Senate Committee Opposes Increasing Tax on Electric, Hybrid Cars in Budget 2024-25

Govt Likely to Amend Finance Bill 2024 For Phase-Wise Implementation of Sales Tax on Formula Milk

Budget FY25 Boosts Chances of New IMF Program Despite Issues: Fitch Ratings

Planning Ministry Unveils National Economic Transformation Unit For PSDP 2024-25

Pakistan's Tax Revenue Likely to Increase by 40% in Upcoming Fiscal Year

Relief to Salaried Class Impossible When Govt Institutions Are Operating At A Loss: Aurangzeb

Will Petrol Price Rise Above Rs. 300 Per Liter in Pakistan Soon?

FBR Forms Committees to Rectify Mistakes in Finance Bill 2024

Sindh Govt Increases Sales Tax to 15%

Govt Shouldn't Hold Us Hostage For Its Non-Filer Issue: Telecom Industry

Senate Panel Proposes More Strict Penalties For Late Filers

Budget 2024-25: Sindh to Raise Salaries More Than Federal Govt

Rupee Ends Budget Week With Gains Against US Dollar

New Property Taxes in Budget to Increase Cost Pressures on Construction Sector

Budget 2024-25: Punjab Announces Rs. 42.5 Billion for School Education

This Budget Will Help Pakistan Get New IMF Loan: Moody's

FBR to Seal Businesses and Restaurants For Refusing Debit/Credit Card Payments

National Assembly Budget Increased By Rs. 4 Billion

Govt to Give 104% Higher Power Subsidies

Senate Panel Calls for Tax Exemption on Mobile Apps For Freelancers to Boost Remittances

Punjab Announces Free Solar Systems for Public

KP Govt Ready to Increase Employee Salaries

Women Dismayed by Makeup Price Hike in Budget

Govt Likely to Give Big Relief On Petrol Price Before Eid

Private Schools Association Rejects 2024-25 Budget

Govt to Impose 18% Sales Tax On Milk

Govt Proposes Over Rs. 23 Billion for 16 Ongoing Projects of IT Ministry

Government Allocates Rs. 4 Billion to Promote E-Bikes Nationwide

Budget 2024-25: Pakistan's Defense Budget Increased by 17%

Newspaper Industry Opposes Huge Tax in Budget

Budget Takes Pakistan One Step Closer to Sealing New IMF Program: Brokerage House

Builders and Developers Reject New Massive Taxes on Real Estate Industry

Record-Breaking Budget for IT Sector: Aurangzeb

IT Industry’s Budget Proposals Completely Overlooked Despite Govt Assurances: P@SHA

