions and the reduction of import duties on small cars will enable companies like Pak Suzuki, Kia Lucky, Prince, and other small car makers to reinvigorate their production and sales.

Duties on spares should be reduced to max. 30% to encourage spares imports legally or else smuggling will be ever end. I ordered $10 valued car parts from UAE, and ending paying Rs 8200 as customs duty, including many other charges.. Next time, will get it smuggled..

You are right foolish economist make public in worsen situation in their line of duty slavery for IMF. Our country is in default situation. Bravo for empty headed policy makers.

Reduction in import duties is just Lollipop, there will be no reduction in prices because Dollar Rate is increasing on seconds bases.

Can we stop the smugling of different item in the country? Is it beyond our power and can not do it due to some compulsion?

Local car manufacturer should comply with Deletion Plan, and shall decrease dependence on imports, which burdens import bill. They must invest on importing manufacturing technology rather than importing parts.

Consumers paying the cost through legal foreign exchange should also be given reasonable discount by the manufacturer, it will reduce dependence on other sources of foreign exchange.

Manufacturer should be given tax rebate against export of vehicles earning Forex.

Transparency and vigilance of tax collection should be enhanced, particularly the tax collections received by authorized tax collecting agents (through digital system in particular).

I afraid that the relief will not be given to the end customer in the same capacity.

Honda 70 cc 1.5 lakh

honda125cc 2.0 lakh

Ybr 125cc 2.85 lakh

Yama 110cc 2.0.lakh

Ab konsi sasti garri honi shayad

Sasti garri 1 crore ki mile Ge.

Pakistan does not have US $ to pay foreign exchange for ckd hence reduction in 1000 cc cars prices is a for cry.

Flat import duty @50% should be charged on all imports to encourage localisation. In 73 years, Pakistan could not be able to manufacture sewing, spinning and knitting needles. Shamelessly all policies are adhocism. Smuggling is promoted by the anti Smuggling departments. Everything is fake and farce.

Most of the civilised nations have given cut of date between 2025 to 2030 to banning sale of fossil fuels based cars. Sadly Pakistan is going no where and us under the burden of a government who had destroyed economy by building motorways, metros and thermal power stations at inflated costs.

Engine, gear and other parts must be manufactured in the county rather than importing but the main problem is dollar