Increase in Petroleum Levy Will Be Phased in Slowly: Finance Minister

More Taxes Will Be Imposed on High Income Earners: Aurangzeb

Pakistan Will Spend Half Its Budget On Debt Servicing Next Fiscal Year

Govt Allocates 203% Higher Budget For Education

PSX Gains Over 2,100 Points in First Hour of Trade After Budget

Budget 2024-25: Govt. Announces Big Relief on Solar Panels

Govt Excludes Budgetary Support From IMF, Saudi Arabia In New Budget

Here Are The Highlights From Budget 2024-25

Govt to Increase Import Duty on Steel to Boost Local Manufacturing

Govt to Impose 45% Capital Gains Tax on Non-Filers

Govt Proposes Increase in Petroleum Levy to Rs. 80 Per Liter

Budget 2024-25: Federal Revenues and Expenditures in Numbers

Premium Smartphones to Get More Expensive Following Budget 2024-25

Budget 2024-25: Salaried Class to Face Up to 35% Income Tax

Budget 2024-25: Government Implements Hiring Freeze for Grade 1 to 16

Here Are the Salient Features of Budget 2024-25

Govt to Impose Sales Tax Withholding Regime for Coal, Paper Scrap Sectors

Budget 2024-25: GST on Textile and Leather Products Raised from 15% to 18%

Govt to Withdraw Tax Exemptions for Ex-FATA/PATA

Budget 2024-25 Increases Federal Excise Duty on Cement by 50%

Imported Hybrid Car Prices Increased in Budget 2025

Government Raises Minimum Wage to Rs. 37,000 in New Finance Bill

Govt Proposes 5% FED on Real Estate

Govt Proposes to Increase Tax Rate on Capital Gains From Mutual Funds to 15%

Sales Tax Doubled on Computers and Laptops in Budget 2025

Govt Introduces Fixed Minimum Sales Tax for Imports in Budget 2025

Full Budget 2024-25 Speech in Urdu

18% Sales Tax Proposed on Imported Kits and Locally Produced Phones

Govt Ends Tax Exemption For Expensive Electric Vehicles in Budget 2025

Govt Increases Car Prices in Budget 2025 With Higher Tax

Govt to Increase Pensions by 15%

Medicines to Get More Expensive as Govt Proposes Huge Sales Tax in Budget 2024-25

Govt Approves Up to 25% Increase in Salaries

Telcos, Utility Companies to Face Rs. 100 Million Fine for Ignoring New Tax Rules for Non-Filers

Govt Likely to End Exemption for AOPs on Filing Income Tax Returns

FBR Likely to Get Power to Notify Minimum Value of Import Goods for Income Tax Collection

Govt Likely to Impose 29% Income Tax Rate on Exporters

Tax Rate on Imported LPG May Rise to 18%

Budget 2024-25 Increases Capital Gains Tax on Real Estate to a Minimum of 15%

Govt Reduces Tax Benefit for Educational Institutes in Budget 2024-25

Budget Latest: Govt Likely to Impose 5% Sales Tax on Petroleum Products

Late Return Filers Set to Face Additional Tax on Sale, Purchase of Property

Govt Likely to Extend Withholding Tax Regime to All Sectors in Value Chain

Govt Likely to Impose Up to 45% Tax Rate on Non-Salaried, AOPs

Govt Considering Additional Tax Measures of Nearly Rs. 1.5 Trillion in FY25 Budget

Govt Considering 75% Tax on Mobile Calls for Non-Filers

Jun 20, 2024 | 3:31 pm

Senate Committee Opposes Increasing Tax on Electric, Hybrid Cars in Budget 2024-25

A meeting of the Senate Standing Committee on Finance and Revenue was held under the chairmanship of Senator Saleem Mandviwala… Read More

Jun 20, 2024 | 1:03 pm

Govt Likely to Amend Finance Bill 2024 For Phase-Wise Implementation of Sales Tax on Formula Milk

The government may amend Finance Bill 2024 to impose phase-wise sales tax on infant formula etc. The phase-wise taxation under… Read More

Jun 19, 2024 | 10:03 am

Budget FY25 Boosts Chances of New IMF Program Despite Issues: Fitch Ratings

Pakistan’s ambitious FY2024-25 budget strengthens prospects for an IMF deal, Fitch Ratings said in a report on Tuesday. It is… Read More

Jun 18, 2024 | 6:08 pm

Planning Ministry Unveils National Economic Transformation Unit For PSDP 2024-25

The Ministry of Planning and Development, under the leadership of Minister Ahsan Iqbal, has announced the establishment of the National… Read More

Jun 18, 2024 | 6:01 pm

Pakistan's Tax Revenue Likely to Increase by 40% in Upcoming Fiscal Year

Pakistan’s tax growth (including petroleum development levy) is projected to reach 40 percent for fiscal year 2024-25 compared to a… Read More

Jun 18, 2024 | 12:43 pm

Relief to Salaried Class Impossible When Govt Institutions Are Operating At A Loss: Aurangzeb

Finance Minister Muhammad Aurangzeb on Tuesday said the federal government was finding it very hard to give relief to the… Read More

Jun 17, 2024 | 2:09 pm

Will Petrol Price Rise Above Rs. 300 Per Liter in Pakistan Soon?

MS petrol has long been a big gossip point for everyone since it nearly doubled in rates two years ago.… Read More

Jun 17, 2024 | 1:39 pm

FBR Forms Committees to Rectify Mistakes in Finance Bill 2024

The Federal Board of Revenue (FBR) has constituted two Anomaly Committees to rectify errors created by the FBR in Finance Bill… Read More

Jun 16, 2024 | 4:13 pm

Sindh Govt Increases Sales Tax to 15%

The Sindh government has raised the provincial sales tax on services to 15 percent, effective July 1. The expected revenue… Read More

Jun 16, 2024 | 3:11 pm

Govt Shouldn't Hold Us Hostage For Its Non-Filer Issue: Telecom Industry

The Telecom Operators Association has expressed serious concerns over the coalition government’s budget proposals for 2024-25, warning that increased taxes… Read More

Jun 16, 2024 | 12:28 pm

Senate Panel Proposes More Strict Penalties For Late Filers

The Senate Standing Committee on Finance and Revenue convened for its 5th session to study the provisions of the Income… Read More

Jun 15, 2024 | 5:05 pm

Budget 2024-25: Sindh to Raise Salaries More Than Federal Govt

The Sindh government has announced a Rs. 3.056 trillion budget for the fiscal year 2024-25. The budget was presented by… Read More

Jun 14, 2024 | 5:35 pm

Rupee Ends Budget Week With Gains Against US Dollar

The Pakistani rupee (PKR) gained further ground 2nd day in a row against the US Dollar today after opening trade… Read More

Jun 14, 2024 | 5:17 pm

New Property Taxes in Budget to Increase Cost Pressures on Construction Sector

The 2024-25 federal budget is expected to have a mixed impact on the construction sector. According to a report by… Read More

Jun 14, 2024 | 4:06 pm

Budget 2024-25: Punjab Announces Rs. 42.5 Billion for School Education

The Punjab government has unveiled a comprehensive budget of Rs42.5 billion for the school education department for the fiscal year… Read More

Jun 14, 2024 | 3:49 pm

This Budget Will Help Pakistan Get New IMF Loan: Moody's

The federal budget 2024-25 will likely support Pakistan’s ongoing negotiations with the International Monetary Fund (IMF) for a new Extended… Read More

Jun 14, 2024 | 3:22 pm

FBR to Seal Businesses and Restaurants For Refusing Debit/Credit Card Payments

The Senate Standing Committee on Finance and Revenue reviewed the Finance Bill 2024 under the chairmanship of Senator Saleem Mandviwala… Read More

Jun 14, 2024 | 2:04 pm

National Assembly Budget Increased By Rs. 4 Billion

The budget for the National Assembly has been increased by Rs. 4 billion for the next fiscal year. The proposed… Read More

Jun 14, 2024 | 12:44 pm

Govt to Give 104% Higher Power Subsidies

The federal government has drawn up a Rs. 1,190 billion subsidy package for the power sector in the new federal… Read More

Jun 14, 2024 | 12:42 pm

Senate Panel Calls for Tax Exemption on Mobile Apps For Freelancers to Boost Remittances

The Senate Standing Committee on Finance and Revenue advocated for the removal of all taxes from digital applications, highlighting the significant… Read More

Jun 14, 2024 | 12:11 pm

Punjab Announces Free Solar Systems for Public

The Punjab government has announced an ambitious budget for the fiscal year 2024-25, unveiling a significant initiative aimed at providing… Read More

Jun 14, 2024 | 12:04 pm

KP Govt Ready to Increase Employee Salaries

Advisor to the Chief Minister for Information, Barrister Muhammad Ali Saif, announced on Thursday that the provincial government is prepared… Read More

Jun 14, 2024 | 12:03 pm

Women Dismayed by Makeup Price Hike in Budget

Women throughout the port city of Karachi have expressed dismay over the anticipated price rise for essential makeup items following… Read More

Jun 14, 2024 | 11:29 am

Govt Likely to Give Big Relief On Petrol Price Before Eid

MS petrol and High-Speed Diesel (HSD) prices are expected to fall tomorrow due to international oil prices declining in the… Read More

Jun 14, 2024 | 11:03 am

Private Schools Association Rejects 2024-25 Budget

The All Pakistan Private Schools & Colleges Association has expressed serious concerns about the government’s neglect of the private education… Read More

Jun 14, 2024 | 10:47 am

Govt to Impose 18% Sales Tax On Milk

The federal government has proposed to impose an 18 percent sales tax on milk and fat-filled milk (presently zero-rated) in… Read More

Jun 13, 2024 | 5:17 pm

Govt Proposes Over Rs. 23 Billion for 16 Ongoing Projects of IT Ministry

The details of the Public Sector Development Program (PSDP) for the federal budget 2024-25 have been disclosed. Under the PSDP,… Read More

Jun 13, 2024 | 4:27 pm

Government Allocates Rs. 4 Billion to Promote E-Bikes Nationwide

In this year’s budget, Pakistan’s Finance Minister, Senator Muhammad Aurangzeb, allocated Rs. 4 billion to promote electric bikes (e-bikes) and… Read More

Jun 13, 2024 | 4:04 pm

Budget 2024-25: Pakistan's Defense Budget Increased by 17%

The government has announced a budget of Rs. 2.12 trillion for the armed forces for the fiscal year 2024-25, which… Read More

Jun 13, 2024 | 3:17 pm

Newspaper Industry Opposes Huge Tax in Budget

The All Pakistan Newspapers Society (APNS) has rejected the imposition of a 10 percent GST, calling it “disastrous for the… Read More

Jun 13, 2024 | 3:10 pm

Budget Takes Pakistan One Step Closer to Sealing New IMF Program: Brokerage House

Brokerage house Topline Securities Thursday said that the federal budget for FY25 will likely pave the way for a new… Read More

Jun 13, 2024 | 3:08 pm

Builders and Developers Reject New Massive Taxes on Real Estate Industry

The Association of Builders and Developers (ABAD) has opposed budgetary measures, including increasing the Capital Gains Tax (CGT) on real… Read More

Jun 13, 2024 | 1:29 pm

Record-Breaking Budget for IT Sector: Aurangzeb

Finance Minister Muhammad Aurangzeb on Thursday said the federal government has allocated the biggest and record budget for the IT… Read More

Jun 13, 2024 | 1:14 pm

IT Industry’s Budget Proposals Completely Overlooked Despite Govt Assurances: P@SHA

Muhammad Zohaib Khan, Chairman Pakistan Software Houses Association (P@SHA), has expressed his profound apprehensions that IT Industry’s budgetary proposals have… Read More

Jun 13, 2024 | 12:57 pm

Increase in Petroleum Levy Will Be Phased in Slowly: Finance Minister

The increase in petroleum development levy (PDL) will be slowly phased into fuel prices in order to bring them in… Read More

Jun 13, 2024 | 12:41 pm

More Taxes Will Be Imposed on High Income Earners: Aurangzeb

Finance Minister Muhammad Aurangzeb on Thursday said higher taxes will be imposed on high-income earners next fiscal year. He also… Read More

Jun 13, 2024 | 12:05 pm

Pakistan Will Spend Half Its Budget On Debt Servicing Next Fiscal Year

The country will spend around Rs 9.775 trillion on debt servicing including interest payments and retiring its principal amounts during… Read More

Jun 13, 2024 | 11:50 am

Govt Allocates 203% Higher Budget For Education

The Ministry of Education will get Rs. 25.75 billion or a 203 percent higher budget in fiscal year 2024-25 compared… Read More

Jun 13, 2024 | 11:32 am

PSX Gains Over 2,100 Points in First Hour of Trade After Budget

The Pakistan Stock Exchange gained over 2,100 points in the first 2 hours of trade as buyers flocked to the… Read More

Jun 13, 2024 | 11:25 am

Budget 2024-25: Govt. Announces Big Relief on Solar Panels

The federal government has proposed significant tax relaxations on importing raw materials for solar panels and the aquaculture industry as… Read More

Jun 13, 2024 | 11:20 am

Govt Excludes Budgetary Support From IMF, Saudi Arabia In New Budget

The federal government hasn’t factored in any budgetary support from the International Monetary Fund (IMF) and Saudi Arabia in the… Read More

Jun 12, 2024 | 10:01 pm

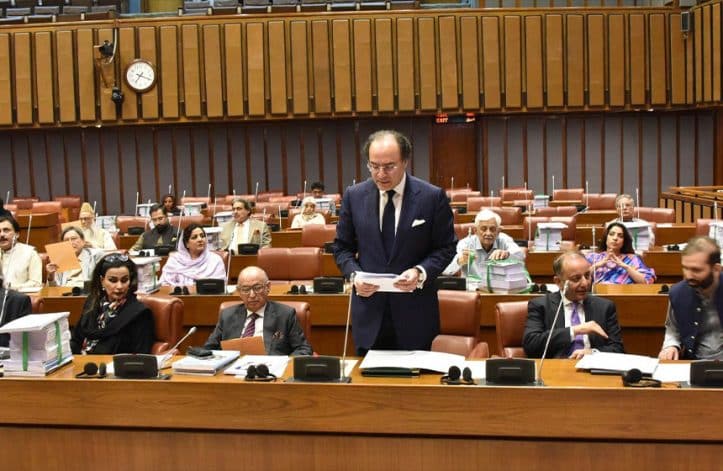

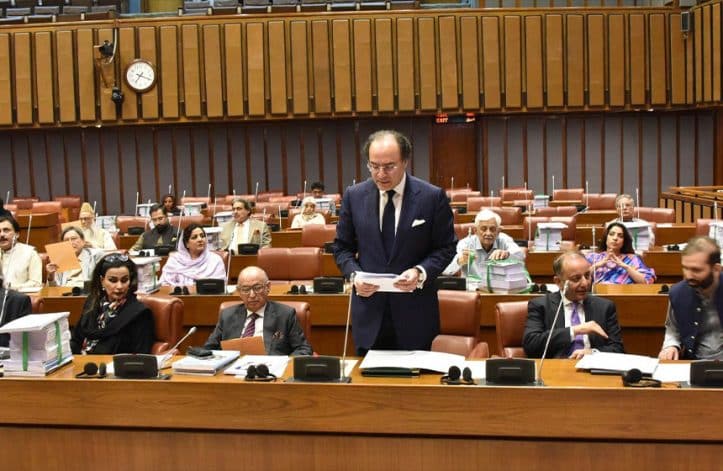

Here Are The Highlights From Budget 2024-25

Finance Minister Muhammad Aurangzeb on Wednesday unveiled the federal budget 2024-25 with a full outlay of Rs. 18.9 trillion. Here… Read More

Jun 12, 2024 | 9:39 pm

Govt to Increase Import Duty on Steel to Boost Local Manufacturing

The federal government has decided to increase the import duty on steel, ball bearings, paper products, etc. in order to… Read More

Jun 12, 2024 | 9:07 pm

Govt to Impose 45% Capital Gains Tax on Non-Filers

Capital Gains Tax (CGT) on securities would be 15 percent on filers irrespective of the holding period and 45 percent… Read More

Jun 12, 2024 | 7:50 pm

Govt Proposes Increase in Petroleum Levy to Rs. 80 Per Liter

The federal government has proposed an increase in the maximum petroleum levy on petrol and high-speed diesel to Rs. 80… Read More

Jun 12, 2024 | 7:24 pm

Budget 2024-25: Federal Revenues and Expenditures in Numbers

The federal government today announced its Rs. 18.6 trillion federal budget for 2024-25, against a total of Rs. 12.97 trillion… Read More

Jun 12, 2024 | 7:17 pm

Premium Smartphones to Get More Expensive Following Budget 2024-25

According to the finance bill of 2024, sales tax on smartphone imports as well as IMEI registration is now 25%… Read More

Jun 12, 2024 | 7:10 pm

Budget 2024-25: Salaried Class to Face Up to 35% Income Tax

The new income tax slabs for the salaried class under the federal budget 2024-25 revealed that a higher rate of… Read More

Jun 12, 2024 | 7:03 pm

Budget 2024-25: Government Implements Hiring Freeze for Grade 1 to 16

The Government of Pakistan has announced a freeze on new hirings for Basic Pay Scale (BPS) 1 to 16 positions.… Read More

Jun 12, 2024 | 6:59 pm

Here Are the Salient Features of Budget 2024-25

The federal government has announced the budget for the fiscal year 2024-25. Finance Minister Muhammad Aurangzeb presented the Federal Budget… Read More

Jun 12, 2024 | 6:53 pm

Govt to Impose Sales Tax Withholding Regime for Coal, Paper Scrap Sectors

The federal government has decided to impose sales withholding tax on copper, coal, paper and plastic scrap. Finance Minister Muhammad… Read More

Jun 12, 2024 | 6:47 pm

Budget 2024-25: GST on Textile and Leather Products Raised from 15% to 18%

In the latest budget announcement for the fiscal year 2024-25, the Government of Pakistan has decided to increase the General… Read More

Jun 12, 2024 | 6:42 pm

Govt to Withdraw Tax Exemptions for Ex-FATA/PATA

The federal government has decided to withdraw exemptions given to Ex-FATA/PATA. Finance Minister Muhammad Aurangzeb announced in his budget speech… Read More

Jun 12, 2024 | 6:41 pm

Budget 2024-25 Increases Federal Excise Duty on Cement by 50%

In a move set to impact the construction industry, the incumbent government announced a significant increase in the Federal Excise… Read More

Jun 12, 2024 | 6:38 pm

Imported Hybrid Car Prices Increased in Budget 2025

The government has removed tax exemptions on imported hybrid cars, according to the official budget 2024-25 announcement. These cars will… Read More

Jun 12, 2024 | 6:31 pm

Government Raises Minimum Wage to Rs. 37,000 in New Finance Bill

The Government of Pakistan has proposed an increase in the minimum wage from Rs. 32,000 to Rs. 36,000, as part of the finance bill for the fiscal year 2024-25.… Read More

Jun 12, 2024 | 6:28 pm

Govt Proposes 5% FED on Real Estate

The federal government has proposed to impose a 5 percent federal excise duty (FED) on new plots and residential and… Read More

Jun 12, 2024 | 6:25 pm

Govt Proposes to Increase Tax Rate on Capital Gains From Mutual Funds to 15%

The federal government has proposed a 15 percent tax rate on individuals who invest through mutual funds, reliable sources told… Read More

Jun 12, 2024 | 6:25 pm

Sales Tax Doubled on Computers and Laptops in Budget 2025

The Government of Pakistan has proposed an adjustment in the budget 2024-2025 by doubling the sales tax on computers and… Read More

Jun 12, 2024 | 6:20 pm

Govt Introduces Fixed Minimum Sales Tax for Imports in Budget 2025

To enhance revenue collection and curb tax evasion, the upcoming fiscal budget of Pakistan for 2024-2025 has proposed to introduce… Read More

Jun 12, 2024 | 6:14 pm

Full Budget 2024-25 Speech in Urdu

Finance Minister Muhammad Aurangzeb is currently presenting the federal budget 2024-25 in parliament today. Here’s the full budget speech. Note:… Read More

Jun 12, 2024 | 6:10 pm

18% Sales Tax Proposed on Imported Kits and Locally Produced Phones

The federal government has proposed an 18% sales tax on the import of mobile phone assembly kits and the local… Read More

Jun 12, 2024 | 5:58 pm

Govt Ends Tax Exemption For Expensive Electric Vehicles in Budget 2025

In a new proposal, the government has suggested withdrawing tax exemptions enjoyed by electric cars valued above $50,000, according to… Read More

Jun 12, 2024 | 5:50 pm

Govt Increases Car Prices in Budget 2025 With Higher Tax

The government has proposed an increase in withholding tax charged on the purchase of new cars, according to the official… Read More

Jun 12, 2024 | 5:29 pm

Govt to Increase Pensions by 15%

The federal government has proposed to increase the pensions of federal government employees by 15 percent, Finance Minister Muhammad Aurangzeb… Read More

Jun 12, 2024 | 5:27 pm

Medicines to Get More Expensive as Govt Proposes Huge Sales Tax in Budget 2024-25

The coalition government unveiled the budget for the fiscal year 2024-25 today, introducing significant changes that could impact the cost… Read More

Jun 12, 2024 | 5:15 pm

Govt Approves Up to 25% Increase in Salaries

The federal cabinet has reportedly approved to increase the salaries of government employees with increments of up to 25 percent… Read More

Jun 12, 2024 | 5:08 pm

Telcos, Utility Companies to Face Rs. 100 Million Fine for Ignoring New Tax Rules for Non-Filers

The federal government is considering imposing heavy financial penalties on telecom and utility companies that do no cooperate in implementing… Read More

Jun 12, 2024 | 4:44 pm

Govt Likely to End Exemption for AOPs on Filing Income Tax Returns

The government is considering a proposal that all Association of persons (AOPs), irrespective of their income, may be required to… Read More

Jun 12, 2024 | 4:31 pm

FBR Likely to Get Power to Notify Minimum Value of Import Goods for Income Tax Collection

The federal government is considering a proposal to empower the Federal Board of Revenue (FBR) to notify the minimum value… Read More

Jun 12, 2024 | 4:25 pm

Govt Likely to Impose 29% Income Tax Rate on Exporters

The federal government has proposed to increase the income tax rate for exporters by 1 percent on export proceeds, sources… Read More

Jun 12, 2024 | 4:09 pm

Tax Rate on Imported LPG May Rise to 18%

The federal government has proposed to increase the sales tax rate on imported liquefied petroleum gas (LPG) from 10 percent… Read More

Jun 12, 2024 | 4:05 pm

Budget 2024-25 Increases Capital Gains Tax on Real Estate to a Minimum of 15%

The 2024-25 budget has introduced significant changes to the taxation regime for capital gains, particularly affecting immovable property such as… Read More

Jun 12, 2024 | 3:42 pm

Govt Reduces Tax Benefit for Educational Institutes in Budget 2024-25

The federal government has proposed to restrict tax credit to 80 percent for educational institutions which are non-profit organizations (NPOs) in the new budget and to prevent potential misuse by other schools and colleges.… Read More

Jun 12, 2024 | 3:30 pm

Budget Latest: Govt Likely to Impose 5% Sales Tax on Petroleum Products

Petrol, diesel and other fuel categories are expected to get more expensive as the federal government has proposed a 5… Read More

Jun 12, 2024 | 3:14 pm

Late Return Filers Set to Face Additional Tax on Sale, Purchase of Property

The government is considering increasing withholding tax rate progressively on the sale and purchase of immovable property according to investment.… Read More

Jun 12, 2024 | 2:36 pm

Govt Likely to Extend Withholding Tax Regime to All Sectors in Value Chain

The federal government is considering extending withholding tax regime to all sectors in the value chain. According to sources, currently,… Read More

Jun 12, 2024 | 2:30 pm

Govt Likely to Impose Up to 45% Tax Rate on Non-Salaried, AOPs

The federal government has introduced revised slab tax rates for non-salaried persons and Associations of Persons (AOP) with the basic… Read More

Jun 12, 2024 | 2:15 pm

Govt Considering Additional Tax Measures of Nearly Rs. 1.5 Trillion in FY25 Budget

The federal government is considering additional tax measures of nearly Rs. 1.5 trillion in the upcoming federal budget. According to… Read More

Jun 12, 2024 | 1:58 pm

Govt Considering 75% Tax on Mobile Calls for Non-Filers

The government is considering a proposal to impose a 75 percent tax on mobile phone calls of non-filers in a… Read More